WHY ARCS ARE UNHAPPY OVER FEWER TOXIC ASSETS

Syllabus:

GS 3:

- Indian economy and issues associated

- Banking sector

Focus:

The Asset Reconstruction Companies (ARCs) are experiencing rising challenges mainly because of dwindling NPAs and enhanced regulatory risks. New changes influencing their day to day operations and future prospects are also an issue in the current structures and a bad relationship with the RBI.

Source: Mint

Falling NPA Levels:

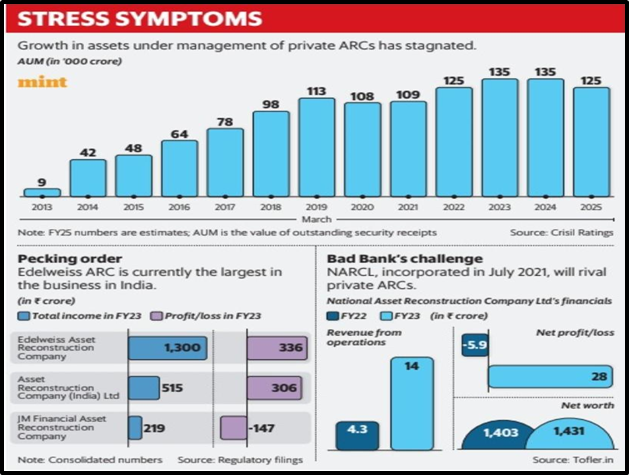

- Declining NPAs: From the table above, it is clearly seen that the overall NPAs in the banking sector have reduced and have touched a 12 year low of 2.8% recently in March.

- Impact on ARCs: A low NPAs mean low volume of distressed assets available for ARCs and recovered from.

- Growth Slowdown: The flow of new ARCs has reduced, and thus the rate of expansion of these balance sheets is slow.’

- Estimates: According to Crisil, ARCs would be facing a 7-10 % contraction in assets in the current year.

- Shift to Retail: As corporate bad loans have reduced, it has forced the ARCs to concentrate on the smaller retail loans which gives a lower return rate.

About Non-Performing Assets (NPAs)

Classification:

Provisioning:

Metrics:

About Asset Reconstruction Companies (ARCs):

|

Regulatory Clampdown:

- Higher Capital Requirements: The requirement of net owned funds for investment in ARC has been raised to ₹ 300 crore from earlier ₹ 100 crore with minimum progression.

- Impact on Smaller ARCs: Smaller ARCs will find it hard to meet the new requirements hence the possibility of consolidation in the sector.

- Increased Compliance Costs: New rules that have been set have impacted ARCs in increasing their operational and compliance expenses.

- Stricter Settlement Conditions: ARCs have needed independent advisory committees to assess proposed settlements, which have affected the efficiency of recovery processes.

- Recent Cases: The major problem in the Indian ARCs is that some of them have faced restrictions in their operations by RBI for violating the regulations.

Trust Deficit with the RBI:

- Regulatory Concerns: The RBI has pointed out that the defaulting promoters are exploiting another approach of going to ARCs to sell their assets in a bid to evade the existing insolvency laws.

- Corrective Measures: ARCs are tightening the process of due diligence and compliance in an effort to counteract the regulatory issues that are being flagged.

- Industry Response: ARC sector is actively striving to improve the oversight and devising the ways to seek a third party help to address these issues as regulatory non-compliance.

- Impact on Trust: The existing distrust with the RBI impacts on the functioning of the ARCs and their engagement with the regulatory authorities.

- Future Outlook: These prospective changes could limit ARCs’ capacity to manage and operate their distressed assets in the future and may result in negative regulatory changes.

Key Challenges for ARCs:

- Regulatory Hurdles: Essentially, higher own funds and tighter regulatory standards increase operational expenses and pressurise smaller ARCs.

- Slow Retail Recovery: Retail loan NPAs are significantly constrained and lend limits new revenue opportunities in that sector only a little.

- Stricter Settlement Rules: New regulations for settlement proposals involve independent committees extending the time involved in the recovery procedures.

- Trust Deficit with RBI: Such apprehensions with regard to attempts to get round insolvency legislations through asset sales diminish confidence and regulatory committee.

Way Forward:

- Enhanced Due Diligence: To regain the keys of public’s trust, it is recommended that all the established ARCs must improve their due diligence and compliance mechanisms to suit the new set of rules and regulations in the market.

- Adaptation to Regulatory Changes: The enhancement of the capital requirements and operational costs of the workings require changes to the need for ARC seeking capital and streamlining of their processes.

- Focus on Recent Bad Loans: This is an indication that focusing on latest bad loans as opposed to old written off assets will result in faster and efficient recoveries.

- Improved Coordination with NARCL: Other state backed entities are; NARCL collaboration has the possibility of more avenues for asset recovery.

- Addressing Trust Deficit: These issues call for the construction of mutual and open cooperation with RBI to eliminate existing problems and increase effectiveness.

Conclusion:

The asset reconstruction industry has experienced some challenges marked by a reduced level of NPA, stiff regulations, and lack of trust with the RBI. In coping with these challenges, ARCs need to improve compliance levels, be responsive to regulatory changes and strengthen relationships with state-supported institutions like NARCL. Proper precautions in these fields can aid the ARCs to rise above the current challenges and regain growth in assets recovery.

Source: Mint

Mains Practice Question:

Explain the key considerations which are causing the current challenges to Asset Reconstruction Companies (ARCs) in India. As far as regulatory and operational problems are concerned, what measures should be taken to enhance the functioning of ARCs so that they efficiently meet the needs of asset recovery?