Bharat (BH ) Series Registration Mark

Ministry of Road Transport and Highways (MoRTH) has allowed the conversion of regular vehicle registrations into Bharat Series (BH) numbers as part of measures to widen the scope of the BH series ecosystem.

- Earlier, only new vehicles could opt for the BH series mark.

What is Bharat series (BH-series)?

- In August 2021, the Indian government began issuing BH Number Plates or Bharat Series Registration Numbers for non-transportation vehicles.

- The BH Series number plate eliminates the need to change a vehicle’s registration when moving to a different state.

- When moving to a different state, a car has to be re-registered.

- When the owner of a vehicle changes States, a vehicle with the BH registration mark does not need to be assigned a new registration mark.

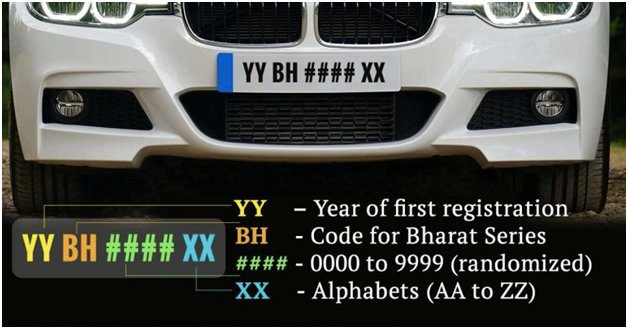

- Format of Bharat series (BH-series) Registration Mark –

Registration Mark Format:

- YY BH #### XX

- YY – Year of first registration

- BH- Code for Bharat Series

- ####- 0000 to 9999 (randomized)

- XX- Alphabets (AA to ZZ)

Why such a move?

- Changing stations happens to personnel in the public and private sectors.

- When it comes to the transfer of registration from the parent state to another state, such movements make these employees feel uneasy.

- A person is only permitted to maintain a vehicle in a state other than the one in which it is registered for a maximum of 12 months under section 47 of the Motor Vehicles Act of 1988.

Who can get this BH series?

- Defense personnel, employees of the Central Government, State Government, Central/State PSUs, and private sector businesses/organizations will all have optional access to the BH-series.

- The motor vehicle tax is imposed for a period of two years or a multiple of two years.

- As soon as a person relocates to a new State or UT in India, this scheme will enable unrestricted personal vehicle transportation between such States/UTs.

- A motor vehicle tax equal to half of what was previously assessed for that vehicle will be imposed yearly after the completion of the fourteenth year.