Trump, tariffs and a trade war with China

Syllabus:

GS 2: India and its neighbourhood couuntries

Why in the News?

Recently, United States initiated tariffs on Canada, Mexico, and China to boost federal revenue and address economic concerns, sparking debates on trade wars and potential political implications.

Introduction

- United States has adopted a policy of muscular nationalism, initiating a trade war targeting key trading partners, including Canada, Mexico, and China.

- With significant tariffs imposed on imports, the move is driven by political and economic motivations, aiming to boost federal revenues while facing challenges like rising costs, supply chain disruptions, and potential retaliatory measures.

- United States, under President Donald Trump, has embraced aggressive nationalism, initiating a trade war targeting its largest trading partners, Canada and Mexico, with steep tariffs.

Tariff Imposition on Canada and Mexico

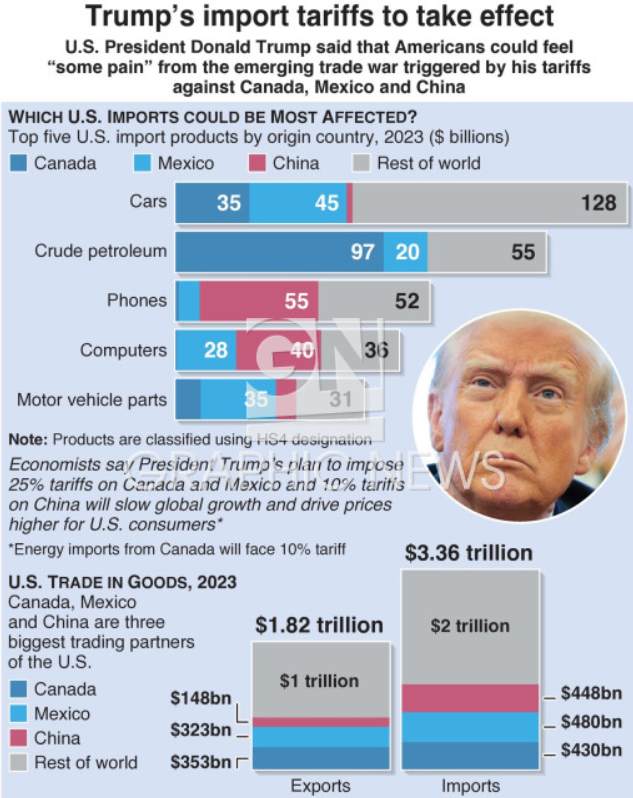

- US has imposed a 25% tariff on imports from Canada and Mexico, with a relatively lower 10% tariff on energy imports from Canada.

- Initially set to take effect on February 4, these tariffs have been delayed by 30 days.

Reasons Behind the Trade War

- The move appears to align with the policies of President Donald Trump, who focused his election campaign on addressing trade and security threats, particularly from China.

- However, it is surprising that the US has imposed only a modest 10% tariff on Chinese goods while targeting Canada and Mexico with harsher measures.

- Combined, these two nations account for over 28% of US imports, making them significant trade partners.

Potential Outcomes

- This aggressive policy raises concerns about strained relations with neighboring countries, disruption in trade flows, and potential economic consequences for all parties involved.

Reasons for the Tariffs

Border Control

- US government claims the tariffs are intended to pressure Canada and Mexico into reducing illegal drug and immigrant flows across their borders into the United States.

- However, this reasoning is widely regarded as weak, especially concerning Canada, which has minimal involvement in such activities compared to Mexico.

Lack of Clarity

- Canadian officials involved in negotiations with the US have expressed frustration over the absence of clear guidelines or actions required to lift the tariffs.

- This lack of transparency further undermines the credibility of the border control justification.

Political Narrative

- The border control argument serves as a convenient narrative to justify the tariffs, masking more significant economic and political motives.

Underlying Motivations Behind the Tariffs

Symbol of Economic Power

- President Trump has long viewed tariffs as a symbol of national economic strength.

- This protectionist stance aligns with his broader nationalist agenda, which seeks to prioritize American interests over global cooperation.

Revenue Shortfall

- Tax Cuts and Jobs Act of 2018, also known as the Trump tax cuts, reduced corporate and personal income tax rates.

- These tax cuts, set to expire in 2025, are estimated to add $4.6 trillion to the federal deficit over 10 years if extended.

Role of Tariffs in Generating Revenue

- Tariffs offer a potential revenue source to offset the financial burden of extending the tax cuts.

- With annual US imports totaling around $4 trillion, tariffs on Canada, Mexico, and China could generate significant revenue.

Revenue Estimates from Tariffs

Revenue Potential

- Canada, Mexico, and China collectively account for 42% of US imports.

- At current import levels, the announced tariffs could raise approximately $320 billion annually.

Additional Revenue from EU Tariffs

- President Trump has also threatened tariffs on the European Union, which accounts for 16% of US imports.

- A 25% tariff on EU imports could generate an additional $160 billion annually, bringing the total potential tariff revenue to $480 billion.

Link to Tax Cuts

- The combined revenue from these tariffs could finance nearly the entire annual cost of extending the Trump tax cuts, estimated at $460 billion.

Economic and Political Implications

Impact on Supply Chains

- North America’s highly integrated supply chains mean that tariffs will disrupt production processes and increase costs for businesses.

- These higher costs will likely be passed on to US consumers, leading to higher prices for goods.

Consumer Prices and Cost of Living

- Rising consumer prices could exacerbate cost-of-living concerns, a critical issue in the 2024 presidential election.

- Persistent inflationary pressures may lead to political backlash, particularly with midterm elections scheduled for 2026.

Retaliatory Measures

- Canada has already implemented retaliatory tariffs, and Mexico has indicated it may follow suit.

- These retaliatory measures could harm US exporters, as Canada and Mexico account for over 33% of US exports.

Political Risks

- Prolonged tariffs may face opposition within Congress, particularly from Republicans concerned about the economic and political fallout.

- With slim Republican majorities in Congress, maintaining support for the tariffs could prove challenging.

Challenges to Revenue Assumptions

Decline in Import Volume

- Tariff revenue projections assume that the volume and price of imports will remain stable.

- If importers pass on tariffs to consumers, demand may decrease, leading to lower import volumes and reduced revenue.

Long-Term Adjustments

- Over time, importers and exporters may seek alternative sources and destinations for their goods, further diminishing tariff revenues.

Economic Costs of Retaliation

- Retaliatory tariffs by Canada and Mexico could reduce demand for US exports, negatively impacting American businesses.

- The economic costs of these countermeasures may outweigh the benefits of the tariffs.

Likely Outcomes of the Trade War

Short-Term Strategy

- President Trump is likely to use the tariff threat over the next few months to project optimistic budget revenue estimates.

- This strategy aims to secure congressional approval for the extension of the Trump tax cuts.

Symbolic Concessions

- Once the budget bill is passed, the administration may seek symbolic concessions from Canada and Mexico to justify lifting the tariffs.

Long-Term Conflict with China

- The trade war with China may persist longer due to broader strategic and economic issues.

- Resolving the China conflict will likely require more substantial negotiations and concessions.

Conclusion

While US tariffs aim to address revenue needs and political goals, they carry significant risks, including economic disruptions and political backlash. A balanced approach, prioritizing dialogue and strategic adjustments, could yield more sustainable and mutually beneficial outcomes.

Source: Indian Express

Mains Practice Question:

Analyze the impact of protectionist trade policies, such as high tariffs, on a nation’s economy, political stability, and global trade relations.