ANGEL TAX ABOLISHED FOR FOREIGN INVESTMENTS IN START-UPS

Why in the news?

- Finance Minister Nirmala Sitharaman announced the removal of the angel tax on foreign investments in start-ups.

- The measure aims to bolster the Indian start-up ecosystem, boost entrepreneurial spirit, and support innovation.

source:researchgate

About Angel Tax:

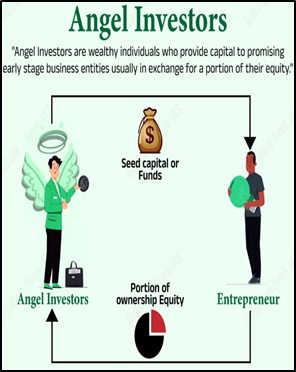

- Angel Tax: Tax on excess capital raised by unlisted companies above fair market value.

- Introduced: Section 56(2)(vii)(b) of the Income Tax Act, 2012.

- Purpose: Prevents use of unaccounted money through overvalued share subscriptions.

- 2023 Amendment: Includes foreign investors; excess share price over fair market value is taxable.

- Example: If fair market value is Rs 10 and shares are sold at Rs 20, the Rs 10 excess is taxable.

Budget 2023-24 Changes:

- Angel Tax extended to foreign investors, except for government-recognized startups.

- Previously applied only to resident investors.

Key points:the Income Tax Act

Associated Article: https://universalinstitutions.com/dpiit-supports-industrys-call-to-remove-angel-tax/ |