TAX TRENDS: SHIFTING DYNAMICS IN INDIA’S REVENUE LANDSCAPE”

Syllabus:

GS 3:

- Indian Economy and issues .

- Taxation and Tax reforms

- Government Budgeting

- Policy Transformation

Why in the News?

Recent tax data revealing a surge in personal income tax collections and a decline in corporate tax revenues have sparked discussions on India’s tax system’s fairness and effectiveness. The shift towards greater reliance on personal income tax and indirect taxes has raised concerns about income distribution and tax burden.

Source: The Hindu

Political Context:

- During recent election campaigning, Congress emphasized social justice and welfare measures, drawing attention to rising wealth inequality.

- Prime Minister Narendra Modi accused Congress of favoring specific religious groups, sparking controversy over manifesto proposals.

- The debate highlighted contrasting visions for addressing socio-economic disparities and the role of taxation in promoting equity.

- Congress defended its manifesto, emphasizing the need to address wealth inequality and dismissing accusations of religious favoritism.

- The exchange underscored the significance of taxation policies in shaping socio-political narratives and electoral agendas.

Tax Collection Trends:

- Recent provisional data from the Finance Ministry highlight an increase in net tax collections, driven by rising personal income tax and securities transaction tax revenues.

- Conversely, net corporate tax collections have slightly decreased, reflecting a shifting trend in tax contributions.

- The data indicate a growing reliance on personal income tax as a source of revenue, raising questions about the sustainability and fairness of the tax system.

- Analysis suggests that changes in corporate tax policies, including reductions implemented in 2019, have influenced the decline in corporate tax collections.

- The contrasting trends in tax collections underscore the need for a comprehensive review of tax policies to ensure fiscal stability and equity.

| Corporate Tax:

Corporate tax applies to all Indian companies, both public and private, registered under the Companies Act 1956. It’s a direct tax levied on a company’s net income or profits generated from its operations. The tax is imposed on the corporation’s net profits, calculated by deducting allowable expenses like cost of goods sold, operating costs, and depreciation from total revenue. |

Analysis of Tax Data:

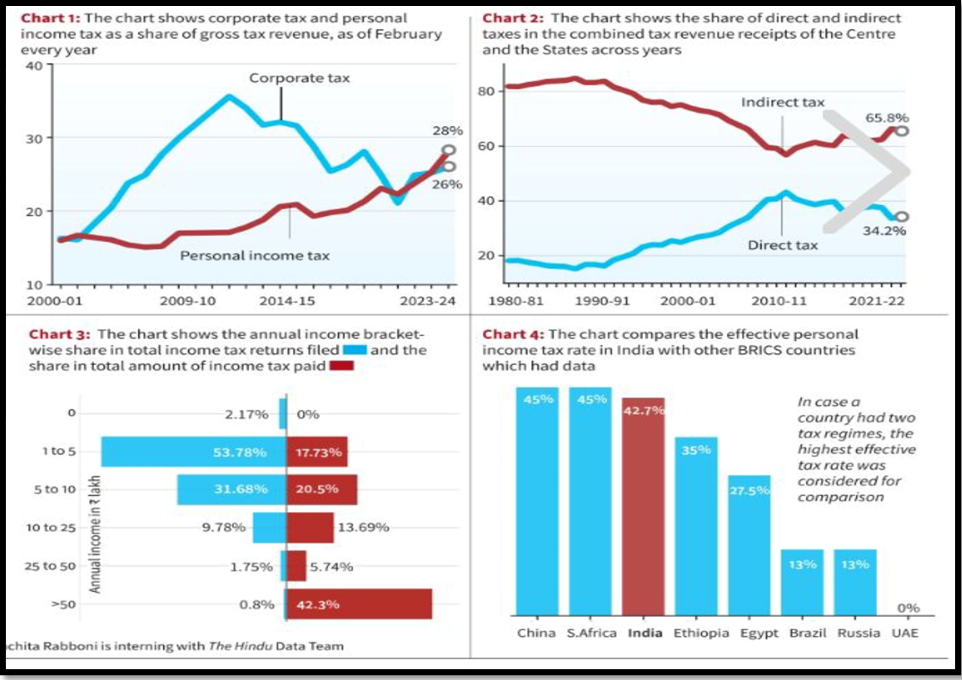

- Chart 1 illustrates the changing proportions of corporate tax and personal income tax within gross tax revenue over the years, with personal income tax witnessing a notable rise.

- Corporate tax reductions implemented by the BJP-led government in September 2019 have contributed to a significant decline in corporate tax shares post-FY19.

- The data reveal a widening gap between personal income tax and corporate tax shares, indicating a shift in the composition of tax revenues.

- Policy implications include the need for measures to enhance corporate tax contributions while addressing concerns about the growing burden on individual taxpayers.

- A deeper analysis of tax data is essential to understand the underlying factors driving changes in tax collection patterns and their implications for fiscal policy.

Direct vs. Indirect Taxes:

- The share of direct taxes, known for their progressive taxation structure, has been declining, while indirect taxes, including GST and excise duties, have been on the rise.

- Chart 2 depicts the shifting dynamics of direct and indirect tax shares in combined revenue receipts of the Centre and the States, indicating a steady increase in indirect tax contributions.

- The trend suggests a need to reassess the balance between direct and indirect taxation to ensure equitable tax burdens across different income groups.

- Policy interventions may include reforms to strengthen direct tax systems and mitigate the regressive nature of indirect taxes.

- Addressing the imbalance between direct and indirect taxes is crucial for promoting inclusive growth and reducing income inequality.

Impact on Taxpayers:

- Chart 3 reveals that a majority of personal income tax filers fall within the ₹1 lakh-₹5 lakh annual income bracket, with fewer individuals earning above ₹50 lakh.

- Comparison with BRICS economies shows India’s personal income tax rates among the highest (Chart 4), indicating a significant tax burden on middle-class and lower-income citizens.

- The data highlight the disproportionate burden borne by middle-class and lower-income individuals due to the increasing share of personal income tax in total revenue.

- Policy responses may include measures to enhance tax progressivity and ensure that higher-income individuals contribute proportionally more to tax revenues.

- The impact of taxation policies on different income groups underscores the need for targeted interventions to promote economic equity and social cohesion.

Implications and Concerns:

- The data highlight a growing burden on middle-class and lower-income individuals due to the increasing share of personal income tax and indirect taxes in total revenue.

- Rising personal income tax collections coupled with a decline in corporate tax contributions underscore concerns about the fairness and distribution of the tax burden.

- Policy responses may include measures to enhance tax progressivity and ensure that higher-income individuals contribute proportionally more to tax revenues.

- The impact of taxation policies on different income groups underscores the need for targeted interventions to promote economic equity and social cohesion.

- Addressing rising wealth inequality and ensuring equitable tax contributions should be key policy priorities for promoting economic inclusivity.

Way Forward / Policy Considerations:

- Enhance Progressivity:

Implement measures to make the tax system more progressive, ensuring that higher-income individuals contribute proportionally more to tax revenues.

- Review Corporate Tax Policies: Evaluate the impact of corporate tax cuts on revenue generation and consider measures to balance corporate and personal tax contributions.

- Strengthen Tax Compliance: Enhance efforts to curb tax evasion and improve tax collection mechanisms to maximize revenue while minimizing the burden on honest taxpayers.

- Promote Inclusive Growth: Focus on policies that foster inclusive economic growth, providing opportunities for all segments of society to thrive and contribute positively to the economy.

- Public Awareness Campaigns: Conduct public awareness campaigns to educate taxpayers about their rights and responsibilities, fostering a culture of tax compliance and transparency.

- Financial Literacy: Promote tax awareness among citizens through initiatives and accessible resources. Empower taxpayers to make informed financial decisions.

- Investment Incentives: Offer incentives for investments in key sectors like infrastructure and innovation. Stimulate economic growth and job creation.

- Strengthen Tax Administration: Combat tax evasion and improve revenue collection. Invest in technology for better monitoring and compliance.

- Progressive Taxation: Ensure higher-income individuals contribute proportionally more. Review tax brackets for fairness across income groups.

- Social Safety Nets: Expand welfare programs to support low-income households. Targeted interventions can alleviate poverty and disparities.

Conclusion:

The evolving tax landscape in India necessitates a comprehensive review of tax policies to ensure equity, efficiency, and sustainable revenue generation. Addressing the rising burden on middle-income earners and enhancing tax compliance mechanisms are crucial for fostering economic growth and social development.

Source:The Hindu

Mains Practice Question:

Discuss the recent trends in tax collection patterns in India, focusing on the rising share of personal income tax and its implications for economic equity and fiscal policy.

Associated Articles:

https://universalinstitutions.com/tax-authorities-and-tribunals/