MANUFACTURING INDUSTRIES

Introduction

- Industries play a pivotal role in the modern economy, serving as a cornerstone for economic development, employment, and the production of goods and services. They are integral to the economic structure, contributing significantly to the Gross Domestic Product (GDP), national income, and investment. The interdependence between agriculture and industry highlights the symbiotic relationship that drives competitiveness and production efficiency. Industries are categorized based on the economic activities they are involved in, which are primarily classified into primary, secondary, and tertiary activities.

Economic Contributions and Interdependence

- Employment Opportunities: Industries provide employment to a large section of society, helping to alleviate unemployment and poverty.

- Contribution to National Income: The contribution of industries to the national income includes Agriculture (more than 16%), Services (55%), and Industry (29%).

- Agriculture and Industry Interdependence: Industries rely on agriculture for raw materials, pushing the agricultural sector towards increased production and competitiveness.

Classification of Economic Activities

- Primary Activities: These industries depend directly on environmental resources like land, water, forest, and are categorized as Red-Collar jobs. Examples include hunting, fishing, and pastoral activities.

- Secondary Activities: This sector transforms raw materials from primary activities into useful products, known as Blue-Collar jobs. It encompasses manufacturing, processing, and construction industries.

- Tertiary Activities: Providing services to consumers and supporting primary and secondary sectors, tertiary activities are crucial to the economic chain, referred to as White-Collar jobs. This includes transportation, healthcare, food service, banking, etc.

The Secondary Sector

- The secondary sector, considered the economy’s backbone, transitions individuals from primary activities to more skill-oriented jobs. Despite its potential, the secondary sector in India has not fully realized its capabilities, with the service sector taking precedence as the largest economic sector.

Current State in India

- GDP Contribution: The secondary sector contributes approximately 16-17% of India’s GDP.

- Employment Trends: There has been a decline in the rate of employment within this sector over the last five years, indicating a shift towards other sectors.

- Key Industries: Includes agro-based industries, the automobile industry, and the iron-steel industry.

Classification of Industries

| Classification Basis | Category | Description | Examples |

| Based on Raw Materials | Agro-based | Industries using raw materials from agriculture | Cotton, jute, sugar, tea, coffee, rubber |

| Mineral-based | Industries using minerals from mining | Iron, steel, aluminum, cement | |

| Forest-based | Industries using products from forests | Paper, resins, leaf utensils, baskets | |

| Strength of Labor & Size | Large scale | Employ large numbers of workers, large capital, and superior technology | Cotton industries, textile industries, automobile industry |

| Small scale | Employ a small number of workers, less investment, small volume of products | Cottage industries, handicrafts, power looms | |

| Based on Ownership | Private Sector | Owned and operated by individuals or companies | Bajaj Auto, Mahindra & Mahindra, TISCO |

| Public Sector | Owned by the government or state | BSNL, PSUs, Steel plants | |

| Joint Sector | Jointly owned by government and private players | OIL, Gujarat State Fertilizers, Maruti Udyog Ltd. | |

| Cooperative Sector | Owned cooperatively by a group of individuals | Sugar industry, AMUL | |

| On the Basis of Finished Goods | Heavy Industries | Use and produce bulky raw materials | Iron steel Industry |

| Light Industries | Finished products are light in weight | Electric fans, sewing machines | |

| Based on Mode of Operations | Basic industries | Depend on many other small industries | Iron & steel industries, machine tools |

| Consumer bases | Convert raw materials into final products for consumers | Consumer goods industries, FMCG | |

| Cottage industries | Small industries set up by artisans | Handloom, khadi, woodwork | |

| Ancillary Industries | Manufacture parts and components for big industries | – | |

| Capital Intensive Industries | Require huge investment | Iron and steel industry | |

| Labour Intensive Industries | Require a large labor force | Shoe making industry |

Importance of the Industrial Sector in India:

The industrial sector is pivotal to the development and economic growth of India, serving as a fundamental driver of progress in various dimensions. Here’s an in-depth look at its importance:

- Backbone of the Economy: The manufacturing sector is crucial for any nation’s development, acting as the core structure supporting other sectors.

- Economic Transition: Traditionally, economies evolve from primary to secondary sectors. However, India has seen a leap directly to the tertiary sector, bypassing the extensive growth potential of the industrial sector.

- Employment Generation: Industries mechanize primary activities, such as agriculture and mining, creating substantial job opportunities. This shift is vital for accommodating the workforce transitioning from primary sector occupations.

- Poverty Alleviation: The transformation towards an industrialized economy is essential for reducing unemployment and poverty, given the sector’s capacity to create large-scale employment.

- Contribution to GDP: Prior to the pandemic, the manufacturing sector contributed about 16% to India’s GDP, a figure considered low compared to other South Asian economies where the industrial share is around 30%.

- Goals of Industrial Policy: Aiming to increase the sector’s GDP contribution to 25% and create 100 million new jobs reflects the government’s recognition of the sector’s potential.

Significance of the Industrial Sector

- Demographic Dividend: India’s demographic dividend presents a unique opportunity. The manufacturing sector is crucial for creating labor-intensive jobs, enhancing the standard of living for the burgeoning workforce, especially in sectors like textiles and automobiles.

- Advantage of Cheap Labor: India’s competitive advantage in labor costs attracts global value and supply chains, positioning the country as a favorable destination for manufacturing and service industries.

- Integration into Global Supply Chains: Embracing new economic reforms to integrate global supply chains within the Indian economy can significantly benefit from the advanced manufacturing sector and skilled human capital.

- Boost to Exports: The export of manufactured goods can expand trade and commerce, attracting foreign exchange. Initiatives like Special Economic Zones (SEZs) and National Investment and Manufacturing Zones (NIMZs) are designed to increase India’s share in global exports.

- Promotion of Equitable Growth: Industrial development in tribal and backward areas aims to reduce regional disparities, distributing the development’s benefits to remote areas and promoting equitable growth.

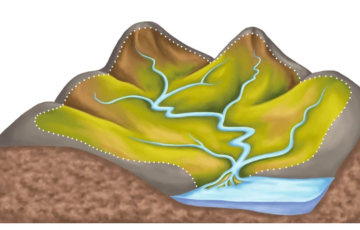

Geographical Distribution of Major Industrial Regions in India

- The industrial landscape of India is marked by a diverse array of regions each specializing in different sectors based on geographical advantages, resource availability, and historical development.

| Industrial Region | Characteristics and Industries | Key Industrial Centers |

| Mumbai-Pune Region | Originated with the cotton textile industry.

Development boosted by Mumbai High petroleum and nuclear energy projects. Hosts a variety of industries including leather, synthetic, plastic goods, and food industries. Spans Mumbai-Thane to Pune and adjacent areas. |

Mumbai, Pune, Nashik, Solapur, Kolaba, Ahmednagar, Satara, Sangli, Jalgaon |

| Hugli Region | Developed around the Hugli river port.

Influenced by tea plantations, coalfields, and iron ore deposits. Includes cotton, paper, jute, textile, pharmaceuticals, fertilizer, and petrochemical industries. |

Haldia, Kakinara, Kolkata, Serampore, Titagarh, Belur, Triveni, Bansberia, Birlanagar |

| Bangalore-Chennai Region | Spans Karnataka and Tamil Nadu.

Lacks coalfields; development driven by hydroelectric plants. Industries include aircraft manufacturing, textiles, silk, sugar mills, and petroleum refinery. |

Bangalore, Chennai, Salem |

| Gujarat Region | Encompasses areas like Ahmedabad, Vadodara, and Surat.

Growth attributed to the decline of Mumbai’s textile industry and the discovery of oil fields. Key industries include petrochemicals, engineering, pharmaceuticals, and food processing. |

Ahmedabad, Vadodara, Surat, Jamnagar, Rajkot, Bharuch |

| Chotanagpur Region | Covers Jharkhand, Orissa, and West Bengal.

Known for heavy metallurgical industries due to rich mineral resources. Hosts major iron and steel plants, as well as heavy engineering, fertilizers, and cement industries. |

Ranchi, Jamshedpur, Durgapur, Bokaro, Rourkela, Dhanbad |

| Vishakhapatnam-Guntur Region | Stretches from Visakhapatnam to Kurnool in Andhra Pradesh.

Industries propelled by port facilities and mineral reserves. Includes petroleum refinery, petrochemical, sugar, and textile industries. |

Visakhapatnam, Guntur, Eluru, Vijayawada |

| Gurgaon-Delhi-Meerut Region | Features light and market-oriented industries.

Specializes in electronics, textiles, sugar, cement, and machine tools. Benefits from proximity to the national capital and advanced infrastructure. |

Gurgaon, Delhi, Faridabad, Meerut, Ghaziabad, Agra, Mathura |

| Kollam-Thiruvananthapuram Region | Dominated by plantation agriculture and hydropower.

Industries include textiles, rubber, glass, chemical fertilizers, and food processing. Focused on coconut products, aluminum, and cement industries. |

Thiruvananthapuram, Kollam, Ernakulam, Alappuzha |

These industrial regions are crucial for India’s economic development, each contributing uniquely to the nation’s industrial output and employment opportunities. The strategic development of these areas, leveraging their geographical and resource-based advantages, is key to fostering balanced and sustainable industrial growth across the country.

Geographical Distribution of Major Industrial based on Geographical Factors and Non-Geographical Factors.

- The location of industries is crucial for their success and sustainability. Various factors, both geographical and non-geographical, play a significant role in determining where industries are established. This detailed table outlines the factors influencing the location of industries, providing insights into why certain industries are found in specific regions of India.

| Category | Factor | Explanation | Examples |

| Geographical Factors | Raw Materials | Industries often locate near raw material sources to minimize transportation costs, especially for weight-loss materials where the finished product is lighter than the raw inputs. | Sugar industries in sugarcane-growing states like Uttar Pradesh, Maharashtra; Iron & Steel industry near coalfields in Bokaro, Durgapur. |

| Power | Consistent and ample power supply is critical for industries, making proximity to power sources a key factor. | Aluminium industries, which are power-intensive, tend to locate near power sources. | |

| Labor | The availability of skilled, semi-skilled, and unskilled labor influences industrial location, with certain regions specializing in specific types of industry due to their labor force. | Glass work in Firozabad (Uttar Pradesh), silk work in Varanasi, carpets in Mirzapur. | |

| Markets | Proximity to markets is important for reducing transportation costs and meeting demand efficiently. | Cotton industries in urban centers like Mumbai, Ahmedabad; petroleum products near markets for easier transportation of crude oil. | |

| Transport | Efficient transport links (land, water, air) are essential for the collection of raw materials and distribution of finished goods. | Industrial centers like Agra, Delhi, Ghaziabad have developed due to efficient transport links. | |

| Water | Many industries require large quantities of water for their processes, making proximity to water sources a necessity. | Iron and steel, textile, and chemical industries near water resources like Kolkata, Mumbai, and Chennai. | |

| Climate | The climate can affect the process and quality of production, with some industries requiring specific climatic conditions. | Cotton textile industries in the humid coastal areas of Maharashtra and Gujarat; sugar industries in southern India due to favorable climatic conditions for sugarcane. | |

| Non-Geographical Factors | Government Policies | Industrial policies and incentives offered by the government or state can attract industries to specific locations. | The establishment of BHEL, Durgapur, and Bhilai steel plants due to the Second Industrial Policy; TATA’s Nano plant moved to Gujarat from West Bengal due to favorable policies. |

| Capital | The availability of capital and government subsidies can influence the location of an industry, especially for capital-intensive sectors. | Telecom and automobile industries requiring substantial capital investment. | |

| Access to Agglomeration Economies | Proximity to a leading industry or cluster of industries can provide benefits through linkages and interdependencies. | Industries tend to cluster in regions where they can benefit from the presence of other related industries, such as IT hubs. | |

| Historical Factors | The historical development of certain regions as industrial centers due to colonial or trade history can influence current industrial locations. | The growth of the cotton industry in Mumbai and shipbuilding in Chennai and Kochi due to colonial legacy and historical trade routes. | |

| Industrial Inertia | Once established, industries may resist moving due to the costs and complexities of relocation, even if the original advantages of the location diminish. | Industries may continue to operate in less optimal locations due to the high costs and challenges associated with moving to a new area. |

Measures to Solve the Problems of Industrial Inertia

- Addressing Labor Supply Issues

- Skilled Labor Availability: Enhance training and education facilities in new areas to develop a skilled and experienced workforce. Example: Development of industrial cities in coal fields of Jharkhand and Chhotanagpur plateau increased skilled workers.

- Labor Migration: Encourage migration through incentives and support services to ensure new areas have an optimum supply of labor.

- Improving Infrastructure

- Transport and Communication: Develop well-connected railroad, transport, and communication infrastructure in new areas to match the development levels of established industrial regions.

- Modernization vs. Relocation Costs: Analyze the cost-benefit aspects of modernizing existing locations versus relocating to new sites, considering market access and the availability of resources.

- Financial Support and Accessibility

- Financial Resources: Address the shortage of financial resources by enhancing access to banking in both rural and urban areas. Initiatives like rural banks and NABARD can provide necessary financial support for industrial relocation or expansion.

- Dependent Industries: Ensure that industries dependent on major industries (e.g., iron & steel, automobile, heavy engineering) are also encouraged to move, maintaining the industrial ecosystem’s integrity.

- Concept of High Technology Industry

- R&D Intensity: A significant focus on research and development efforts leading to advanced scientific and engineering product manufacturing.

- Skilled Workforce: A large proportion of the workforce comprises professionals and highly skilled workers.

- Innovative Examples: Robotics on assembly lines, computer-aided design (CAD) and manufacturing, electronic controls in smelting and refining processes, and continuous new chemical and pharmaceutical product development.

- Regional Concentration: High-tech industries often cluster in regionally concentrated, self-sustained, and highly specialized “Technopolises” or technology parks, fostering innovation and economic growth.

- Examples of Technopolis: Silicon Valley near San Francisco and Silicon Forest near Seattle are prime examples where high-tech industries have thrived, contributing significantly to regional and national economies.

Major Industries in India: Focus on Iron and Steel Industry

The Iron and Steel Industry is a cornerstone of the Indian economy, providing the essential material foundation for various other industries. It is not only pivotal for infrastructural development but also plays a significant role in the country’s economic growth.

| Aspect | Detail |

| Global Position | India is the 2nd largest producer of steel and the 4th largest producer of iron in the world. |

| China leads globally in steel production. | |

| Significance | Crucial for economic development and industrial growth. |

| Serves as a foundation for sectors such as rail tracks, agriculture, shipbuilding, and automobile manufacturing. | |

| Historical Evolution | Initial development with Bengal Iron Works at Kulti in 1870; production started in 1874. |

| Tata Iron and Steel Company (TISCO) established by Dorabji Tata in 1907, becoming the largest steel plant in the British Empire by 1939. | |

| Hindustan Steel Limited (HSL) set up three steel plants in the 1950s. | |

| Kalinganagar and Bokaro emerged as significant steel hubs in the early 21st century due to their proximity to coal mines, mineral deposits, and raw materials. | |

| Current Status | India’s steel production capacity is 143.91 million tonnes. |

| India is the world’s second-largest producer of crude steel, with an output of 9.5 million tonnes (MT). | |

| Holds one-fifth of the world’s reserves of iron ore deposits. |

Key Insights

- Strategic Importance: The iron and steel industry forms the backbone of the infrastructure and manufacturing sectors, underscoring its strategic importance to India’s overall industrial capability.

- Resource Rich: India’s rich reserves of iron ore have been a critical factor in the industry’s development, supporting domestic production and contributing to the country’s status as a key player in the global steel market.

- Industrial Growth Corridors: Regions like Kalinganagar and Bokaro have evolved into major industrial corridors for steel production, benefiting from geographical advantages such as access to raw materials and essential utilities.

- Capacity Expansion: The significant expansion of steel production capacity over the years reflects India’s growing industrialization and its ambition to enhance infrastructural and developmental projects.

Geographical distribution of the steel industry in India, its significance, challenges, and the objectives of the National Steel Policy (2017):

| Aspect | Details |

| Geographical Distribution in India | TISCO Plant, Jamshedpur: Near Mumbai-Kolkata railway line & Kolkata port.

Rourkela Steel Plant, Orissa: Near coal fields of Jharkhand. Bhilai Steel Plant, Chhattisgarh: Near coal mines of Korba; water from Tandula Dam. Visvesvaraya Steel Plant, Karnataka; Visakhapatnam Steel Plant, Andhra Pradesh; Salem Steel Plant, Tamil Nadu. Durgapur Steel Plant, West Bengal: In Raniganj & Jharia coal belt; water from Damodar valley. Bokaro Steel Plant, Jharkhand: Set up in 1964 with Russian collaboration. |

| Significance of Steel Industry | Backbone for infrastructure development.

Enhances forward-backward linkage in industrial infrastructure. Important for regional development. Generates employment, especially in backward areas. |

| Challenges to Steel Industry | Low productivity in Asian countries.

Competition from imports (China & Japan). Shortage of high-quality coal; environmental concerns. Technological and capital inadequacies; foreign dependence. Depletion of raw materials; technological shifts. Transportation sector development prompting location shifts. Seeking economical routes: alternative fuels, cheap labor, low transportation costs. |

| National Steel Policy (2017) | Objective: To achieve 300 MT steel production by 2030.

Vision: Enhance domestic consumption, produce high-quality steel, global competitiveness. Purposes: Develop domestic industries to international standards. Increase domestic production value to meet demand. Promote cost-efficient production. Overseas investment for raw material acquisition. Achieve self-sufficiency with government support. Guide MSMEs, private and public sectors to increase production. Aim for per capita steel consumption of 160 kg by 2030-31. |

Copper Industry:

- Copper is renowned for its exceptional flexibility and excellent heat conductivity, making it an indispensable metal in various industrial applications. Its significance transcends mere physical properties, as copper is historically recognized as one of the oldest metals known to humanity. This metal has played a crucial role throughout history, influencing technological advancements and economic developments from ancient times to the modern global economy.

Global Distribution of Copper

- China: Notably in areas such as Manchuria, Penki, Kirin, Fushun, and Wuhan, China stands as a major player in the copper industry.

- Germany: The Ruhr region is particularly prominent in copper production.

- Japan: Regions such as Osaka-Kobe, Tokyo-Yokohama, and Nagoya are critical for Japan’s copper industry.

- USA: Areas including Cleveland, Michigan, Pittsburgh, and Pennsylvania are significant contributors to the US copper production.

- Canada: The Lawrence Seaway and Appalachian coalfields are noted for their copper production.

- Russia: The Ural-Kuznetsk Siberia region is a key area for Russian copper production.

These regions are instrumental in the global copper supply chain, each with its unique contribution to both the mining and processing segments of the industry.

Industrial Applications and Consumption

- Copper and its alloys find extensive use across a myriad of industries, with the electricity sector being the largest consumer. This heavy consumption is attributed to copper’s availability, affordability, and superior conductivity, making it an essential material for electrical applications. In the hierarchy of metals, copper is ranked as the third most important, following steel and aluminium, due to its wide-ranging applications and significance in modern infrastructure and technology.

Copper Industry in India: A Snapshot

- India’s role in the global copper market is characterized by its limited ore reserves, contributing only about 2% to the world’s total reserves. Despite this, only one-third of the potential mining area, estimated at 60,000 square kilometers, has been explored. India’s mining production accounts for slightly over 2% of the global output, while its refined copper production surpasses 4% of the world’s total.

- In recent years, India has positioned itself as the 4th largest in smelter production and 8th in refined copper consumption. The fiscal year 2021 saw India producing 363,000 tonnes of copper, with imports at 150,000 tonnes and exports at 46,000 tonnes, highlighting its active participation in both domestic and international copper markets.

Geographical Distribution of Copper in India

| State | Key Copper Producing Areas | Details |

| Madhya Pradesh | Taregaon area, Malanjkhand belt in Balaghat district | Has become India’s largest producer of copper. |

| Rajasthan | Khetri-Singhana belt in Jhunjhunu district | Also includes Ajmer, Alwar, Bhilwara, Chittorgarh, Dungarpur, Jaipur, Jhunjhunu, Pali, Sikar, Sirohi, and Udaipur. |

| Jharkhand | Singhbhum district | Most important copper-producing district. Includes Hasatu, Baraganda, Jaradih, Parasnath, Barkanath in Hazaribagh district, Bairakhi in Santhal Parganas, and parts of Palamu. |

Major Copper Industries in India

| Company Name | Established | Location | Products & Operations |

| Hindustan Copper Ltd | 1967 | Operations in Rajasthan, Madhya Pradesh, Jharkhand, Maharashtra, and Gujarat | Specializes in copper smelting, refining, and casting of refined copper. Operates mines and plants across five units. |

| Bhagyanagar India Ltd | Not specified | Hyderabad | One of India’s oldest and largest producers of copper products such as Copper Rod, Strips, Pipes, Busbars, and Sheets. |

| Arcotech Limited | Not specified | Haryana | Manufactures copper alloy products, as well as aluminum plates, bars, sheets, foils, rods etc. |

| Sterlite Copper Industries | Not specified | Tamil Nadu | One of India’s leading copper producers, catering to 36% of the country’s refined copper demand. |

| Hindalco Industries Limited | Not specified | Mumbai | A subsidiary of the Aditya Birla Group that manufactures both aluminum and copper in India. |

Recent Initiatives in the Copper Sector

- Growth in the Copper Sector: The copper sector has witnessed significant growth in recent years, demonstrating a Compounded Annual Growth Rate (CAGR) of 25%. This growth, as indicated by the mining ministry’s data, showcases the expanding copper industry’s capacity and its increasing contribution to the economy.

- Government Policies to Encourage Recycling: In a strategic move to boost the copper recycling industry within the country, the Union Budget of 2021 announced a significant reduction in import duty on copper scrap. The duty was halved from 5% to 2.5%, a policy aimed at encouraging the establishment and expansion of copper recycling units across India. This initiative not only supports environmental sustainability but also aids in reducing the dependency on imported copper by making recycled copper more economically viable.

- Boost in Copper Exports: India has seen a notable increase in its exports of refined copper, totaling 11,432 tonnes. This achievement is credited to the concerted efforts of major players in the industry such as Birla Copper, Sterlite Industries, and Hindustan Copper Ltd. Their capability to scale up production has positioned India as a significant exporter in the global copper market.

- Significance of Copper: Copper is a versatile metal with a wide array of applications, underlining its importance in various industries. Its superior qualities over alternatives like plastic and steel highlight its indispensable role.

- Environmental and Economic Efficiency: Copper pipes, being more eco-friendly than plastic pipes, represent a sustainable choice in plumbing applications. Copper’s natural resistance to corrosion and its strength, coupled with its lightweight nature, make it a cost-effective material. It reduces labor costs and facilitates easy installation over long distances.

- Comparison with Steel: Unlike steel, which is prone to corrosion and rust, copper maintains its integrity over time. Its durability, combined with the fact that it is less expensive and lead-free, makes copper a preferable choice in many construction and manufacturing applications. Copper’s low emission levels during production also give it an environmental edge over synthetic plastics.

Challenges Facing the Copper Industry

- Dependency on Imports: The scarcity of copper resources within India necessitates heavy reliance on imports, notably from countries such as South Africa, Japan, and Australia. This dependence not only raises production costs but also increases working capital needs.

- Impact of Free Trade Agreements: Free trade agreements that allow duty-free imports of copper pose a threat to the domestic copper industry, potentially rendering it obsolete if it cannot compete on price and quality.

- Need for Industry Development: There is a pressing need for the development of the copper semis industry to meet domestic demands. This requires access to capital, competitive technology, skill development, and quality certifications.

- Sustainable Growth: The industry must focus on innovative technology and renewable energy to achieve sustainable growth, ensuring that it remains viable and environmentally responsible in the long run.

Aluminium Industry in India

The aluminium industry is a significant sector within India’s manufacturing landscape, standing as the second most important industry after iron and steel. Characterized by its extensive bauxite reserves and ranking as the 5th largest aluminium producer globally, India’s aluminium sector highlights the country’s pivotal role in the global metals market.

Applications of Aluminium

- Electricity: Aluminium’s excellent conductivity makes it a preferred material for electrical applications.

- Household Utensils and Electric Appliances: Its resistance to corrosion and ease of cleaning favor its use in kitchenware and appliances.

- Manufacturing: The metal’s light weight and strength are advantageous in manufacturing aeroplanes, rail coaches, and vehicles.

- Defense and Nuclear Accessories: Aluminium’s properties are crucial for applications requiring light weight and durability in defense and nuclear sectors.

Growth of the Aluminium Industry: The aluminium industry in India has experienced remarkable growth, increasing its output nearly 20 times. This rapid expansion underscores aluminium’s status as one of the fastest-growing metals globally, reflecting India’s commitment to enhancing its production capabilities and meeting both domestic and international demand.

Production Purposes: The industry focuses on two primary production processes:

- Primary Activities: This involves the production of aluminium from raw materials, primarily through bauxite mining. Bauxite is the principal ore of aluminium, and its processing is the first step in aluminium production.

- Processing into Semi-finished Goods: The produced aluminium is further processed into semi-finished products such as rods, bars, castings, and forgings, which serve as inputs for various manufacturing applications.

Evolution of the Aluminium Industry in India

- Early Discoveries: Although aluminium was discovered in the 19th century, bauxite ore, the primary source of aluminium, is not found in large free-standing quantities. Its extraction and processing form the basis of the aluminium industry.

- Inception: The Aluminium Corporation of India, established in 1937, marked the beginning of aluminium manufacturing in India, with production commencing at Jaykay Nagar in West Bengal by 1942.

- Expansion: The industry saw significant expansion during the Second and Third Five-Year Plans. Key players such as the Indian Aluminium Company (INDAL), Hindustan Aluminium Company (HINDALCO) in Renukoot, UP, and later, the Madras Aluminium Company (MALCO) in Tamil Nadu and Bharat Aluminium Company Ltd (BALCO), contributed to the growth and establishment of the aluminium sector in India.

Geographical Distribution of Bauxite in India

| State | Key Bauxite Producing Areas | Details |

| Orissa | Kalahandi and Koraput districts | Largest bauxite producing state, accounting for more than half of India’s total production. Extends into Andhra Pradesh. |

| Jharkhand | Ranchi, Lohardaga, Palamu, Gumla, Dumka, Munger districts | Notable for significant bauxite production. |

| Maharashtra | Kolhapur district (Udgeri, Dhangarwadi, Radhanagari, Inderganj) | Bauxite capping the plateau basalts. |

| Chattisgarh | Maikala range in Bilaspur, Durg districts; Amarkantak plateau | Key regions for bauxite production. |

| Madhya Pradesh | Amarkantak plateau, Maikala range, Kotni area in Jabalpur | Major bauxite producing areas. |

| Other States | Andhra Pradesh, Kerala, Rajasthan, Uttar Pradesh, Jammu and Kashmir, Goa | Various districts across these states are involved in bauxite production. |

Major Aluminium Smelting Plants in India

| Location | Company Name |

| Korba | Bharat Aluminium Co (BALCO) |

| Alupuram | Hindustan Aluminium Co. (HINDALCO) |

| Renukoot | Hindustan Aluminium Co. (HINDALCO) |

| Madras | Madras Aluminium Co. (MALCO) |

| Hirakud | Hindustan Aluminium Co. (HINDALCO) |

| Angul | National Aluminium Co. (NALCO) |

| Jharsuguda | Vedanta Aluminium Co. (VAL) |

Challenges Faced by the Aluminium Industry

- Dislocation of Power Supplies: Aluminium production is energy-intensive, requiring a stable and continuous power supply. However, disruptions in the grid system and the high cost of electricity significantly impact the industry’s operational efficiency. The aluminium smelting process demands constant electrical energy, and any fluctuation can lead to production losses and increased costs.

- Underutilisation of Bauxite Deposits: India is endowed with substantial bauxite reserves, particularly along the east coast. Despite this, the industry does not fully exploit these resources due to various constraints, including environmental concerns, regulatory hurdles, and lack of infrastructure. This underutilisation results in a missed opportunity for enhancing domestic aluminium production.

- Scale of Production Issues: The economics of aluminium production favor large-scale operations due to the high fixed costs associated with setting up and running smelting plants. Small-scale operations find it challenging to compete, as they cannot achieve the economies of scale necessary to reduce production costs and remain profitable. This barrier to entry limits the industry’s expansion and diversification.

- Capital Intensive Nature: Establishing an aluminium smelting operation requires significant capital investment in technology, infrastructure, and raw materials. The hefty initial investment and ongoing operational costs deter new entrants and constrain existing players’ ability to expand or modernize their facilities.

- Regulatory and Environmental Clearances: The aluminium industry faces stringent regulatory scrutiny, especially concerning environmental clearances and the allotment of bauxite mines. The process for obtaining these clearances is often lengthy and complicated, fraught with bureaucratic delays. These hurdles slow down the industry’s growth and discourage investment.

- Competitiveness on the Global Stage: Despite having substantial reserves of high-quality bauxite, India’s aluminium production quality and efficiency do not match those of leading producers like Australia, Canada, France, and the USA. This discrepancy can be attributed to outdated technology, inefficient production processes, and the challenges mentioned above. As a result, Indian aluminium products may be less competitive in the international market, affecting the industry’s export potential.

Zinc Industry

The zinc industry is an integral part of the global metal market, given zinc’s widespread applications in various sectors due to its distinctive properties. This metal, often found in mixed ores containing lead, plays a pivotal role in alloying, manufacturing, and numerous industrial processes. This overview provides a detailed analysis of zinc’s sources, applications, and its significance in diverse fields.

Sources of Zinc: Zinc is primarily extracted from various ores, the most notable being sphalerite (ZnS), along with others like chalcopyrite and iron pyrites. These sources are pivotal for the extraction and production of zinc, catering to its global demand across different industries.

Applications of Zinc

- Industrial Applications

- Alloying: Zinc is extensively used for alloying with other metals, enhancing their properties for various industrial applications.

- Manufacturing: The production of sheets and zinc dust for the preparation of compounds and salts constitutes a significant portion of its industrial use.

- Zinc Oxides: Utilized in paints, ceramic materials, inks, and matches, zinc oxides serve as a crucial component in the production of dry batteries, electrodes, textiles, and die-casting. The rubber industry and manufacturers of collapsible tubes for drugs and pastes also rely heavily on zinc.

- Diverse Uses

- Protective Coatings: Its strong anti-corrosive properties make zinc ideal for protective coatings on metal surfaces, preventing rust and corrosion.

- Solar Cells and Nuclear Reactors: Zinc’s application in high-tech areas like solar cells and nuclear reactors underscores its versatility.

- Health and Nutrition: Zinc plays a vital role in human health by maintaining the balance of enzymes and supporting the proper functioning of internal organs. It is essential for the growth and development of humans, animals, and plants.

- Specialized Applications

- Sunscreens: Zinc is used in the manufacture of sunscreens, offering protection against harmful UV rays.

- Automobile Tires: Zinc oxide is a key ingredient in manufacturing automobile tires, where it enhances heat resistance and prevents the tires from breaking apart.

- Oil-based Products: In the paint industry, artificial turf, and die-casting industry, zinc is valued for its properties in enhancing the quality of synthetic products.

Significance of Zinc: The significance of zinc extends beyond its industrial applications. It is a critical mineral essential for health, contributing to the immune system and metabolic processes. In agriculture, zinc is crucial for crop growth and soil health, illustrating its importance across various domains of life.

Geographical Distribution of Zinc in India

| State | Key Producing Areas | Contribution to National Production |

| Rajasthan | Zawar mines, Udaipur district | More than 99% of India’s total zinc production |

| Other States | Andhra Pradesh, Kerala, Madhya Pradesh, Bihar, Maharashtra, Sikkim | Minor contributors compared to Rajasthan, details unspecified |

Global Zinc Production

| Country | Notes |

| USA | One of the major producers of zinc. |

| Canada | Significant zinc production, especially in the northern regions. |

| Zimbabwe | Known for its mineral wealth including zinc. |

| Japan | Engages in both mining and the importation of zinc for processing. |

| Mexico | Has several key zinc mining operations. |

| Australia | Major zinc producer with large reserves and mining operations. |

| Peru | Important for its contribution to global zinc production. |

| Russia | Significant zinc production, part of its vast mineral resources. |

| Democratic Republic of Congo | Noted for its mineral-rich region contributing to global zinc supply. |

This distribution highlights the importance of Rajasthan within India for zinc production, being the most significant contributor by a large margin. On a global scale, the production of zinc is widespread, with countries across different continents contributing to the global supply, each with significant mining operations or reserves. The diversity in geographical distribution indicates the widespread availability of zinc as a resource, yet also points to the strategic importance of certain regions or countries in meeting global demand.

Lead Smelting Industry Overview

The lead smelting industry is a critical component of the global metals market, focusing on the extraction and refining of lead, primarily from the mineral galena. Lead’s unique properties make it indispensable in various applications across multiple industries.

Source and Nature of Lead: Lead is a relatively rare element that does not occur freely in nature. The primary source of lead is galena (PbS), a mineral found in crystalline rocks, including pre-Cambrian formations and the Vindhya range. This mineral is the starting point for the lead smelting process, which extracts the usable metal.

Uses of Lead

- Malleability and Other Properties: Lead’s softness, heaviness, and malleability allow it to be formed into thin sheets. Despite being a poor conductor of heat, its physical properties make it valuable for various applications.

- Alloys: Lead is used to create bronze alloys and serves as an anti-friction metal, enhancing the durability and functionality of machinery components.

- Lead Oxide: This compound finds applications in cable covers, ammunition, paints, glass making, and the rubber industry, highlighting lead’s versatility.

- Transportation: In automobiles, airplanes, and machines, lead is utilized for its durability and weight, contributing to the manufacturing of parts that require dense materials.

- Lead Nitrate: This chemical is used in the dyeing and printing industries, showcasing lead’s chemical utility.

- Sanitary Fittings: Lead’s use in manufacturing tubes and pipes for sanitary fittings demonstrates its importance in construction and infrastructure development.

Distribution of Lead Industries in India

- Rajasthan: Dominating India’s lead production, Rajasthan accounts for more than 90% of the country’s output. The Zawar and Debari mines in Udaipur are particularly noteworthy, positioning Rajasthan as a crucial state in India’s lead industry.

- Andhra Pradesh: With notable mines in Kurnool and Nalgonda, Andhra Pradesh contributes significantly to India’s lead production, highlighting the state’s mineral wealth.

- Other Regions: Lead ores are also found in the Himalayan region and Tamil Nadu, though these areas contribute less significantly to the national production compared to Rajasthan and Andhra Pradesh.

Challenges and Opportunities

- The lead smelting industry faces several challenges, including environmental concerns due to lead’s toxicity, the need for sustainable mining practices, and competition from alternative materials. However, opportunities for growth exist in recycling lead from batteries and other products, developing more environmentally friendly smelting technologies, and expanding applications for lead in new technological domains.

Cotton Textile Industry in India

The cotton textile industry in India represents a significant segment of the country’s economy and its rich cultural heritage. As the second-largest producer of cotton globally, trailing only behind China, India’s contribution to the cotton sector is monumental. This industry, deeply rooted in India’s history from the Harappan civilization through British rule, has evolved significantly over the centuries. This overview explores the industry’s development, factors influencing its growth, government initiatives for expansion, and its historical evolution.

Historical Significance and Global Recognition

- Ancient Dominance: India’s prowess in cotton textile production dates back to ancient times, with a monopoly in cotton textiles since 1500 BC. Indian cotton, particularly the Muslin from Dhaka and Chintzes of Masulipatnam, gained enormous demand in the European market, showcasing the country’s long-standing tradition in producing high-quality cotton fabrics.

- Industrial Evolution: The establishment of the first cotton mill in Kolkata in 1818 marked the beginning of India’s formal cotton textile industry. The industry saw further growth with the establishment of the Bombay Spinning and Weaving Company in 1854, and Ahmedabad’s emergence as the ‘Manchester of India’ following the opening of the Shahpur mill in 1861. However, the advent of the Industrial Revolution and discriminatory policies under British rule significantly impacted the industry and its exports.

- Nationalistic Revival: The Swadeshi Movement of 1906 played a crucial role in revitalizing the Indian cotton textile industry. The movement, coupled with the non-cooperation movement (1920-22), led to the emergence of new centers like Ahmedabad, further strengthening the industry’s foundation in India.

Modern Landscape and Government Initiatives

- Production and Export: With Maharashtra leading in cotton cultivation followed by Gujarat, India has maintained its status as a global cotton powerhouse. Between October 2020 and April 2021, India majorly exported cotton to Bangladesh and China, accounting for over 80% of its exports, with Vietnam and Indonesia as other significant importers.

- Industry Growth Factors: The growth of the cotton textile industry in India is influenced by several factors, including its tropical location, the suitability of cotton clothing for the hot and humid climate, large cotton production, abundance of skilled labor, and competitive foreign markets. The industry today is an indigenous enterprise, a result of concerted efforts in capital and entrepreneurship.

- Government Support: Recognizing the industry’s importance, the Indian government has facilitated more than 60% of the world’s cotton production and allowed 100% Foreign Direct Investment (FDI) through the automatic route in the textile sector. Initiatives like the Merchandise Exports from India Scheme (MEIS) and schemes such as the Scheme for Integrated Textile Parks (SITP), Integrated Skill Development Scheme (ISDS), and Integrated Processing Development Scheme (IPDS) are designed to bolster cotton production and the textile industry.

| State/Region | Important Centers | Key Features/Location Assets |

| Uttar Pradesh | Kanpur, Moradabad, Etawah, Meerut, Ghaziabad | Concentrated in the western parts where cotton is grown. |

| West Bengal | Calcutta, Howrah, Sodepur, Serampore, Shyamnagar | Mills located around Calcutta and Howrah, benefiting from a large market, chief coal-producing areas, and port facilities. |

| Madhya Pradesh | Gwalior, Indore, Ujjain, Raipur, Dewas, Bhopal, Jabalpur | Concentrated in the Western Malwa Plateau’s cotton tract. |

| Karnataka | Bangalore, Bellary, Mysore, Devangiri | |

| Andhra Pradesh | Hyderabad, Warangal, Guntur, Ramagundam, Tirupati | Industry growth aligned with the cotton-growing areas of Telangana. |

| Rajasthan | Kota, Jaipur, Jodhpur, Ganganagar, Bhilwara | |

| Punjab | Amritsar, Ludhiana | Emerged as a leading cotton-producing state. Introduction of new cotton varieties like BT cotton, alongside R&D for better varieties. |

Global Context: The cotton textile industry is not limited to India but spans across the globe, with several countries leading in production and innovation. Key countries include:

- China: A global leader in cotton production and textile manufacturing, benefiting from extensive cultivation areas, advanced technology, and a robust manufacturing infrastructure.

- Bangladesh: Known for its booming garment industry, Bangladesh is a significant player in the cotton textile market, primarily due to its cost-effective labor and growing manufacturing capabilities.

- Vietnam: Has emerged as a competitive textile producer, with growth driven by foreign investment and a focus on exporting textile products.

- Sri Lanka, Portugal, Egypt: Each of these countries has a unique position in the global cotton textile industry, from Sri Lanka’s focus on ethical and sustainable production to Egypt’s reputation for high-quality cotton.

This distribution underscores the cotton textile industry’s reliance on geographical, climatic, and economic factors, both in India and globally. The industry’s growth is intricately linked to the availability of raw materials, technological advancements, and market demand, shaping the economic landscape of regions engaged in cotton textile production.

The cotton industry in India is influenced by a variety of factors that affect its operations, development, and competitive edge both domestically and internationally. This industry, vital for the Indian economy, faces challenges but also benefits from certain advantages due to the country’s unique geographical and socio-economic conditions.

Advantages Influencing the Cotton Industry

- Proximity to Cotton-Producing Areas: The industry benefits from being located near cotton-producing areas, reducing transportation costs and facilitating easier access to raw materials.

- Availability of Labor: India’s large population provides a cheap and abundant labor force, essential for labor-intensive industries like cotton textile manufacturing.

- Major Centers of Production: States such as Gujarat, Maharashtra, Tamil Nadu, Uttar Pradesh, Karnataka, and Punjab are major centers, contributing significantly to the industry’s output.

- Climatic and Soil Conditions: The sub-tropical climate and presence of black soil in India are conducive to cotton cultivation, supporting a booming industry.

- Well-Connected Transportation: Efficient connectivity with cotton-producing areas and export markets through a well-developed transportation network enhances the industry’s reach and efficiency.

- Decentralized Nature: The decentralization of the cotton textile industries, supported by developments like railway lines and government policies, has facilitated the spread of the industry across the country.

Challenges Faced by the Cotton Industry

- Quality of Raw Cotton: The partition led to a scarcity of long-staple cotton in India, affecting the quality of the end products.

- Obsolete Machinery: Many mills operate with outdated machinery, resulting in lower productivity and inferior quality products.

- Dominance of the Unorganised Sector: The sector’s fragmentation hinders the realization of economies of scale and competitive advantages.

- Productivity and Labor Issues: Compared to advanced countries, the productivity of Indian labor is lower due to the lack of automation and modern technology.

- Complex Labour Laws: Indian labor laws, like the Industrial Disputes Act of 1947, impose restrictions that limit the industry’s growth potential.

- Lack of Foreign Investment: The reluctance of foreign investors, deterred by the use of outdated technology and machinery, limits the industry’s modernization and competitiveness.

- High Production Costs: High costs of production, combined with competition from countries using more advanced machinery, render Indian cotton textiles less competitive internationally.

- Erratic Power Supply: Inadequate and irregular power supply severely impacts production schedules and overall productivity.

Government Policies and Support

- Initiatives like the Technology Upgraded Fund Scheme (TUFS) and the IN SITU upgradation of power looms reflect the government’s support for modernizing the industry and promoting decentralization. State-level incentives aimed at easing business operations are also pivotal in attracting new investments and encouraging industry expansion.

Jute Textile Industry

The jute textile industry holds a significant position in the Indian economy, being the second most important textile industry after cotton. Known for its golden fiber, jute is primarily produced in the eastern states of India, with West Bengal at the forefront due to its ideal soil and climatic conditions. This document expands on the facets of the jute industry, including its global standing, domestic consumption, export destinations, and historical evolution.

Importance and Global Standing

- Dominance in India: The jute industry is predominantly located along the Hugli River in Kolkata, West Bengal, thanks to the region’s favorable conditions. West Bengal alone accounts for 80% of India’s jute industry, followed by Andhra Pradesh.

- Global Production and Export: India is the largest producer of jute products. However, Bangladesh leads in acreage and global jute exports, contributing to three-fourths of worldwide exports, while India’s share stands at 7%.

- Labor Intensive: The production of jute is labor-intensive, relying heavily on manual labor for cultivation, harvesting, and processing.

Domestic Consumption and Export

- High Domestic Consumption: The Indian market consumes over 90% of its jute production, underscoring a vast domestic demand for jute products.

- Export Destinations: Indian jute products find markets across the globe, including the USA, UK, Australia, Belgium, Egypt, Germany, Italy, Japan, Saudi Arabia, and Turkey. Notably, in 2021, the USA emerged as the top importer of Indian jute, with exports valued at Rs. 20,214.48 million.

Evolution of the Jute Industry

- Colonial Beginnings: The British colonial rule significantly contributed to the initial development and expansion of the jute industry, with raw jute exported from Bengal to Europe from the 1840s.

- Shift to Finished Products: The 20th century saw a shift in demand from raw jute to finished products, alongside a decline in raw jute exports.

- Industrialization: The transition from a handloom to a large-scale industry began in 1855 in Kolkata, marking a significant leap in production and export capabilities.

- Impact of Partition: The 1947 partition disrupted the jute industry, dividing the mills and the jute-producing areas between India and Bangladesh (then East Pakistan), affecting production and global competition.

Concentration in the Hooghly Basin: The high concentration of jute mills in the Hooghly Basin is attributed to several factors:

- Availability of Raw Material: The Ganga-Brahmaputra delta, producing about three-fourths of India’s jute, is proximal, ensuring a steady supply of raw materials.

- Energy Supply: Coal from the Raniganj fields supports the industry’s power requirements.

- Water Transportation and Processing: The availability of cheap water transportation and abundant water for jute processing and washing is crucial.

- Climate: The humid climate of the region benefits the spinning and weaving processes.

- Export Connectivity: Proximity to Kolkata port facilitates easy export operations.

- Labor: The dense population provides a cheap labor force, essential for this labor-intensive industry.

- Capital and Services: The vicinity to Kolkata offers access to big capitalists, banking, and insurance services, supporting the industry’s financial needs.

Factors Influencing the Jute Industry

- Climatic and Soil Conditions: The specific climatic conditions and fertile soil of the Ganges delta are ideal for jute cultivation, making this region a primary producer.

- Transportation: Efficient transport networks, including highways, railroads, and ports, facilitate the movement of raw and finished jute goods, enhancing the industry’s efficiency.

- Market Accessibility: The domestic market for jute products, such as gunny bags, remains robust across India, supported by environmental policies and the ban on plastic bags.

- Raw Material Availability: Besides jute, the availability of Mesta as a complementary fiber expands the raw material base for the industry.

- Labor: The availability of cheap labor, especially in the neighboring regions of Bihar and Uttar Pradesh, supports the labor-intensive processes of the jute industry.

- Diversification and Environmental Awareness

- The industry benefits from a growing diversification in the use of jute products beyond traditional packaging to applications in oil conservation, apparel, and more, spurred by environmental awareness and regulatory support against plastic use.

Challenges Faced by the Jute Industry

- Raw Material Shortage: Partition led to a significant portion of jute-producing areas becoming part of Bangladesh, causing a raw material shortage in India.

- Obsolete Machinery: The predominance of outdated machinery hampers productivity and quality, with insufficient modernization efforts noted.

- International Competition: Advanced technology in newly established jute mills in Bangladesh enables the production of higher quality goods at lower costs than Indian counterparts.

- Synthetic Competition: The industry faces stiff competition from synthetic packing materials, reducing the market share for jute goods.

- Technological and Diversification Limitations: Limited by old processing technology and a lack of product diversification, the industry struggles to expand beyond traditional handicraft and packaging uses.

- Infrastructural Issues: Challenges in infrastructure, including power supply, transportation, and capital, threaten the industry’s sustainability.

- Economic Disparities: The discrepancy between the high procurement prices of raw jute and the lower selling prices of processed goods undermines profitability.

- Quality Concerns: Natural disasters affecting the Ganges delta region can degrade the quality of jute fibers, impacting the overall quality of jute products.

Government Initiatives to Support the Jute Sector

- Golden Fiber Revolution and Technology Mission on Jute and Mesta: Aimed at enhancing jute production, despite challenges from cheaper synthetic alternatives.

- Technical Textiles Mission: Includes Jute Geo-Textiles (JGT) for applications in civil engineering and soil erosion control, reflecting an effort to diversify jute uses.

- Jute SMART Initiative: Launched to ensure transparency in jute procurement, fostering an integrated platform for government sacking procurements.

- Jute ICARE: Provides farmers with better cultivation tools and practices, aiming to improve yield and quality.

- Legislative Measures: The Jute Packaging Materials Act (1987) and mandates for jute packaging for food grains and sugar promote the use of jute over plastics.

- Minimum Support Price (MSP): Inclusion of jute in the MSP regime encourages farmers to cultivate jute by ensuring a guaranteed price for their crop.

Sugar Industry

The sugar industry in India holds a significant position in the agricultural and industrial landscape, being one of the largest producers of sugarcane and cane sugar globally. This industry, second only to the cotton textile industry in terms of agricultural-based industrial size, plays a crucial role in the economic fabric of the country.

Overview of the Sugar Industry

- Global Standing: India ranks as the second largest producer of sugar worldwide, trailing behind Brazil.

- Introduction by the British: The modern sugar industry in India was initiated by British Indigo planters as a response to the declining demand for indigo.

- Climatic Dependence: Over 80% of sugarcane cultivation occurs in tropical and subtropical regions, which are ideal due to favorable climatic conditions.

- Location Criticality: Given that sugarcane is heavy, of low value, weight-losing, and perishable, sugar mills are strategically located near cultivation areas to prevent the loss of sucrose content, which diminishes with time.

Factors Influencing the Shift from North to South India

- The sugar industry has witnessed a significant geographical shift from North to South India over the years. Initially, North India accounted for 90% of the country’s sugar production, which has now reduced to approximately 35-40%. This shift can be attributed to several key factors:

- Climatic Advantages

- Tropical Climate: The peninsular region’s tropical climate results in higher yields per unit area compared to the temperate northern region.

- Sucrose Content: Sugarcane varieties in the tropics have a higher sucrose content, enhancing sugar production efficiency.

- Crushing Season Length: The crushing season in South India spans 7-8 months, in contrast to North India’s shorter 4-month season, allowing for extended production periods.

- Cooperative Movement: The cooperative movement in Peninsular India has seen more success and better management compared to its Northern counterpart, leading to more efficient and productive cooperative sugar mills.

- Politicization and Pricing: The politicization of the cooperative movement in the South has enabled farmers to negotiate better terms and secure higher prices for sugarcane, utilizing mechanisms like the Fair and Remunerative Price (FRP) and State Advised Prices (SAP).

- Modernization of Mills: Mills in South India are generally newer and equipped with modern machinery, resulting in higher productivity compared to older mills in the North.

Geographical Distribution of the Sugar Industry

| Region | Country/Area | Characteristics and Key Centers |

| India | ||

| North | Uttar Pradesh, Bihar, Haryana | Uttar Pradesh features a higher number of mills but smaller in size compared to Maharashtra.

Key centers: Meerut, Gorakhpur. |

| Bihar and Haryana contribute significantly, complementing the northern belt’s production capacity. | ||

| South | Maharashtra, Karnataka, Tamil Nadu | Maharashtra leads in production, with significant centers like Ahmednagar, Kolhapur.

Karnataka contributes notably to the southern belt’s output. |

| Tamil Nadu is distinguished by high productivity per acre, higher sucrose content, and a longer crushing season, leading to the highest yield.

Key centers: Coimbatore, Karur. |

||

| Global | ||

| Brazil | The world’s largest sugar producer, known for its vast sugarcane plantations and advanced ethanol production from sugarcane. | |

| India | Consistently ranks among the top sugar producers globally, with its diverse climatic conditions and extensive sugarcane cultivation areas. | |

| Thailand | Major exporter of sugar, with a strong agro-industrial base in sugarcane production. | |

| Australia | Known for its efficient, large-scale sugarcane farming in Queensland, contributing significantly to global sugar exports. |

Insights and Expansion:

- Regional Variations in India: The sugar industry’s geographic distribution within India is markedly divided between the north and south. The northern region, led by Uttar Pradesh, has a larger number of mills, which are generally smaller, impacting the total production volume. In contrast, Maharashtra in the south has fewer but larger mills, enabling it to surpass Uttar Pradesh in total production. Tamil Nadu, with its high efficiency in sugarcane cultivation, exemplifies how agronomic factors like sucrose content and crop yield per acre are crucial for industry performance.

- Global Landscape: Brazil dominates the global sugar industry, not only in production but also in the innovative use of sugarcane for ethanol production, reflecting the industry’s potential for diversification. India’s significant role as a global sugar producer is supported by its vast cultivation area and regional production nuances. Thailand and Australia are notable for their export-oriented sugar industries, with Thailand’s agro-industrial prowess and Australia’s large-scale, efficient sugarcane farming setting standards in the industry.

Challenges to the Sugar Industry

- Low Yield

- Issue: India boasts the largest area under sugarcane cultivation globally, yet it suffers from one of the lowest yields per hectare. This discrepancy leads to insufficient sugarcane supply to mills, affecting overall production levels.

- Impact: The low yield not only results in a diminished sugar output but also hinders the industry’s ability to meet both domestic and international demand efficiently.

- Short Crushing Seasons

- Issue: The sugar manufacturing process is highly seasonal, with crushing seasons lasting only 4-7 months annually. During the off-season, mills and workers remain idle, leading to significant financial strain on the industry.

- Solution: Implementing staggered sowing and harvesting schedules could ensure a more consistent sugarcane supply, potentially extending the crushing season and enhancing productivity.

- High Cost of Production

- Issue: India’s sugar production costs are among the highest worldwide, attributed to expensive sugarcane, outdated technology, inefficient production processes, and substantial excise duties.

- Solution: Reducing production costs could involve better utilization of by-products such as bagasse and molasses, adopting modern technologies, and streamlining production methods.

- Old and Obsolete Machinery

- Issue: Many sugar mills, particularly in North India, operate with outdated machinery, leading to low productivity and reduced production output.

- Solution: Upgrading to modern machinery and technology can significantly improve efficiency, yield, and the overall competitiveness of the sugar industry.

- Government Policies

- Issue: The sugar sector suffers under the weight of government control and populist policies. These include unviable sugarcane pricing, which causes fluctuations between surplus and shortage, and a dependency on government-funded bailouts and subsidies.

- Impact: Such policies create a cycle of financial instability within the industry, leading to large cane arrears and inhibiting long-term growth and sustainability.

Strategies for Overcoming Challenges

- Agricultural Improvements: Enhancing sugarcane yield through advanced agricultural techniques, better crop management, and high-yield sugarcane varieties.

- Season Extension: Developing strategies to extend the crushing season, thus ensuring better utilization of resources and stable employment for workers.

- Technological Advancements: Investing in new technologies and equipment to modernize production processes, improve efficiency, and reduce costs.

- Policy Reforms: Advocating for rational government policies that ensure fair sugarcane pricing, reduce bureaucratic control, and encourage industry growth through incentives and support for innovation.

- By-product Utilization: Focusing on the efficient use of by-products to create additional revenue streams and reduce waste.

The Rangarajan Committee Formula and the Future of India’s Sugarcane Industry

- The Rangarajan Committee’s recommendations represent a pivotal shift towards more sustainable and economically viable practices within India’s sugarcane sector. By introducing a formula to fix cane prices, the committee aims to ensure fair compensation for farmers, improve the financial health of sugar mills, and enhance the overall efficiency of the sugarcane industry. This detailed examination explores the committee’s formula, its implications, and the way forward for the sugarcane industry in India.

- The Rangarajan Committee Formula: The Rangarajan Committee proposed a nuanced formula to determine the price of sugarcane, considering the market prices of sugar and its by-products. This approach aims to create a more equitable and transparent system for fixing cane prices, ensuring that they reflect the actual market value of the produced commodities.

Key Features:

- Cane Pricing: The formula takes into account the prices of sugar as well as by-products like molasses, bagasse, and press mud, aiming to provide a comprehensive assessment of the sugarcane’s value.

- Government Support: In scenarios where the formula-based cane price falls below the government’s threshold for reasonable payment, a dedicated fund, supported by cess levies, would be established to bridge the payment gap to farmers.

Way Forward: The future of India’s sugarcane industry hinges on addressing several critical areas through technological innovation, policy reform, and strategic planning.

- Sugarcane Mapping

- Need for Accurate Data: The absence of reliable, recent sugarcane maps hampers the sector’s ability to make informed decisions. Utilizing remote sensing technologies for mapping sugarcane areas could drastically improve planning and resource allocation.

- Benefits: Accurate mapping would enhance understanding of crop distribution, yield potentials, and resource requirements, leading to better management and sustainability practices.

- Innovation in Sugarcane Cultivation

- R&D for Higher Yields: Investing in research and development to introduce high-yield, disease-resistant sugarcane varieties, like the CO 238 developed for Uttar Pradesh, could significantly improve productivity and sugar recovery rates.

- Impact: Such innovations not only boost the industry’s output but also ensure long-term sustainability by addressing climatic and environmental challenges.

- The Ethanol Option

- Blending Ethanol with Petrol: Proper implementation of blending ethanol, produced from sugarcane, with petrol offers a multitude of benefits, including providing a steady cash flow for sugar mills, securing better prices for farmers, enhancing India’s energy security, and reducing environmental pollution.

- Strategic Importance: This approach aligns with global trends towards biofuels and represents a crucial step towards energy diversification and sustainability.

- Sugar Pricing Reform

- Revenue Sharing Formula: The Rangarajan Committee’s Revenue Sharing Formula for fixing cane prices based on the market value of sugar and by-products could revolutionize price discovery in the sugarcane sector, making it more economically viable.

- Long-term Benefits: Such reforms are essential for the sector’s financial health, ensuring fair compensation for farmers and stability for sugar mills, and could serve as a model for other agricultural sectors.

Rubber Industry in India

The rubber industry in India, being the fourth largest producer and consumer globally, plays a significant role in the country’s economy and its agricultural landscape. Kerala’s dominance in rubber production, contributing to around 74% of India’s total output, underscores the regional concentration of this industry.

Historical Background of Rubber Industry in India

- Introduction and Expansion: The commercial cultivation of rubber in India dates back to 1873, introduced by the British. Significant expansion occurred from 1902 in regions like Kerala, Karnataka, and Tamil Nadu.

- Cultivation Process: Rubber is mainly cultivated for its latex, a milky white liquid extracted from the rubber tree’s bark through a process known as tapping. This raw latex is then refined into rubber for commercial use.

Usage of Rubber

- Versatility: Rubber’s applications range from everyday items like erasers to industrial products including tires, tubes, and various other manufacturing needs.

- Advantages of Natural Rubber: It is preferred over synthetic variants due to its superior strength, toughness, and elasticity, crucial for industries like construction and automobile.

- Post-COVID Demand Surge: The automobile sector’s growth post-COVID and increased demand for latex products (gloves, belts, tubes, pharmaceuticals) have boosted the rubber market.

Challenges Facing the Rubber Industry

- Global and Economic Factors: The decline in demand can be attributed to factors like reduced Chinese demand post-COVID, the European energy crisis, and global inflation.

- Supply Dynamics: A large supply from regions like Ivory Coast, catering to the domestic tire industry, has impacted prices and demand.

- Regional Impact on Kerala: With over 75% of India’s rubber production, Kerala’s economy is heavily reliant on rubber. The falling prices have led to unrest among the local population.

- Labor and Production Fragmentation: The industry’s reliance on extensive labor and the predominance of small and medium enterprises in rural areas face challenges due to volatile prices and demand uncertainties, leading to production fragmentation.

Government Initiatives for the Rubber Industry

- Support Schemes: Initiatives like the Rubber Plantation Development Scheme and the Rubber Group Planting Scheme aim to support cultivation.

- Policy and Investment: The National Rubber Policy of 2019 and the allowance of 100% Foreign Direct Investment (FDI) in rubber production industries are steps towards bolstering the sector.

- Rubber Board Initiatives: The Rubber Board implements these schemes, focusing on the prosperity of rubber growers and the industry’s development.

Geographical Distribution

| Country | Specific Regions |

| India | Kerala: Kottayam, Kollam, Ernakulam, Kozhikode districts.

Karnataka: Chikmagalur and Kodagu are the main producing districts. Tamil Nadu: Nilgiri, Madurai, Kanyakumari, Coimbatore and Salem. Other states: Assam, Tripura, Meghalaya, Nagaland, Manipur, Goa, Andaman & Nicobar Islands. |

| World | Germany, Brazil, the United States, Italy, India, Thailand, Indonesia, Malaysia, Vietnam, Liberia, India, USA, China, Japan. |

- India’s role as a significant producer is underscored by its varied climate zones, enabling production across multiple states and districts. Similarly, the global list showcases the diversity of climates and ecosystems where this production thrives, from the tropical regions of Brazil and Indonesia to the temperate zones of Germany and the United States.

- Understanding the geographical distribution is crucial for assessing market dynamics, supply chain logistics, and potential impacts of climate change on production. It also highlights the importance of sustainable practices to ensure the long-term viability of this industry in both local and global contexts.

Petrochemical Industries

The petrochemical industry represents a vital sector within the global economy, deriving an extensive range of products from crude petroleum. These products serve as fundamental raw materials for numerous other industries, collectively forming the backbone of what is known as the petrochemical sector. This industry has witnessed rapid growth over the years, leading to a situation where the demand often outstrips the supply capabilities of existing infrastructure and production units.

- Raw Materials and Production: Crude petroleum, the primary raw material for this sector, undergoes refining processes to yield various petroleum products. These include but are not limited to Liquified Petroleum Gas (LPG), petrol, diesel, polymers, and synthetic fibers. The complexity of refining and the diverse output make the petrochemical industry integral to modern economies, catering to sectors ranging from automotive to textiles.

- Key Hubs in India: In India, the petrochemical industry is predominantly concentrated along the western and eastern coasts, with significant hubs in both regions. Mumbai and Digboi serve as pivotal centers in the western and eastern parts of the country, respectively. Other major hubs include:

- Maharashtra: Mumbai, Ratnagiri, Pune, and Nagpur

- Gujarat: Jamnagar, Gandhinagar, Vadodara, and Hajira

- Uttar Pradesh: Auraiya

- West Bengal: Haldia

- Andhra Pradesh: Visakhapatnam

These locations are strategically chosen, often due to their proximity to crude oil producing regions both within India and in the Gulf states, facilitating easier access to raw materials.

- Production Units and Industrial Focus: The majority of major production units are strategically located along the western coast of India. This geographical positioning is advantageous, minimizing transportation costs and ensuring a steady supply of crude oil. Industries specializing in the manufacturing of nylon and polyester, for example, find their homes in Kota, Mumbai, Modinagar, Pune, and Ujjain, among others. The northeastern region of India, particularly in Assam and Arunachal Pradesh, also hosts significant production units, leveraging local crude oil resources.

Challenges Facing the Petrochemical Industry

- High Excise Duty: Government-imposed excise duties on petroleum products have led to increased prices for petrol and diesel, impacting both production costs and consumer prices.

- Obsolete Technologies: The use of outdated technologies hampers efficiency and optimization in production processes, limiting the industry’s ability to meet growing demand effectively.

- High Import Costs: For many petrochemical products and raw materials not available domestically, high import costs have escalated the overall cost structure, affecting the competitiveness of Indian petrochemical products in the global market.

Fertilizer Industry in India

The fertilizer industry in India plays a pivotal role in the agricultural sector, being instrumental in enhancing crop yields during and since the Green Revolution. As the third-largest producer of fertilizers globally, it stands as one of the eight core industries critical to the country’s industrial development. The strategic placement of nitrogenous fertilizer production units near petrochemical industries underscores the interdependence within the industrial ecosystem for raw materials.

Major Fertilizer Industrial States

- Gujarat

- Tamil Nadu

- Uttar Pradesh

- Punjab

- Kerala

- Maharashtra

- Madhya Pradesh

- Andhra Pradesh

These states have been pivotal in the production and distribution of a wide array of fertilizers essential for the nation’s agricultural needs.

Factors Affecting Industrial Growth

- Development of Pipelines: The establishment of an extensive pipeline network, such as the Hajira-Vijaipur-Jagdishpur pipeline, has significantly enhanced the efficiency of transporting raw materials and finished products, reducing costs and facilitating widespread distribution.

- Production Diversity: The industry supports the production of a variety of fertilizers, including urea, phosphatic, ammonia, nitrogen, phosphate, and potash, catering to diverse agricultural needs.

- Domestic Mineral Reserves: The presence of phosphorus mineral reserves in Rajasthan and Madhya Pradesh slightly mitigates the dependence on imports for raw materials.

Challenges Facing the Industry

- Need for Increased Investment: To meet the growing demand from the agricultural sector, significant investments are needed to enhance production capacities.

- Insufficient Indigenous Production: The gap between domestic production and demand leads to heavy reliance on imports from countries like Russia, China, and Ukraine, affecting the balance of payments (BOP).

- Resource Shortage: The scarcity of critical resources such as phosphate, sulfur, and potash necessitates imports, making the industry vulnerable to international market price fluctuations.