Daily News Analysis.

PUShP Portal (gs-3)

News: State recommendations for providing incentives to buyers and sellers on the surplus power portal PUSHp have been requested by the National Power Committee (NPC).

The Ministry of Power launched the High Price Day Ahead Market (HP-DAM) and Surplus Power Portal (PUShP). It was introduced to ensure better access to electricity during the period of highest demand at a cost larger than the cap of Rs 12 per unit by a specific category of sellers.

The power distribution firms (DISCOMs) would be allowed to list their excess power on the web in terms of block periods, days, and months. The surplus electricity will be available for requisition by the DISCOMs that require it. Both variable charges (VC) and fixed costs (FC), as established by regulators, will be paid by the new buyer.

The original beneficiary loses all recall rights once power is transferred because the entire FC obligation is transferred to the new beneficiary as well. This will free up all the available generation capacity and lessen the burden of fixed costs on the DISCOMs.

About DISCOMS-

In India’s electricity supply chain, distribution performs the most important role, yet it may also be the weakest link. India’s power sector DISCOMs continue to experience problems with metering, inadequate investment, and AT&C losses.

In order to explicitly address the operational shortcomings and financial limitations of the discoms, the Revamped Distribution Sector Reform Scheme (RDSS) was introduced; however, the implementation of the programme is problematic.

The states must emphasize the need for flexibility in prioritizing investments in their action plans if they are to take advantage of the many opportunities provided by the RDSS. Additionally, this effort must be backed with fulfilled pledges for an expedited but careful implementation.

Pilibhit Tiger Reserve : Five-Year-Plan To Safeguard Turtles (GS-2)

News: By creating its first “five-year plan,” Pilibhit Tiger Reserve (PTR) has set out on an ambitious mission to protect turtles, carry out species identification, and gauge their populations both inside and outside the reserve.

Pilibhit Tiger Reserve is situated in the Uttar Pradesh districts of Pilibhit, Lakhimpur Kheri, and Bahraich. It is located in Uttar Pradesh at the boundary between India and Nepal amid the Terai plains and Himalayan foothills.

The reserve is the source of many rivers, including Sharda, Chuka, and Mala Khannot, as well as the Gomti. The Sharda Sagar Dam, which reaches a maximum length of 22 km (14 mi), is located on the reserve’s border.

North Indian damp deciduous vegetation – It is distinguished by sal woods, tall grasses, and marshes, which are preserved by recurrent river flooding. Numerous wild creatures, including the critically endangered tiger, swamp deer, Bengal florican, hog deer, and leopard, among others, call it home.

Tiger Reserves in India-

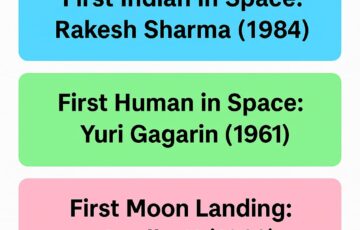

The National Tiger Conservation Authority of the Government of India, which oversees Project Tiger, is in charge of managing the tiger reserves in India, which were established in 1973. Up to 2018, tiger reserves were designated in 50 protected areas. The third tiger reserve in the State and the 53rd total tiger reserve were established in Uttar Pradesh’s Ranipur Wildlife Sanctuary in 2022.

80 percent of the tigers in the world reside in India. India believed there were 1,411 tigers in 2006; by 2022, that number was expected to treble to 3167. According to the World Wildlife Fund and the Global Tiger Forum, the number of wild tigers worldwide increased from 3,159 in 2010 to 3,890 in 2016. This increase was largely attributed to the growth of tiger populations in India.

Earendel : Celestial Body (GS-3)

News: The distant celestial body Earendel has been shown to have significant information by the James Webb Space Telescope.

The farthest and oldest star known is Earendel, which was found by the Hubble Space Telescope in 2022. It is a big B-type star that is nearly a million times as bright and more than twice as hot as our Sun. It is roughly 12.9 billion years away and is situated in the Sunrise Arc Galaxy. It was only discovered by Webb and Hubble as a result of gravitational lensing, a natural phenomena.

The galaxy cluster WHL0137-08, which is situated between Earth and Earendel, caused a kink in space-time that the star just so happened to line up against. When a large celestial object, like a galaxy cluster, bends spacetime enough to make it appear as though it were a lens, this phenomenon is known as gravitational lensing.

The gravitational lens is the name given to the object that bends light. Magnification, which enables humans to observe objects that would otherwise be too far away and too faint to detect, is a significant result of this lensing distortion.

Celestial Bodies-

A celestial object is an observable cosmic phenomenon that happens naturally. The terms “object” and “body” are frequently used synonymously in astronomy. A celestial object, on the other hand, is a complex, less cohesively bonded structure that could include numerous bodies or even other objects with substructures, as opposed to a celestial body, which is a single, tightly bound, adjoining entity.

Space objects like the Sun, planets, moons, and stars are referred to as celestial bodies or heavenly group. They are normally quite far away from us and are a part of the vast cosmos we inhabit. Such objects are scattered throughout the majestic night sky, and when viewed through a telescope, they reveal intriguing worlds of their own.

We rely on telescopes to examine them because we cannot see them all with our eyes due to their great distance. The definition of a heavenly body encompasses both known and undiscovered objects equally. A celestial body is, by definition, any natural object that is not part of the Earth’s atmosphere.

The Moon, Sun, and other planets in our solar system are straightforward examples. However, those are only extremely brief samples. There are many celestial bodies in the Kuiper belt. A celestial body is any asteroid that is in space.

Employee Stock Option Plan (GS-3)

News: In order to enable startups to hire “low-cost” workers, a legislative panel recently proposed that the government change the Income Tax Act to ensure that ESOPs (Employee Stock Option Plans) are taxed only at the time of sale of shares and not on notional gains.

Employee stock ownership plans (ESOPs), sometimes known as employee stock option plans (ESOPs) outside of the United States, give employees the opportunity to purchase business shares at a set price.

It is a technique used by businesses to draw in, keep, and reward employees. ESOPs aid in coordinating employee interests with the expansion and success of the business.

In an ESOP, qualified employees are given the option, but not the duty, to purchase business shares at a predetermined price, also referred to as the “exercise price” or “strike price.” This price is often set below the price at which the company’s shares are already trading in the market. The vesting period is the time frame during which employees must wait before exercising their option to buy the predetermined amount of shares.

It must be issued in compliance with the provisions of the Companies Act of 2013 and the Companies (Share Capital and Debentures) Rules of 2014. This applies to all businesses other than those that are publicly traded. The Securities and Exchange Board of India Employee Stock Option Scheme Guidelines should be followed by listed companies while issuing stock options.

Securities and Exchange Board of India (SEBI)

In compliance with the Securities and Exchange Board of India Act, 1992, SEBI was founded as a statutory entity on April 12, 1992. The Securities and Exchange Board of India’s core responsibilities include promoting and regulating the securities market as well as safeguarding the interests of investors in securities.

The regulatory body prior to the establishment of SEBI was the Controller of Capital Issues, which received its jurisdiction from the 1947 Capital Issues (Control) Act. In accordance with a decision of the Indian government, the SEBI was established in April 1988 as the country’s capital markets’ regulator.

At first, SEBI lacked any statutory authority and was a non-statutory organization. The SEBI Act of 1992 gave it legal authority and autonomy. Mumbai serves as SEBI’s administrative center- Delhi, Chennai, Kolkata, and Ahmedabad house SEBI’s regional offices.

India Web Browser Development Challenge (GS-2)

News: The Indian Web Browser Development Challenge (IWBDC) was just introduced by the Ministry of Electronics and Information Technology (MeitY).

MeitY is leading the effort, with assistance from the Bangalore-based Centre for Development of Advanced Computing (C-DAC), the Controller of Certifying Authorities (CCA), and others. The Challenge aims to motivate and enable tech enthusiasts, visionaries, and developers from all regions of the nation to develop a native web browser.

The proposed browser will employ a root certificate from India’s CCA, have its own trust store, and offer cutting-edge functions as well as improved security and data privacy protection measures. The government has set aside a cash award for the developers in the amount of Rs 3.4 crores as part of the contest.

The Companies Act of 2013 permits applications from Indian Tech Start-ups, MSMEs, Companies, and LLPs registered in India. Indian citizens or people of Indian heritage must own at least 51% of the company. It is not acceptable for the applicant’s entity to be a subsidiary of any foreign corporation.

Applicants may submit their applications as “individuals” or “organizations.” Members who apply as “individuals” should form Groups with a minimum of 3 and a maximum of 7 members. Startups, MSME, and other applicants should only submit applications under the “organization” category.

About DeitY:

Department of Electronics and Information Technology is known as DeitY. The Department of Information Technology was its previous name. In the year 2012, it was called the Department of Electronics and Information Technology. DeitY, which had previously been a division of the Ministry of Communications and Information Technology, was elevated to the status of a full-fledged ministry of electronics and information technology in July 2016.

The Department of Electronics and Information Technology (DeitY) is in charge of the following duties:

- Information technology, electronics, and internet policy issues

- Promotion of services using IT and the internet

- Supporting other departments in their efforts to promote e-government, e-commerce, e-medicine, e-infrastructure, etc.

- Cyberlaws-related issues Initiatives to close the digital divide Initiatives to promote the hardware and software industries, including knowledge-based businesses, strategies for boosting IT exports, and industrial competitiveness