RBI’s e-rupee could use UPI for a reformist leap

Relevance

- GS Paper- 3 Indian Economy and issues relating to planning, mobilization, of resources, growth, development, and employment.

- Inclusive growth and issues arising from it.

- Tags: #erupee #UPI #RBI #reform #currentaffairs #upsc.

Why in News

Reserve Bank of India (RBI) took a significant step by authorizing UPI as a platform for banks to extend credit lines, broadening its horizons further While the Unified Payments Interface (UPI) continues to gain well-deserved attention, its integration with India’s Central Bank Digital Currency (CBDC) holds the potential to usher in a transformative era for the banking sector.

Unlocking New Avenues for Efficiency and Innovation

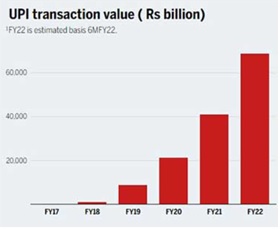

- India’s leadership in advocating for UPI has become evident, with a staggering 10 billion online money transfers in August alone, enough to captivate dignitaries from even the largest economies.

- Managed by the National Payments Corporation of India, which is owned by various lenders, UPI is built upon the state-run Aadhaar system of biometric IDs, ensuring secure identity verification for bank and telecom users.

- As privacy concerns are addressed, the simplicity of using a mobile device for seamless interbank transactions via UPI is garnering well-deserved attention.

- Reserve Bank of India (RBI) took a significant step by authorizing UPI as a platform for banks to extend credit lines, broadening its horizons further.

- However, real excitement emerged when the State Bank of India (SBI) announced its integration of UPI with e-rupee wallets designed for holding RBI’s CBDC.

- This innovative move enables e-rupee wallet holders to make swift retail transactions by scanning UPI network QR codes, ensuring liquidity for e-rupees and potentially positioning UPI as a catalyst for a profound transformation.

UPI: The Cornerstone of Digital Payments in India

- RBI Governor Shaktikanta Das, hailed UPI as “the backbone of digital payments in India” and a driving force behind fintech innovations. While Das outlined the potential role of CBDCs (with RBI’s e-rupee currently in trials) as a rapid, cost-effective, and secure alternative for cross-border money transfers, this global need for improved international transactions remains evident.

- CBDC adoption by G20 countries under common protocols would undoubtedly benefit the global economy.

- In the Indian context, leveraging RBI’s digital tokens could serve as a strategic countermeasure against the rise of cryptocurrencies and the potential for secret capital flight, both of which demand vigilant attention from RBI.

The Distinctive Power of CBDCs

- What sets CBDCs apart from traditional UPI transactions is the legal backing they carry, representing a direct claim on the currency issuer, RBI.

- With the inherent safety of RBI’s promise, e-rupees provide unmatched security. In contrast, UPI transactions rely on the stability of the commercial banks within the payment ecosystem, introducing systemic risk differences over time that cannot be underestimated.

- If RBI were to offer interest on e-rupees and maintain their ease of use, individuals would have a strong incentive to convert their bank balances into CBDCs.

- While this shift may reduce the funds available to banks in the form of deposits, the essence of a modern economy’s need for banks lies not in their access to people’s savings but in their expertise in risk assessment and profitable credit allocation.

- The internet has eliminated geographical barriers, allowing RBI to access and centralize deposits, which could be subsequently lent to banks for onward lending, resulting in a potentially superior banking model.

In conclusion, the integration of e-rupees with UPI has the potential to propel India’s banking system into a new era of efficiency and innovation. The journey is just beginning, and it is wise to keep our options open as these developments unfold.

| e-RUPI Overview:

– e-RUPI is a digital voucher system. – Beneficiaries receive it as an SMS or QR code on their mobile phones.

Redemption Process: – It is a prepaid voucher. – Beneficiaries can redeem it at any authorized center. – No need for a physical card, digital payment app, or internet banking access.

Purpose and Distinction: – Not to be confused with digital currency. – e-RUPI is specific to individuals and purposes.

Initiated by NPCI: – Developed by the National Payments Corporation of India (NPCI). – Aim to promote cashless transactions.

Collaboration: – Developed in partnership with the Department of Financial Services, Ministry of Health & Family Welfare, and National Health Authority.

How Does e-RUPI Function?

– e-RUPI is a digital payment solution that operates without cash or physical contact. – Beneficiaries will receive e-RUPI on their mobile phones, either as an SMS with a unique string or as a QR code. – It functions similarly to a prepaid gift voucher, allowing redemption at designated accepting centers. – No credit or debit card, mobile app, or internet banking is required for redemption. – e-RUPI facilitates digital connections between service sponsors, beneficiaries, and service providers, eliminating the need for physical interactions. |

Sources: Livemint

Mains Question

“Examine the potential impact of the integration of India’s Unified Payments Interface (UPI) with the Central Bank Digital Currency (CBDC) on the banking sector and the economy. Discuss the advantages, challenges, and strategic implications of this fusion, both domestically and globally. 250words.