TAX REFORMS: RE-EVALUATING INDIA’S AGRICULTURAL INCOME EXEMPTION

Syllabus:

GS 2 :

- Government Policies and Interventions for Development in various sectors and Issues arising out of their Design and Implementation.

- Welfare Schemes for Vulnerable Sections of the population by the Centre and States.

Why in the News?

The new government’s first budget presentation is sparking widespread discussions on tax policies. A significant focus is on revising agricultural income tax exemptions to address misuse by non-agricultural entities and ensure a fairer tax system, balancing economic growth with equity.

Source: Teachoo

Overview:

- Budget Focus: The new government’s first budget presentation is next week, filled with various suggestions on where to focus, as traditionally seen during this period.

- Economic Context: The government enjoys rapid tax growth, stable economic expansion, and moderate inflation, yet faces middle-class discontent and electoral setbacks, indicating underlying challenges.

- Tax Mitigation Efforts: Over the past decade, measures like the GST and corporate tax rate cuts have been introduced to reduce the tax burden, making India more competitive internationally.

- Personal Tax Reduction: There is a demand for lower personal income tax rates, conflicting with concerns about rising inequality, leading to an alternate income tax regime with limited exemptions and lower rates.

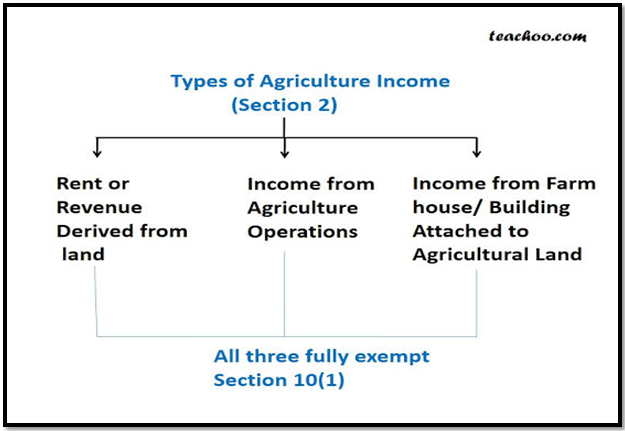

- Agricultural Exemption Concerns: The exemption for agricultural income has become controversial due to its misuse for tax avoidance and laundering by non-agriculturists, as highlighted by the Tax Administration Reform Commission.

- Constitutional Argument: Agricultural income is exempt due to its coverage under the State List in the Constitution, but cooperative federalism, as seen with GST, can address this through Union and state collaboration.

| Constitutional Protection from Taxing Agricultural Income

Taxing Non-Agricultural Income:

Power to States:

Agricultural Income Taxation

|

Addressing Agricultural Income Misuse

- CAG Findings: In 2019, the Comptroller and Auditor General found significant issues with agricultural income exemptions, including lack of verification and data entry errors, leading to large unverified claims.

- Corporate Exemptions: A notable portion of agricultural income exemptions are claimed by corporate entities, raising concerns about fairness, especially since these entities already benefit from reduced corporate tax rates.

- Audit Observations: The CAG audit revealed that 22.57% of examined cases had exemptions without proper documentation, and 10.7% involved registered companies, highlighting systemic loopholes.

- Public Sector Involvement: Companies claiming exemptions included multinationals, public sector companies, and firms in non-agricultural fields like biotechnology and pharmaceuticals, further complicating the issue.

- High-Profile Claims: Stories of eminent personalities in non-agricultural sectors claiming large agricultural income exemptions are common, adding to public perceptions of unfairness.

- Scrutiny Recommendations: The Public Accounts Committee recommended scrutinizing agricultural income above certain thresholds to identify high-risk cases, suggesting reforms to address the misuse and perceptions of inequity.

Proposed Reforms and Their Benefits

- Threshold Reforms: Introducing thresholds for agricultural income exemptions, such as removing exemptions above ₹50 lakh or ₹1 crore, can help reduce unfair advantages and ensure a fairer tax system.

- Corporate Exemption Removal: Eliminating agricultural income tax exemptions for corporate entities can plug significant loopholes and increase the integrity of the tax system.

- Fairer Tax System: These reforms can lead to a more equitable tax system by ensuring that large-scale and corporate claimants do not exploit agricultural income exemptions for tax avoidance.

- Direct Tax Rate Reduction: By addressing agricultural income tax exemptions, the government can further lower direct tax rates under the new income tax regime, addressing middle-class concerns.

- Enhanced Revenue: Restricting exemptions to genuine agricultural income can increase government revenue, which can be used for development and social welfare programs.

- Economic Balance: These reforms aim to balance the need for tax fairness with economic growth, ensuring that tax policies support a robust and equitable economy.

Implementation and Stakeholder Dialogue

- Cooperative Federalism: The successful implementation of these reforms requires cooperation between the Union and state governments, similar to the collaborative spirit seen with GST.

- Stakeholder Engagement: Engaging relevant stakeholders, including farmers, corporate entities, and tax authorities, is crucial for evolving appropriate tax exemption thresholds and policies.

- Policy Dialogue: Continuous dialogue and consultations with stakeholders can help refine the reforms and address concerns related to low income and high risks in agriculture.

- Transitional Measures: Gradual implementation of these reforms, with transitional measures, can help mitigate potential disruptions and ensure a smooth transition to a fairer tax regime.

- Public Awareness: Raising public awareness about the need for these reforms and their benefits can help build support and ensure successful implementation.

- Monitoring and Evaluation: Regular monitoring and evaluation of the reformed tax policies can help identify any issues and make necessary adjustments to ensure their effectiveness and fairness.

Challenges

- Administrative Bottlenecks: Coordination issues and complex procedures could hinder efficient implementation, requiring enhanced training and resources for tax officials.

- Political Resistance: States and stakeholders may resist changes, fearing revenue impacts and increased tax burdens, necessitating careful negotiation and consensus-building.

- Implementation Complexity:

Determining appropriate thresholds and integrating new tax reforms into existing systems requires substantial analysis and technological upgrades.

- Compliance and Enforcement: Ensuring accurate reporting and preventing misuse demands stringent verification processes and advanced monitoring mechanisms.

- Public Perception: Addressing fairness concerns among small farmers and communicating the benefits of the reforms are crucial for public support.

- Economic Impact: Sudden policy changes could disrupt agricultural markets and income stability, necessitating careful policy design to protect small farmers.

- Technological Constraints: Managing agricultural income data efficiently and implementing automated systems require robust technological infrastructure and investment.

- Legal and Constitutional Hurdles: Amending laws and addressing jurisdictional issues between Union and state governments involve complex legislative processes and potential legal challenges.

Way Forward

Enhanced Coordination:

- Establish joint committees and regular dialogues between Union and state governments to facilitate smooth implementation.

Stakeholder Engagement:

- Engage with farmers and industry representatives, and run awareness campaigns to foster acceptance and cooperation.

Simplified Procedures:

- Streamline tax filing processes and provide training to tax officials to improve efficiency and compliance.

Technological Upgradation:

- Invest in robust IT infrastructure and automation systems to manage and verify agricultural income data accurately.

Effective Communication:

- Implement clear communication strategies and feedback mechanisms to address public concerns and build support.

- Gradual Implementation: Use a phased approach and provide transitional support to mitigate disruptions and ensure smoother adaptation.

Legal Framework Strengthening:

- Enact clear legislation and seek judicial clarity to address jurisdictional issues and provide a solid foundation for reforms.

- Monitoring and Evaluation: Conduct regular assessments and adapt policies based on outcomes and stakeholder feedback to enhance effectiveness.

Conclusion

Revising agricultural income tax exemptions is crucial to plugging loopholes and ensuring tax fairness. Implementing thresholds and removing exemptions for corporate entities can enhance revenue and reduce inequality, fostering a more robust and equitable economy.

Source:The Hindu

Mains Practice Question:

Discuss the implications of revising agricultural income tax exemptions in India. How can such reforms balance the need for fair taxation with the protection of genuine agricultural income?”

Associated Article: