SEBI CHARGES HINDENBURG FOR PROFITING FROM ADANI REPORT

Why in the news?

- The Securities and Exchange Board of India (SEBI) charged Hindenburg Research with making “unfair” profits.

- SEBI accused Hindenburg of colluding to use “non-public” and “misleading” information to induce “panic selling” in Adani Group stocks.

source:medium

About The Securities and Exchange Board of India (SEBI):

- Establishment: Statutory regulatory body by the Government of India in 1992 through the SEBI Act, 1992.

- Objective: Regulate the securities market and protect investors.

- Powers:

- Quasi-judicial: Pass judgments on frauds and unethical practices.

- Quasi-executive: Examine accounts, impose rules, take legal actions.

- Quasi-legislative: Formulate rules on listing, insider trading, disclosures.

Securities Appellate Tribunal:

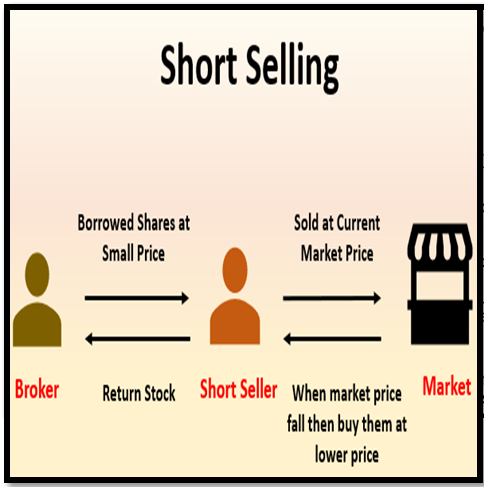

Short Selling: Key Points

Associated Article: https://universalinstitutions.com/sebis-proposed-changes-to-insider-trading-provisions/ |