Core Inflation Trends Shape RBI’s Rate Cut Decisions

Core Inflation Trends Shape RBI’s Rate Cut Decisions

Why in the News?

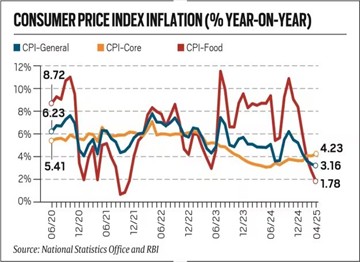

Core inflation, excluding volatile food and fuel prices, is rising while food inflation falls. This reversal influences the Reserve Bank of India’s approach to monetary policy and potential interest rate cuts.

Inflation Trends and RBI’s Focus:

- Inflation was mainly driven by food prices for a long time, prompting calls for RBI to focus on core inflation (excluding food and fuel) rather than headline inflation.

- Recently, food inflation has dropped below both headline and core inflation levels, marking a significant reversal.

- Core inflation is currently above RBI’s medium-term target of 4%, while food inflation is at its lowest since October 2021.

- RBI kept the repo rate steady at 6.5% for nearly two years, as core inflation remained moderate earlier.

Factors Affecting Inflation

- The rupee stabilized around 85.4 per dollar, easing fears of imported inflation caused by currency depreciation.

- Low global oil prices (around $65 per barrel) and stable commodity costs help keep inflation in check.

- India benefits from cheaper imports from countries like China and Vietnam, which are redirecting exports due to US tariffs.

- Government imposed anti-dumping duties on some Chinese goods to protect domestic industries.

Outlook for RBI Monetary Policy

- Stable rupee, declining food inflation, and lower global commodity prices create disinflationary pressures, allowing RBI to consider further rate cuts.

- Improved food production following a good monsoon season and agricultural output supports this trend.

- RBI is expected to focus on core inflation trends in upcoming monetary policy reviews, as food inflation becomes less of a concern.

Inflation Metrics: |

– CPI (Consumer Price Index) measures overall consumer goods prices.

About Repo Rate:

|