PM-SVANIDHI BOOSTED ANNUAL INCOME OF STREET VENDORS BY RS 23,000

Why in the news?

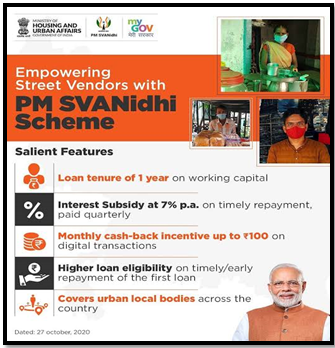

PM SVANidhi, launched in 2020, provided a working capital loan of Rs 10,000 to street vendors impacted by the COVID-19 lockdown.

source:mygov

Study Findings:

- SBI study: 43% beneficiaries are women, 44% belong to OBC, 22% to SC/ST.

- Persistency ratio increasing: 2nd loan/1st loan repaid.

- Loans incentivized: 7% interest subsidy, cashback for digital transactions.

- Public Sector Banks (PSBs) lead in loan sanctioning.

- Demographics:

- 65% borrowers aged 26-45.

- Increased spending post-loan disbursement.

- Behavioural shift towards digital transactions.

- Impact on Jan Dhan Beneficiaries:

- SVANidhi loans increase spending of Jan Dhan beneficiaries.

- Promotes digital acceptability, migration to higher digital transactions.

- City-wise Distribution:

- Mega cities: Varanasi leads in active spenders (45%), followed by Bengaluru, Chennai, Prayagraj

| About PM-SVANidhi

· PM-SVANidhi is Micro-credit scheme launched by the Government of India for street vendors. o Central sector scheme under the Ministry of Housing and Urban Affairs. o Provides Working Capital (WC) loans of up to Rs 10,000 to urban street vendors. o Tenure of one year with monthly repayments. · Objectives: o Facilitate working capital loans. o Encourage regular repayment. o Promote digital transactions. o Provides collateral-free loans up to Rs 50,000 in incremental tranches · Eligibility: o Street vendors with ULB-issued Certificate of Vending or Identity Card.. · Benefits: o Collateral-free loan: Rs. 10,000. o 7% interest rebate till March 31, 2022. o Simple application process. o Cashback for digital transactions. o Easy loan status check on SVANidhi website. |

source:mygov

source:mygov