“ADDRESSING INEQUALITY: EXPLORING MEASURES FOR EQUITABLE GROWTH IN INDIA”

Syllabus:

- GS-3-Inequality in India and its impact

Focus :

- Top of Form

- Income inequality in India is stark, with the top 1% owning 22.6% of national income and 40.1% of wealth in 2022-23.

- From 1990 to 2022, the number of very high net worth individuals rose from 1 to 162, while income tax filers increased from 1% to 9% between 2017-2020.

Source - TH

Introduction:

- Debate sparked by Congress’s Nyay Patra on inequality and wealth concentration.

- Prime Minister’s comments on wealth redistribution prompt discussions.

- Rising inequality evidenced by World Inequality database, posing questions on growth.

| Status of Inequality in India :

1. Growth in Average Incomes:

2. Emergence of Very High Net Worth Individuals:

3. Rise in Percentage of Income Taxpayers:

4. Extreme Levels of Inequality in India:

|

Election Issue and Political Economy:

- Inequality as a core election issue, reflecting concerns about economic disparities.

- Failure of trickle-down economics, emphasis on supporting ‘wealth creators.’

- Shift towards addressing inequality marks a significant political economy shift.

Redistribution Measures and Taxation:

- Public discussion focused on direct redistribution measures like taxing the rich.

- India’s low tax-GDP ratio and regressive taxation structure.

- Need for progressive taxation to address wealth inequality effectively.

Low Welfare Spending and Social Sector Allocation:

- Low public spending on health and social sectors compared to other countries.

- Challenges in achieving National Health Policy targets amidst COVID-19.

- Decline in budget allocations for crucial sectors like MGNREGA and education.

Questioning Nature of Growth:

- Focus on generating employment through equitable growth.

- Declining employment elasticity of output amidst jobless growth.

- Importance of creating decent jobs with adequate remuneration.

Role of Government in Job Creation:

- Government’s role in directly creating jobs through public services expansion.

- Importance of filling existing vacancies and improving quality of jobs.

- Direct job creation efforts to improve human development outcomes and reduce inequality.

Employment-Centered Growth Policies:

- Supporting small and medium enterprises for labor-intensive growth.

- Promoting skill training and human capital development.

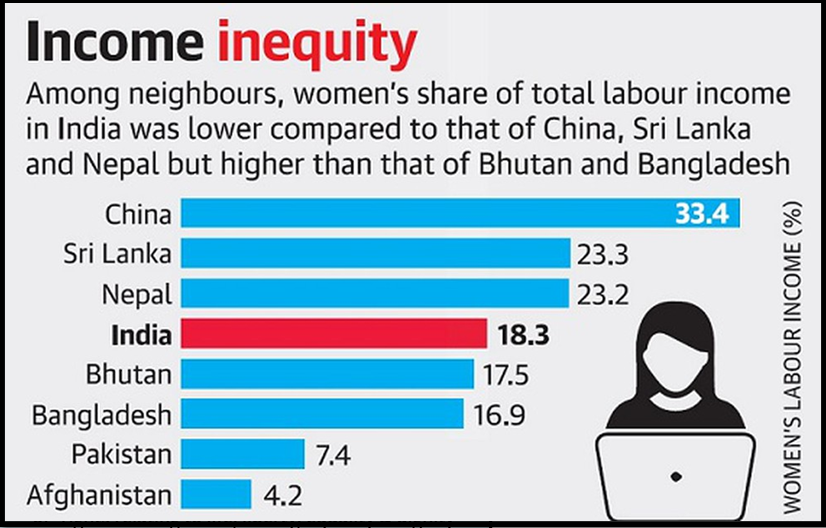

- Enabling women’s participation in the labor market through supportive policies.

Conclusion:

- Need for a shift towards employment-centered growth for addressing inequality.

- Importance of government policies in promoting equitable growth and reducing disparities.

- Emphasizing the role of employment in tackling intergenerational inequality and promoting economic development.

Source:The Hindu

Mains Practice Question :

GS-3

“Discuss the significance of addressing inequality as a core election issue in India, focusing on measures such as taxation reforms, welfare spending, and employment-centered growth policies. Evaluate the role of government in promoting equitable growth and reducing economic disparities in the country.” (250 words)