Carbon Markets: Challenges, Opportunities, and Global Relevance

Syllabus:

GS-3:

Conservation , Groupings & Agreements Involving India and/or Affecting India’s Interests

Focus:

The climate conference in Baku, Azerbaijan, approved standards to establish an international carbon market by next year, reviving discussions on carbon markets as a tool to limit global emissions and combat climate change.

Understanding Carbon Markets:

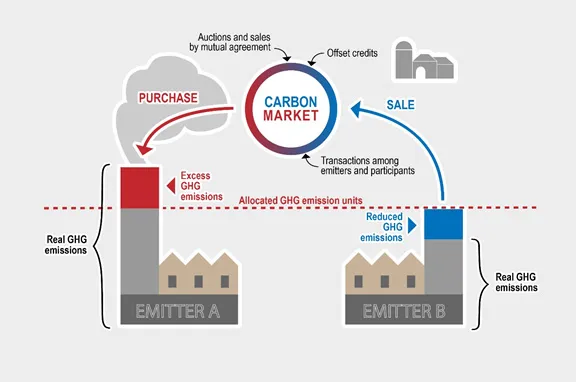

- Definition: Carbon markets facilitate the buying and selling of the right to emit carbon into the atmosphere.

- Mechanism:

- Governments issue certificates called carbon credits, each equivalent to 1,000 kg of carbon dioxide emissions.

- Firms without carbon credits cannot emit carbon. The total number of credits issued limits overall emissions.

- Individuals or firms can trade unused credits, with prices determined by supply and demand.

- Introduction: The concept emerged in the 1990s in the U.S. to control sulphur dioxide emissions through a cap-and-trade model.

- Carbon Offsets:

- Separate from carbon credits, offsets involve funding activities like tree planting that reduce emissions elsewhere.

- Environmental NGOs often sell these offsets to businesses seeking to neutralize their carbon footprint.

Related Indian Initiative:

- Clean Development Mechanism (CDM): Under the Kyoto Protocol, India utilized CDM to establish a primary carbon market for emission reduction projects.

- Secondary Carbon Market:

- Perform-Achieve-Trade (PAT) Scheme: Focuses on enhancing energy efficiency.

- Renewable Energy Certificates (REC): Promotes the adoption of renewable energy technologies.

Types of Carbon Markets

- Voluntary Markets:

- Emitters buy carbon credits to offset one tonne of CO2 or equivalent.

- Credits stem from CO2-reducing activities like afforestation.

- Verified by private firms and traded via online registries.

- Valued globally at $2 billion.

- Compliance Markets:

- Regulated by policies, based on the “cap-and-trade” principle.

- EU’s ETS (2005) leads, valued at €683 billion in 2023.

Benefits of Carbon Markets:

- Addressing Externalities:

- Carbon emissions are an externality—costs unaccounted for in traditional market systems due to the lack of ownership over the atmosphere.

- Firms polluting for free face no financial disincentive, leading to excessive emissions.

- Carbon markets impose costs for pollution, incentivizing firms to reduce emissions.

- Efficient Allocation:

- Market-driven trade ensures that carbon credits flow to firms that need them most, optimizing economic activities within emission limits.

- Improved Carbon Accounting:

- Advances in technology and standardized reporting systems allow corporations to better monitor emissions.

- Initiatives like the Carbon Disclosure Project promote voluntary reporting of carbon footprints, though this remains challenging for smaller firms in developing countries.

Corporations’ Preference for Market-Driven Systems

- Voluntary Over Government-Imposed Models:

- Corporations resist government-imposed carbon budgets, citing potential cost hikes and operational restrictions.

- They argue that production processes and supply chains vary widely, making uniform carbon budgets impractical.

- Support for Market Systems:

- Large firms like ExxonMobil and General Motors advocate for carbon markets that allow free trading of credits.

- Market-driven trading is seen as more efficient than government mandates, enabling firms to buy unused credits from others.

- Technological Advancements:

- Real-time tracking in sectors like energy has enhanced emissions monitoring and improved granularity in corporate reporting.

Corporate Preferences and Market Dynamics

- Voluntary Participation: Corporations often prefer voluntary carbon reporting frameworks like the Carbon Disclosure Project to avoid rigid government-imposed carbon budgets.

- Market Efficiency: Large corporations advocate for market-based trading of carbon credits, enabling efficient allocation of emissions rights based on operational needs.

- Cost Concerns: Firms argue that strict government policies may increase costs, impact supply chains, and restrict output.

- Flexibility: Free trading allows firms to purchase credits from less polluting entities, balancing economic and environmental goals.

Future Prospects and Innovations:

- Technological Advancements: Innovations such as real-time energy monitoring enhance accuracy in carbon accounting, particularly for large corporations.

- Global Standards: The Azerbaijan climate conference advances frameworks for a standardized international carbon market, expected to operationalize soon.

- Opportunities for Developing Countries: Carbon offset projects like reforestation provide income sources and contribute to sustainable development.

- Collaboration Over Regulation: Encouraging public-private partnerships can strike a balance between regulatory oversight and market freedom, fostering better results.

Criticisms and Challenges of Carbon Markets:

- Manipulation by Governments:

- Unsupportive governments may increase the supply of carbon credits, lowering prices and undermining emission reduction efforts.

- Corruption or leniency can allow firms to evade restrictions through illegal emissions.

- Effectiveness of Carbon Offsets:

- Critics argue firms often purchase offsets for public image rather than genuine environmental benefits.

- Ensuring that offsets genuinely reduce emissions is challenging.

- Setting Optimal Supply:

- Determining the right number of carbon credits is complex.

- Over-restricting credits can slow economic growth, while oversupplying them renders emission caps ineffective.

- Concerns of Virtue Signaling:

- Firms may invest in offsets for branding rather than actual carbon reduction.

Key Takeaways and Way Forward:

- Opportunities in Carbon Markets:

- Carbon markets represent a practical solution for controlling emissions if implemented with transparency and integrity.

- Technological and policy innovations are vital to ensure the effectiveness of these systems.

- Global Coordination:

- Setting international standards can help harmonize carbon market practices and foster trust among stakeholders.

- The recent Azerbaijan climate conference’s efforts to standardize carbon market rules is a significant step.

- Building Accountability:

- Ensuring independent monitoring of emissions and offset activities is crucial.

- Policymakers must balance economic growth with climate goals to ensure the sustainability of carbon markets.

Conclusion:

Carbon markets hold promise for curbing emissions through economic incentives. However, their success hinges on robust governance, fair global collaboration, and addressing issues like oversupply and accountability. A well-regulated framework can ensure both environmental benefits and sustainable economic growth.

Source: The Hindu

Mains Practice Question:

Discuss the concept of carbon markets and their role in addressing climate change. Examine the challenges in implementing carbon markets globally and suggest measures to make them effective.