India’s service exports surge amid goods decline

Syllabus:

GS-3: Planning ,Government Budgeting, Fiscal Policy ,Monetary Policy

Focus:

India’s services exports are on track to temporarily exceed goods exports, marking a significant shift in the country’s export landscape. This trend highlights the resilience and growth potential of the Indian services sector amidst global economic challenges.

Current Export Trends:

- India’s goods exports fell in July and August compared to last year, with a flat growth of only 1% in the first five months of the financial year.

- In contrast, services exports rose by 7% in August, reaching $30.7 billion, with an overall growth of 11% for the initial five months.

- Services may temporarily exceed goods exports monthly; they comprised 47% of total exports in July

- India ranks as the 7th largest services exporter globally, increasing its share from 19% to 4.6% in world services exports since 2001.

- Goldman Sachs projects services exports could hit $800 billion by 2030, constituting about 11% of India’s GDP.

What is the Service Sector?

- Definition: The service sector comprises industries that provide intangible services instead of tangible goods.

- Industries Included: It encompasses finance, banking, insurance, real estate, telecommunications, healthcare, education, tourism, hospitality, IT, and BPO.

- GDP Contribution: In FY21, services accounted for 54% of India’s total Gross Value Added (GVA).

- Foreign Direct Investment: The sector has attracted 53% of total FDI inflows from 2000 to 2021.

Significance of the Service Sector for India:

- Balancing Trade Deficit: Services trade surplus offsets the merchandise trade deficit, enhancing economic stability.

- Growth Potential: Strategic government focus can expand the services trade surplus, currently around $89 billion.

- Knowledge Economy Transition: The sector supports India’s shift from an assembly economy to a knowledge-driven economy, emphasising IT and finance.

- Employment Generation: It employs nearly 26 million people and contributes to 40% of total global exports.

- Global Competitiveness: India’s reputation for high-quality services boosts exports and foreign exchange earnings.

Potential Opportunities in the Service Sector:

- Tourism: Significant contributor to GDP and employment; FTAs increased by 14% in 2017.

- Ports and Shipping: Ports handle 90% of cargo volume and 70% of value, with steady traffic growth.

- Space Sector: Growth in satellite applications and private sector participation post-2020.

- Logistics & Transportation: Competitive advantage due to natural coastline and river networks.

- IT/BPM Sector: Major export contributor, generating $190.5 billion in revenue in 2019-20.

Government Initiatives to Promote Service Export

- Service Exports from India Scheme: Introduced in 2015, offering incentives to service exporters for five years.

- Skill India Initiative: Aims to provide market-relevant training to 40 crore youth by 2022 for service sector employment.

- Purchasing Managers Index (PMI): Indicator of business activity in services and manufacturing, guiding policy formulation.

- Free Trade Agreements (FTAs): Actively pursuing FTAs with key economies to enhance market access for Indian service providers.

Structural Advantages of Services Exports:

- India maintains a services trade surplus of approximately $13-34 billion monthly, easing the current account deficit pressure.

- Services exports are less sensitive to global economic fluctuations compared to goods, particularly in crises.

- The digital nature of many services means they’re less affected by logistical issues and geopolitical tensions.

- Studies indicate services require fewer imported inputs and can quickly adapt supply in competitive markets.

- The growth of remote work has bolstered digitally delivered services, increasing by 37% from 2019 to 2022.

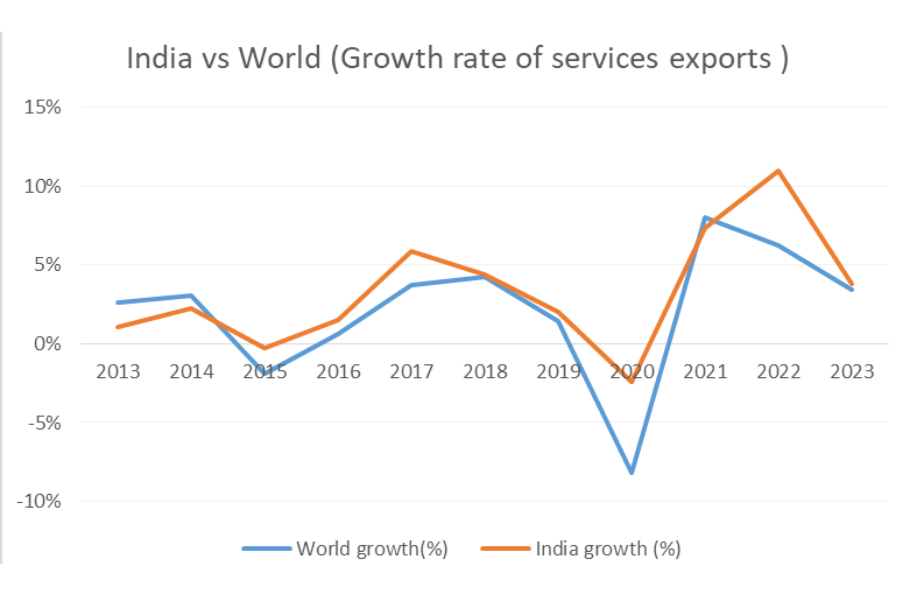

Evolution of Service Exports

- Initially driven by offshoring, India’s services sector has evolved into specialised global capability centres (GCCs).

- The number of GCCs increased from 700 to 1,580, generating $46 billion in revenue in

- Computer services dominate, accounting for around 47% of total service exports.

- Despite resilience, the services sector is not immune to global economic downturns and is price-sensitive.

- Analysts express concerns over potential shifts of back-office functions to lower-cost countries.

Domestic Economic Implications

- Historically, services were seen as low productivity sectors compared to manufacturing, hindering policy support.

- The services sector now generates 67% of global GDP, surpassing agriculture and industry combined.

- Growth in high-value services is expected to drive consumption in discretionary spending and real estate demand.

- However, services employment is concentrated in urban centres, limiting rural job creation.

- There’s a pressing need for services to create jobs as GDP growth no longer generates employment at past rates.

Navigating the Shift

- The shift towards services exports represents a second chance for India’s economy, compensating for mixed outcomes in goods exports.

- While services have been a positive growth driver, it remains critical to address the structural issues within the economy.

- Policymakers must focus on diversifying export sectors and enhancing job creation to match service sector growth.

- The long-term impact of this transition will be determined by how effectively India can leverage its service capabilities.

- Sustaining momentum in service exports is essential for ensuring a balanced and inclusive economic future.

Impact of Service Exports on India’s Balance of Payments (BoP)

- The surplus in services trade helps India manage its balance of payments, compensating for the merchandise trade deficit.

- Merchandise trade continues to show a deficit due to heavy reliance on imports, especially petroleum and gems.

- Even excluding petroleum and gems, imports exceed exports, showing India’s persistent dependency on foreign goods.

- The growth in service exports has provided a buffer, reducing pressure on the overall BoP.

- This balancing act is crucial for maintaining economic stability, particularly as the demand for imported inputs under schemes like Production-Linked Incentive (PLI) persists.

Global Demand Sensitivity of Services Exports

- Services exports show lower sensitivity to global demand fluctuations compared to goods exports.

- Studies reveal that a 1% rise in global GDP results in a5% increase in Indian services exports, compared to nearly 5% for goods exports.

- This lower “income elasticity” means that services exports are less likely to suffer in global downturns, as seen during the COVID-19 crisis.

- The digital and remote nature of services offers resilience in times of logistical or geopolitical disruptions.

- As a result, services exports are expected to remain a reliable source of revenue even during periods of global economic instability.

Challenges in India’s Service Exports:

- Geographic Concentration: Services exports are concentrated in major cities like Bengaluru, Hyderabad, and Gurugram, limiting broader employment opportunities across India.

- Skilled Workforce Dependency: The service sector primarily employs a highly skilled workforce, leaving a large portion of India’s unskilled or semi-skilled labour force untapped.

- Global Economic Vulnerability: While less sensitive than goods exports, services still face risks from global economic downturns, especially in areas like IT and consulting.

- Price Sensitivity: IT and outsourcing services remain vulnerable to price competition from other low-cost countries, potentially losing market share.

- Job Creation: Although the services sector grows, it does not create jobs at the scale required to absorb India’s vast labour pool, contributing to unemployment concerns.

Way Forward for Enhancing Service Exports:

- Diversifying Service Sectors: Expanding beyond IT and consulting into areas like healthcare, education, and creative industries to capture new global markets.

- Skilling the Workforce: Focus on upskilling and reskilling programs to include more workers in the formal service sector, especially from smaller towns.

- Promoting Decentralisation: Encouraging companies to set up operations in tier-2 and tier-3 cities to spread the benefits of service exports geographically.

- Fostering Innovation: Supporting startups and tech innovation through government initiatives to stay competitive in the global market.

- Leveraging Trade Agreements: Utilising international trade agreements to access new service export markets and reduce barriers to entry.

Conclusion:

India’s service exports, particularly in IT and consulting, are becoming a cornerstone of the economy, offsetting declines in goods exports. As the sector grows, addressing challenges like employment concentration and skills mismatch will be crucial for sustainable economic development and broader benefits across the nation.

Source: Mint

Mains Practice Question:

Discuss the significance of India’s service exports in the current economic landscape. What challenges does this sector face, and what measures can be taken to enhance its contribution to the overall economy?

Associated Article: