How does the Mines and Mineral Bill 2023 plan to bring the private sector into mineral exploration?

Relevance:

GS Paper-2

Indian Economy-Issues related to planning, Mobilization of resources, Growth development, and employment.

Context:

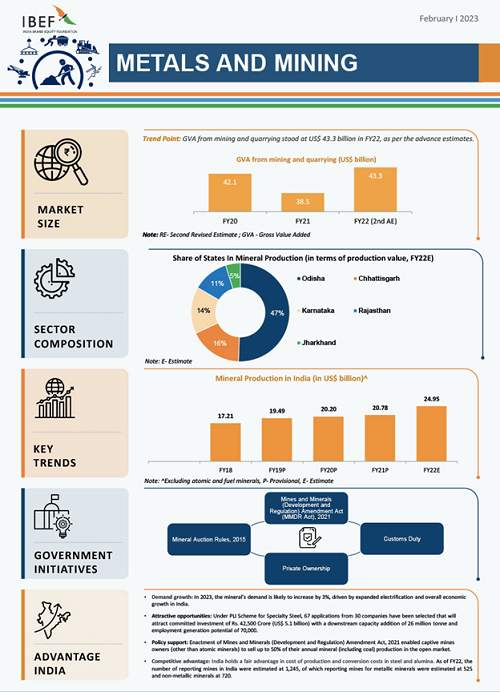

On August 2, Parliament passed the Mines and Minerals (Development and Regulation) Amendment Bill, 2023, in a bid to attract private sector investment in the exploration of critical and deep-seated minerals in the country.

About the Bill:

- The Bill puts six minerals, including lithium — used in electric vehicle batteries and other energy storage solutions — into a list of “critical and strategic” minerals. The exploration and mining of these six minerals, previously classified as atomic minerals, were restricted to government-owned entities.

Import of India’s critical minerals:

- The clean energy transitions of countries including India, seeking to meet their net-zero emission goals, are contingent on the availability of critical minerals such as lithium, which has also been called ‘white gold’, and others including cobalt, graphite, and rare earth elements (REEs).

- These are also crucial for the manufacture of semiconductors used in smart electronics; defence and aerospace equipment; telecommunication technologies and so on.

- The lack of availability of such minerals or the concentration of their extraction or processing in a few geographical locations leads to import dependency, supply chain vulnerabilities, and even disruption of their supplies.

- As per figures quoted by the Ministry, India is 100% import-dependent on countries including China, Russia, Australia, South Africa, and the U.S. for the supply of critical minerals like lithium, cobalt, nickel, niobium, beryllium, and tantalum.

- Also for deep-seated minerals like gold, silver, copper, zinc, lead, nickel, cobalt, platinum group elements (PGEs) and diamonds, which are difficult and expensive to explore and mine as compared to surficial or bulk minerals, India depends largely on imports.

Critical Minerals and their Importance:

Critical minerals are elements that are crucial to modern-day technologies and are at risk of supply chain disruptions-

- Recent categorization: Minerals such as antimony, cobalt, gallium, graphite, lithium, nickel, niobium, and strontium are among the 22 assessed to be critical for India.

- Global Supply Chain Vulnerabilities: The global supply chains for various commodities, including critical minerals like lithium, cobalt, graphite, and rare earth elements, have been shown to be susceptible to shocks, leading to shortages and rising prices.

- Impact on Various Sectors: Critical minerals are essential for manufacturing, infrastructure development, and clean energy transitions. They are crucial for electric vehicle batteries, semiconductors, wind turbines, and other technological advancements.

Import Dependency and Vulnerabilities:

- Import Dependency: India heavily relies on imports for critical and deep-seated minerals, such as lithium, cobalt, nickel, and rare earth elements.

- Supply Chain Disruption: The concentration of extraction and processing in a few geographical locations, like China’s dominance in cobalt and rare earth elements, can lead to supply chain vulnerabilities.

- Projected Demand: A World Bank study anticipates a nearly 500% increase in demand for critical metals like lithium and cobalt by 2050.

Global Initiatives for Supply Chain Resilience:

- Mineral Security Partnership (MSP): Major economies like the U.S., UK, Japan, and the EU have established the MSP to ensure supply chain resilience for critical minerals. India joined this partnership to secure access to these resources.

- Strategic Lists: Countries are compiling lists of critical minerals based on their economic needs and supply risks, aligning with their industrial strategies. This aims to secure stable access to these resources.

Private Sector Participation:

- Exploration and Mining: Mineral exploration is a multi-stage process, from reconnaissance to detailed exploration, before actual mining. India’s exploration efforts have been led by government agencies with limited private-sector involvement.

- Resource Potential: India’s geological setting holds potential for mineral resources similar to mining-rich regions. However, only a fraction of its obvious geological potential has been explored.

Challenges and Concerns:

- Incentives and Risks: Private sector involvement in exploration requires substantial investments and carries inherent risks, making it necessary to create favourable conditions and incentives.

- Revenue Generation Delays: Private explorers’ primary revenue source is a share of auction premiums, contingent on successful mine auctioning, which can take considerable time due to government clearances.

- Auction Process Challenges: Auctioning ELs before exploration begins raises uncertainty regarding future revenue and value estimation.

- Supreme Court Ruling: The Supreme Court’s 2012 ruling emphasized the significance of secure utilization of explored resources, which the new policy does not guarantee.

India’s mining policy:

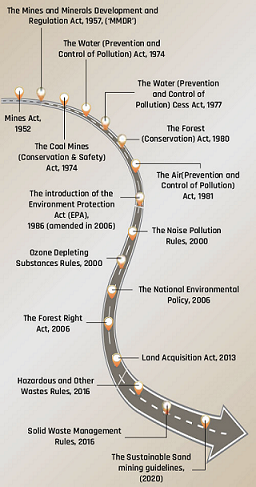

- The Mines and Minerals (Development and Regulation) Act (MMDR Act), 1957, the primary legislation governing mining in the country has been amended several times since its enactment including recently in 2015, 2020, and 2021.

- Later, private companies could also get Prospecting Licences (PL) or Mining Leases (ML), and could even apply for early-stage or greenfield exploration through Reconnaissance Permits (RPs).

- In 2015, the MMDR Act was amended to allow private companies to participate in government auctions for Mining Leases and Composite Licences (CLs).

- However, due to the Evidence of Mineral content (EMT) rule, only government-explored projects were auctioned, limiting private sector involvement.

- The amendment also permitted private firms to register as exploration agencies, with the National Mineral Exploration Trust (NMET) funding for G4 to G1 exploration, but private participation remained limited.

The Mines and Minerals Bill 2023:

- Firstly, the Bill omits at least six previously mentioned atomic minerals from a list of 12 which cannot be commercially mined.

- Being on the atomic minerals list, the exploration and mining of these six — lithium, beryllium, niobium, titanium, tantalum and zirconium, was previously reserved for government entities.

- Secondly, the Act prohibits pitting, trenching, drilling, and sub-surface excavation as part of reconnaissance, which included mapping and surveys. The Bill allows these prohibited activities.

- The Bill also proposes a new type of licence to encourage reconnaissance — level and or prospective stage exploration by the private sector.

- This exploration licence (EL), for a period of five years (extendable by two years), will be granted by the State government by way of competitive bidding.

- This licence will be issued for 29 minerals specified in the Seventh Schedule of the amended Act, which would include critical, strategic, and deep-seated minerals.

Way forward:

Privatization comes with risks of monopolization and black marketeering. Mining sector already prone to irregularities and corruption. Thus, the Government should design a mechanism to include safeguards. Nothing in the Bill ensures that mineral allocation will be prioritized for public sector companies. The Government must make provisions for allocation to public sector first and the remaining should be allocated to the private companies.