EUROPE’S CARBON BORDER TAX TRIGGERS RUSH FOR GREEN POWER IN INDIA

Why in the News?

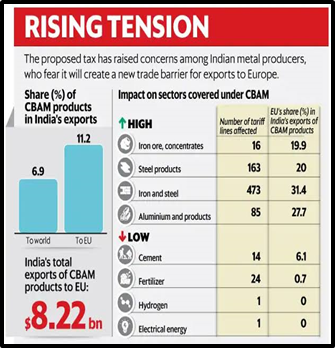

- CBAM Impact: Indian steel and metal companies are scrambling to secure renewable energy deals to reduce carbon emissions ahead of Europe’s Carbon Border Adjustment Mechanism (CBAM) set to begin in 2026.

- Supply Chain Focus: The demand for green power extends beyond large firms to their suppliers, creating a rush to minimize emissions across entire supply chains.

Renewable Energy Demand Surge:

- Capacity Shortage: Renewable energy companies in India, such as Avaada and Sunsure, report a significant demand-supply mismatch, with new projects already sold out until 2026.

- Early Commitments: Companies are making early commitments for future green energy projects to avoid potential penalties under CBAM, leading to an increase in tariffs.

CBAM and Industry Response

- Sector-Specific Levies: CBAM will initially target six sectors, including steel and aluminum, and levy taxes on carbon emissions exceeding European benchmarks.

- Industry Initiatives: Indian steelmakers like JSW and Tata Steel are investing in renewable energy, while aluminum producers like Hindalco and Vedanta are also ramping up green energy usage to comply with future regulations.

Source: UGI

| About Carbon Border Adjustment Mechanism (CBAM) Overview

What is CBAM?

Purpose:

Timeline and Coverage:

How it Works:

Associated Article: https://universalinstitutions.com/what-is-the-eus-carbon-border-adjustment-mechanism/ |