Need for single rate GST, exemption-less taxation: EAC-PM Chairman Bibek Debroy

Why in News?

Recently, the Chairman of the Prime Minister’s Economic Advisory Council, in his personal capacity, has stated that India should have a “Single Goods and Services Tax (GST) Rate” and an “Exemption-less Tax Regime”.

What are the Suggestions?

- Single GST Rate:

- GST rates should be the same on all goods as ‘progressive’ rates work best with direct taxes, not indirect taxes.

- When the GST was first announced, the National Council of Applied Economic Research (NCAER) estimated that it would lead to a 1.5% to 2% increment to the Gross Domestic Product (GDP).

- However, the estimate was based on the premise that all goods and services will be part of GST and there would be a single GST.

- Different GST rates allows a mindset of ‘prime control’ whereby GST rates are pegged higher for items considered ‘elitist’ and lower for items of mass consumption, resulting in differentiation and subjective interpretation and litigation.

- Tax rates need to go higher than the current average of 11.5% as opposed to the 17% revenue-neutral rate for GST officially estimated earlier.

- ‘Exemption-less’ Direct Tax Regime:

- The chairman called for an exemption-less direct tax regime with the argument that while tax evasion is illegal, tax avoidance, by using exemption clauses to reduce tax burden, is legitimate.

- More tax exemptions also lead to an increase in cases of tax complications.

- The artificial difference between corporate taxes and personal income taxes (PIT) should be removed.

- A lot of unincorporated businesses pay taxes under personal income taxes.

- The removal of differences using exemption-less direct tax system will also reduce administrative compliance.

- The chairman called for an exemption-less direct tax regime with the argument that while tax evasion is illegal, tax avoidance, by using exemption clauses to reduce tax burden, is legitimate.

What is the Current Framework of the GST System?

- About GST:

- The Goods and Services Tax (GST) is a value-added tax levied on most goods and services sold for domestic consumption.

- The GST is paid by consumers, but it is remitted to the government by the businesses selling the goods and services.

- It is essentially a consumption tax and is levied at the final consumption point.

- It was introduced through the 101st Constitution Amendment Act, 2016.

- It has subsumed indirect taxes like excise duty, Value Added Tax (VAT), service tax, luxury tax etc.

- The Goods and Services Tax (GST) is a value-added tax levied on most goods and services sold for domestic consumption.

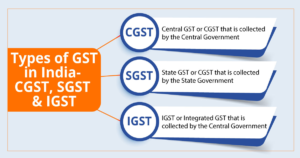

- Existing Tax Structure:

- Central GST (CGST) covers Excise duty, Service tax etc.

- State GST (SGST) covers Value Added Tax (VAT), luxury tax etc.

- Integrated GST (IGST) covers inter-state trade.

- IGST is not a tax but a system to coordinate state and union taxes.

- There are four major GST slabs:

- 5%, 12%, 18% and 28%.

- Some demerit and luxury goods, which are in the 28% bracket, attract additional levy of cesses, the proceeds of which go to a separate fund meant to compensate states for revenue shortfall and repayment of compensation related loans.

-

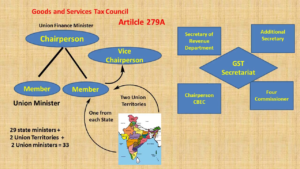

- GST Council:

- Article 279A of the Indian Constitution states that the GST Council to be formed by the President to administer & govern GST.

- Its chairman is Union Finance Minister of India with ministers nominated by the state governments as its members.

- The council is devised in such a way that the centre will have 1/3rd voting power and the states have 2/3rd.

- The decisions are taken by 3/4th majority.

- GST Council:

UPSC Civil Services Examination Previous Year Question (PYQ)

Prelims

Q1. Consider the following items: (2018)

- Cereal grains hulled

- Chicken eggs cooked

- Fish processed and canned

- Newspapers containing advertising material

Which of the above items is/are exempted under GST (Good and Services Tax)?

(a) 1 only

(b) 2 and 3 only

(c) 1, 2 and 4 only

(d) 1, 2, 3 and 4

Ans: (c)

Q2. What is/are the most likely advantages of implementing ‘Goods and Services Tax (GST)’?(2017)

- It will replace multiple taxes collected by multiple authorities and will thus create a single market in India.

- It will drastically reduce the ‘Current Account Deficit’ of India and will enable it to increase its foreign exchange reserves.

- It will enormously increase the growth and size of economy of India and will enable it to overtake China in the near future.

Select the correct answer using the code given below:

(a) 1 only

(b) 2 and 3 only

(c) 1 and 3 only

(d) 1, 2 and 3

Ans: (a)

Mains

- Explain the rationale behind the Goods and Services Tax (Compensation to States) Act of 2017. How has COVID-19 impacted the GST compensation fund and created new federal tensions? (2020)

- Enumerate the indirect taxes which have been subsumed in the Goods and Services Tax (GST) in India. Also, comment on the revenue implications of the GST introduced in India since July 2017. (2019)

- Explain the salient features of the Constitution (One Hundred and First Amendment) Act, 2016. Do you think it is efficacious enough “to remove cascading effect of taxes and provide for common national market for goods and services”? (2017)

- Discuss the rationale for introducing the Goods and Services Tax (GST) in India. Bring out critically the reasons for the delay in roll out for its regime. (2013)