Health cover for elderly: expansion of ayushman bharat pm-jay

Syllabus:

GS 2:

- Government intervention and Schemes

- Issues related to development and management of social sectors related to health.

Why in the News?

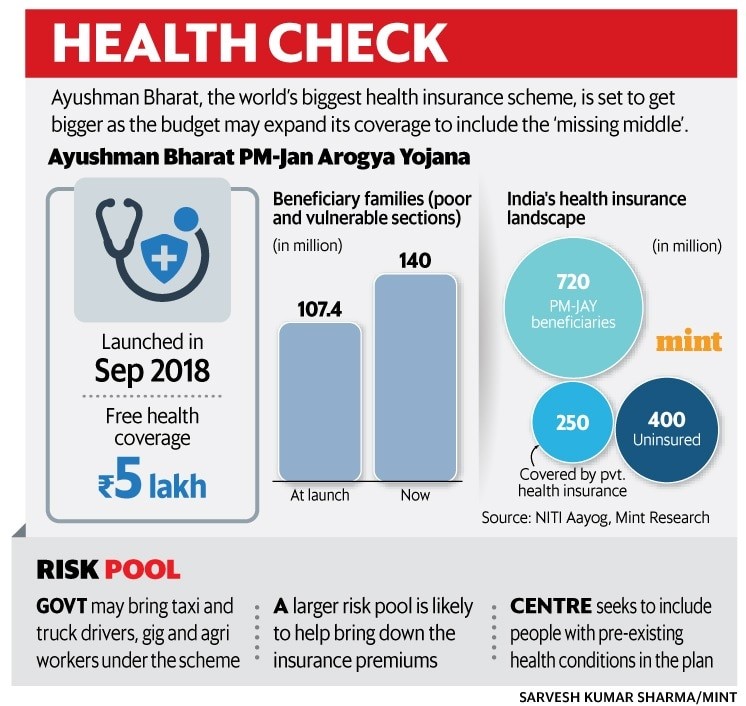

The expansion of Ayushman Bharat-PMJAY to cover all elderly individuals aged 70 and above, regardless of income, represents a significant enhancement in India’s healthcare coverage, addressing the growing needs of an aging population.

Expansion of Ayushman Bharat for the Elderly

- Key Update: The Union Cabinet has expanded Ayushman Bharat Pradhan Mantri Jan Arogya Yojana (AB PM-JAY) to cover all Indians aged 70 and above, irrespective of income.

- Registration Process: Eligible individuals can register via the Ayushman Bharat portal or app. A new module will be added, with face authentication for those with unreadable fingerprints.

- Benefits: The scheme provides ₹5 lakh annual health coverage per family, and this expansion specifically targets the elderly.

- No Waiting Period: Beneficiaries can use the policy immediately after completing eKYC, with no exclusions for pre-existing conditions.

What is Ayushman Bharat-PMJAY?

About:

- PM-JAY is the worlds largest government-funded health insurance scheme.

- Launched in 2018, it offers Rs. 5 lakh per family for secondary and tertiary care.

- Covers surgeries, treatments, medicines, and diagnostics.

Beneficiaries:

- It is an entitlement-based scheme targeting beneficiaries as per the latest SECC data.

- States/UTs can tag non-SECC families with similar socio-economic profiles to cover unauthenticated SECC families.

Funding:

- Funding is shared: 60:40 for most states, 90:10 for Northeast and hilly states, and 100%

- Central funding for UTs without legislatures.

Nodal Agency:

- The National Health Authority (NHA) oversees the implementation of PM-JAY.

- The State Health Agency (SHA) is responsible for the scheme’s implementation at the state level.

Coverage and Benefits for the Elderly

- Universal Coverage for 70+ Age Group: Individuals aged 70 or above are entitled to ₹5 lakh annual health cover, shared within the family.

- Top-Up Cover for Existing Beneficiaries: Elderly members already covered under the scheme will get an additional ₹5 lakh top-up cover exclusively for them.

- Wider Reach: The scheme aims to cover 6 crore individuals, including 1.78 crore already covered. The financial impact of the top-up is minimal.

- Geriatric Packages: The scheme includes 1,670 procedures, with 25 specifically for elderly care, and more are being added.

Existing Coverage and Overlap with Other Schemes

- Other Government Health Schemes: Around 80 lakh people are covered under schemes like CGHS and the Ex-Servicemen Contributory Health Scheme. They can choose to continue with their existing cover or opt for Ayushman Bharat.

- ESIC and Private Insurance: People under ESIC can avail both ESIC and Ayushman Bharat. Those with private insurance can also benefit from Ayushman Bharat.

- Flexibility for Beneficiaries: The scheme complements existing government and private health insurance, offering flexibility for users to choose or combine coverage.

Financial Implications for the Government

- Initial Funding: The government has allocated ₹3,437 crore for the current financial year and the next to cover the expansion.

- State Contributions: States are required to contribute 40% of the schemes cost. States like Delhi, West Bengal, and Odisha have not yet implemented the scheme, though Odisha is in talks to launch it.

- Manageable Financial Burden: Officials highlight that the additional financial burden for the expansion, especially the top-up covers, is minimal.

Importance of the Scheme

- Aging Population: India’s elderly population will rise from 8.6% in 2011 to 19.5% by 2050, making this expanded health coverage essential.

- Higher Hospitalization Rates: The elderly under the scheme have a 7% hospitalization rate, compared to 3-4% for younger people.

- Limited Coverage: Only 20% of those over 60 currently have any form of health insurance, making the expanded Ayushman Bharat scheme crucial.

- Focus on Elderly Women: Women make up 58% of the elderly population, with 54% being widows. The scheme is especially beneficial for elderly widows, offering much-needed healthcare support.

Challenges:

- Low Awareness: Many elderly may be unaware of their eligibility, leading to underutilization.

- Weak Infrastructure: Healthcare facilities, especially in rural areas, may struggle to meet increased demand.

- Administrative Overload: The expanded scheme could overwhelm the system, causing delays in registrations and claims.

- State Financial Pressure: States’ 40% funding contribution may strain weaker states, delaying or limiting coverage.

- Scheme Overlap: Confusion may arise due to the coexistence of Ayushman Bharat with other health schemes.

Way Forward:

- Awareness Drives: Launch campaigns to educate the elderly on registration and benefits.

- Infrastructure Improvement: Upgrade rural healthcare facilities to meet increased demand.

- Simplify Registration: Streamline the process for easier access and reduced delays.

- State-Central Collaboration: Support weaker states with financial and technical assistance for smoother implementation.

- Scheme Integration: Align existing health schemes with Ayushman Bharat to avoid overlaps and confusion.

Conclusion:

Expanding Ayushman Bharat-PMJAY to include all elderly citizens is a pivotal move in improving health insurance coverage for India’s senior population, ensuring broader access to healthcare services and supporting those most in need.

Source: Indian Express

Mains Practice Question:

Discuss the implications of expanding the Ayushman Bharat-PMJAY scheme to cover all individuals aged 70 and above. How does this move address the challenges faced by the elderly in accessing healthcare in India?

Associated Article:

https://universalinstitutions.com/does-pmjay-need-a-design-change/