YEN CARRY TRADE UNWINDING SPARKS GLOBAL MARKET DECLINE

Why in the news?

Global markets fell sharply as investors unwound yen carry trades due to rising Japanese interest rates, reflecting concerns over potential recession and geopolitical tensions.

Global Stock Market Decline:

- Major global stock markets faced sharp declines on Monday.

- Factors included the U.S. economy’s recession odds, geopolitical tensions in West Asia, and the unwinding of the yen carry trade.

Recent Changes and Investor Reactions:

- Interest Rate Increase: Japan’s central bank raised rates by 35 basis points to 0.25% between mid-March and July-end.

- Unwinding of Trades: Higher rates led to a stronger yen, reducing the value of foreign assets when converted back to yen.

- Market Response: Investors sold off assets bought with cheap yen due to the higher opportunity cost and potential further rate hikes in Japan.

source:pintread

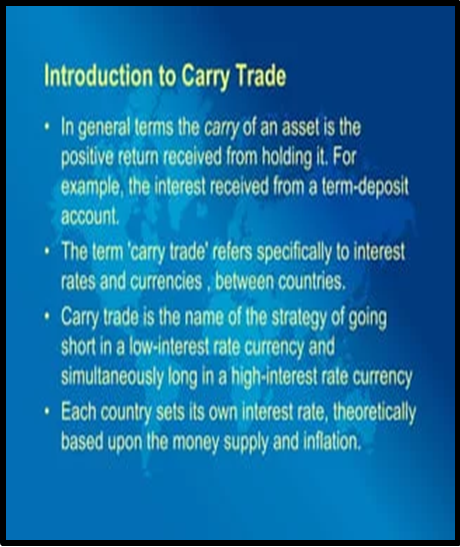

About Yen Carry Trade:

|