GNPA) RATIO OF SCHEDULED COMMERCIAL BANKS REACHED A 12-YEAR LOW

Why in the news?

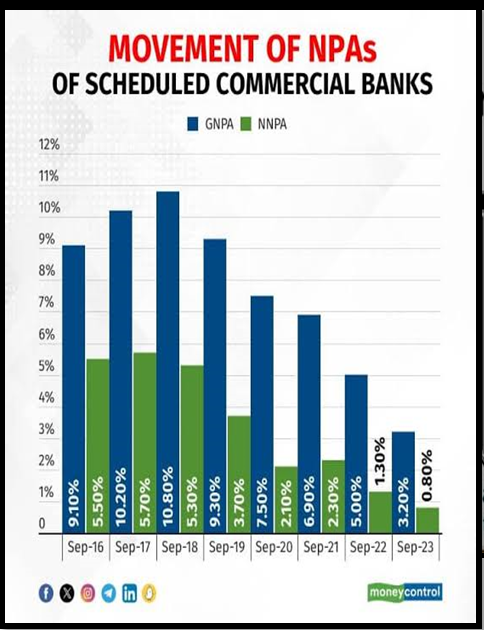

- The Reserve Bank of India’s Financial Stability Report for June 2024 highlights that the gross non-performing assets (GNPA) ratio of scheduled commercial banks reached a 12-year low of 2.8% in March 2024.

- The GNPA ratio is projected to further improve to 2.5% by March 2025, based on macro stress tests assessing banks’ resilience to economic shocks.

Source: Startupchallenge

Current GNPA and NNPA Status

- The GNPA ratio of scheduled commercial banks recorded a sustained improvement, moderating to 2.8% in March 2024.

- The net non-performing assets (NNPA) ratio also improved to a record low of 0.6%, reflecting enhanced asset quality.

About Financial Stability Report :

- The Financial Stability Report is released by the RBI twice a year.

- It details the state of financial stability in the country, incorporating inputs from all financial sector regulators.

| Key Terms:

NPA (Non-Performing Asset)

GNPA (Gross Non-Performing Asset)

NNPA (Net Non-Performing Asset)

|

Associated Article: