TAXONOMY FOR CLIMATE FINANCE WILL PUT INDIAN STANDARDS ON A GLOBAL PLATFORM

Relevance: GS – 3 – Indian Economy and issues relating to planning, mobilization, of resources, growth, development and employment; Climate Finance; Conservation, environmental pollution and degradation, environmental impact assessment.

Why in the news?

- India’s plans to develop a taxonomy for classifying climate finance aim to highlight relevant agendas and present Indian standards globally, according to Ajay Seth, Secretary of the Finance Ministry’s Department of Economic Affairs.

- The government’s approach to developing the climate finance taxonomy.

- Strategies to improve India’s sovereign credit ratings.

- Efforts to recalibrate the infrastructure financing framework.

- Simplifying overseas investment routes for foreign investors.

India’s Climate Finance Taxonomy

- India’s high population and per capita income contrast with countries having smaller populations and higher per capita incomes (over $50,000).

- The dynamics of climate finance will differ for India compared to such countries.

- The planned standards for classifying climate finance will address these unique dynamics.

- Standards and Disclosures:

- Standards will require disclosures on both investment-related and usage-related issues.

- Decisions and guidelines will need to be provided to address these issues.

- Finance Minister Budget Speech:

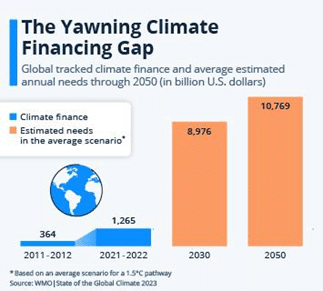

- Announced the development of a taxonomy for climate finance.

- The goal is to enhance the availability of capital for climate adaptation and mitigation. This initiative will support India’s climate commitments and green transition.

- Climate Finance Taxonomy Objectives:

- To identify assets, activities, and projects necessary for a low-carbon economy.

- Ensure alignment with the Paris Agreement’s goals on mitigation, adaptation, and finance commitments.

Improving India’s Credit Rating

- Government Efforts:

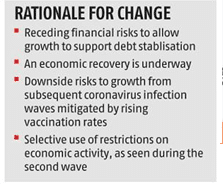

- The government is in regular talks with credit rating agencies to push for better ratings based on the Indian economy’s strength.

- Post-pandemic, India’s economic health has seen significant improvement.

- Current Ratings:

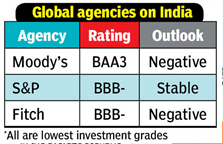

- Sovereign credit rating measures a government’s ability to repay its debt.

- Higher ratings lead to greater trust and lower borrowing costs.

- India’s current ratings:

- S&P and Fitch rate at BBB-

- Moody’s at Baa3 (lowest possible investment grade).

- In May, S&P Global raised India’s outlook to positive from stable after 14 years, sparking hopes for a ratings upgrade.

- Future Plans and Goals:

- The next goal is a ratings upgrade.

- The government aims to manage debt sustainably, ensuring fiscal policy space for future crises.

- The focus is on inclusive, fast-paced economic growth.

- The potential exists to sustain high debt long-term, but not at the current level of 56%.

- Central government’s debt stood at just over 56% of GDP at the end of FY24, down from 57.1% at the end of March 2023.

Committee on Infrastructure Financing Framework

- Headed by Bibek Debroy, Chairman of the PM-EAC, with Ajay Seth as a member.

- It conducted a comprehensive assessment of the characteristics and parameters defining the infrastructure financing framework.

- The final report from the Debroy-led committee is expected this year.

- Focus:

- Evaluating the approach for public versus private financing.

- Exploring ways to incentivize private sector investment.

- Preparing a framework for infrastructure financing under both public and private setups. Developing broad approaches for various sectors including roads, railways, and ports.

Easing FDI Rules

- Upcoming Changes:

- Expected easing of overseas investment rules within the next three months.

- Aimed at simplifying investment norms for foreign portfolio investors (FPIs) and overseas arms of Indian companies.

- Current Regulations:

- Most sectors already allow 100% FDI under the automatic route.

- The inflow of capital regulated under FEMA (Foreign Exchange Management Act) includes complex rules and regulations.

- Proposed Simplifications:

- Discussions ongoing with RBI and SEBI, with common grounds found.

- Simplified rules to be notified by the government.

- Regulatory changes to be implemented by the respective authorities.

- Specific Changes:

- Currently, FPIs can hold up to 10% of stocks in an Indian company.

- Beyond this, shareholding must be diluted or reclassified as foreign direct investment (FDI) with additional compliance.

- Lack of norms for investments by overseas companies of Indian entities in India without parent linkages will be addressed.

Way Forward

- Climate Finance Taxonomy:

- Develop and implement clear standards and disclosures for classifying climate finance.

- Ensure alignment with the Paris Agreement’s goals on mitigation, adaptation, and finance.

- Promote transparency and accountability in climate-related investments.

- Improving Sovereign Credit Ratings:

- Maintain regular dialogue with credit rating agencies to highlight economic improvements.

- Implement fiscal policies to manage debt sustainably.

- Focus on inclusive and fast-paced economic growth to support higher ratings.

- Infrastructure Financing Framework:

- Finalize and implement the comprehensive framework developed by the Debroy-led committee.

- Balance public and private financing approaches for different infrastructure sectors.

- Incentivize private sector investment through policy and regulatory reforms.

- Easing FDI Rules:

- Simplify regulations under FEMA to facilitate easier capital inflow.

- Finalize and notify changes in FDI rules in consultation with RBI and SEBI.

- Establish norms for investment by overseas arms of Indian companies without parent linkages.

- Streamline compliance processes for FPIs to enhance investment attractiveness.

Alternative articles

https://universalinstitutions.com/climate-finance-a-hard-fact-amidst-shifting-commitments/

https://universalinstitutions.com/climate-financing/

https://universalinstitutions.com/financing-indias-green-future/

Mains question

Discuss the implications of India’s plans to develop a climate finance taxonomy. Explain what is the effect of easing FDI rules on the country’s economic growth and sustainable development. (250 words)