Current Account Deficit

Context: Recent data released by the government shows that India’s exports and imports declined by 6.59% and 3.63% respectively in January, there are indications that the current account deficit (CAD) – difference between exports and imports – will moderate despite the global slowdown triggered by the rising inflation and interest rates.

Factors leading to Moderate CAD

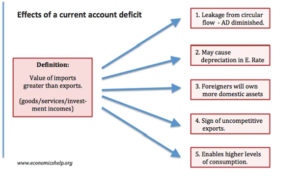

- When the value of the goods and services that a country imports exceeds the value of the products it exports, it is called the current account deficit.

- The moderation in CAD, expected to be aided by

- The fall in commodity prices

- Rising workers remittances and services exports

- Reduction of selling pressure by foreign investors is set to boost sentiment on the investment front, as it will also bring the pressure off the currency.

What is the significance of CAD?

- CAD and the fiscal deficit together make up the twin deficits – the enemies of the stock market and investors.

- If the current account – the country’s trade and transactions with other countries – shows surplus, that indicates money is flowing into the country, boosting the foreign exchange reserves and the value of rupee against the dollar.

- These are factors that will have ramifications on the economy and the stock markets as well as on returns on investments by people.

- According to the RBI, the CAD, which was at $36.4 billion for the quarter ending September 2022, is expected to moderate in the second half of 2022-23 and remain eminently manageable and within the parameters of viability.

How did the trade deficit narrow in Jan?

- January trade deficit narrowed to $17.7 billion, led by a sharp fall in imports, while exports fell by a smaller amount.

- The sharp drop in imports was due to non-oil imports falling, mainly due to a price impact (softening in coal prices from mid-December), likely softening in domestic demand post the festive season (such as lower imports of transport equipment), and seasonal impact of the Chinese New Year holidays.

- After the ₹26,000 crore sell-off by foreign portfolio investors in January, FPI outflows have come down to Rs4,400 crore in February so far.

- Workers’ remittances went up to $30 billion in the April-September 2022 period from $48 billion in the same period a year ago. At the same time, gold imports fell to $20 billion from $23.9 billion a year ago.

How will moderating CAD impact the market?

- While rising CAD raises concerns among investors as it hurts the currency and thereby the inflow of funds into the markets, a notable decline in CAD in January has improved market sentiments.

- The benchmark Sensex at BSE rose 407 points intraday on Thursday before closing at 61,319 with a gain of 44 points or 0.07%.

- Experts say that CAD is very important for the currency. The value of an economy hinges a lot on the value of its currency and thereby, it also supports the equity markets by keeping the fund flow intact.

While the numbers for January have come good, experts say this needs to be sustained. “The reduction in CAD is a positive sign. However, the country needs to maintain this for many more months before we can say that the CAD worry is behind us.

| Practice Question

|