RBI MODIFIES NORMS FOR LENDERS HAVING EXPOSURE TO AIFS

Why in the news?

RBI modified norms for lenders investing in Alternative Investment Funds (AIFs), focusing on provisions for downstream investments in debtor companies.

About the Regulatory Changes:

- The Reserve Bank of India (RBI) has adjusted regulations for regulated entities (REs) regarding their investments in Alternative Investment Funds (AIFs).

- The new directive specifies that REs must allocate provisions only for the portion of their investment in an AIF scheme that is further invested by the AIFs in a debtor’s company, not the entire investment in the AIF scheme.

| What is an Alternative Investment Fund (AIF)?

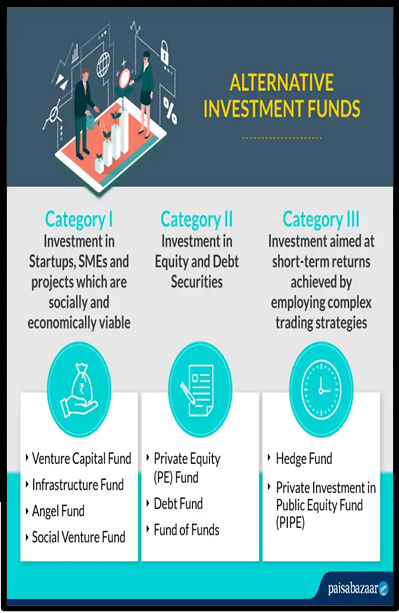

● Alternative Investment Fund (AIF) is a privately pooled investment mechanism in India. ● AIFs gather funds from sophisticated investors to invest according to specific policies, regulated by SEBI. ● As of December 2023, 1,220 AIFs were registered with SEBI. ● SEBI classifies AIFs into three categories: Category I, II, and III. Types of AIFs in India: ● Category I includes funds investing in startups, SMEs, and socially beneficial sectors. ● Category II comprises funds not in I or III and not leveraging. ● Category III involves funds with complex trading strategies and may employ leverage. |