RBI’s Gold Reserves

Context: The Reserve Bank of India’s (RBI) gold reserves touched 794.64 metric tonnes in fiscal 2023, an increase of nearly 5 per cent over fiscal 2022, when it held 760.42 metric tonnes of gold.

Why are these reserves increasing?

- It is because as part of the diversification process, the RBI has been adding gold to its reserves, which is considered a more safe, secure, and liquid asset, to safeguard its returns amid global uncertainty and a rising inflation scenario.

- The RBI bought 34.22 tonnes of gold in fiscal 2023; in fiscal 2022, it had accumulated 65.11 tonnes of gold.

- In its half-yearly report on Management of Foreign Exchange Reserves: October 2022-March 2023,the RBI said 22 tonnes of gold is held overseas in safe custody with the Bank of England and the Bank of International Settlements (BIS), and 301.10 tonnes of gold is held domestically.

- As on March 31, 2023, the country’s total foreign exchange reserves stood at $578.449 billion, and gold reserves were pegged at $45.2 billion. In value terms (USD), the share of gold in the total foreign exchange reserves increased from about 7 per cent at the end of March 2022 to about 7.81 per cent at the end of March 2023. It was 7.06 per cent as of end-September 2022.

Why is the RBI purchasing so much gold?

- Experts believe that the RBI has been stepping up its gold purchases over the last few years in order to diversify its overall reserves.

- This change in strategy has been driven by negative interest rates in the past, the weakening of the dollar and growing geopolitical uncertainty.

- Central banks want security, safety, liquidity and return. Gold is a safe asset to have as it is liquid, has an international price which is transparent, and as it can be traded anytime.

So are other central banks too buying gold?

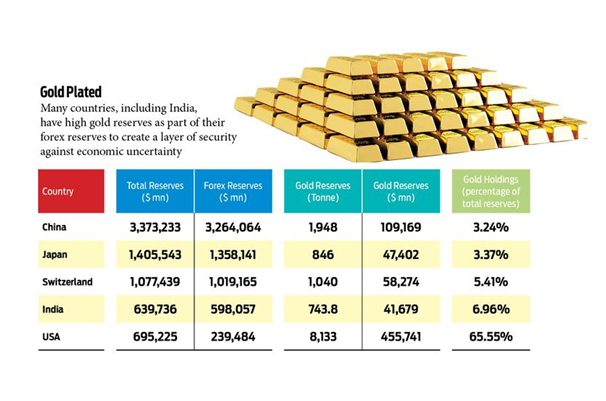

- Yes, many other central banks, including the Monetary Authority of Singapore (MAS), the People’s Bank of China (PBoC) and the Central Bank of the Republic of Turkey have been buying gold.

- In the calendar year 2022, central banks around the world purchased 1,136 tonnes of gold, which was a record high.

- The two key drivers of central banks’ decisions to hold gold are its performance during times of crisis, and its role as a long-term store of value,”

- It’s hardly surprising then that in a year scarred by geopolitical uncertainty and rampant inflation, central banks opted to continue adding gold to their coffers and at an accelerated pace.

| Practice Question

1. Why are central banks around the world storing gold in their reserves? |