What’s causing China’s economic slowdown and its global impact.

Relevance:

- GS Paper- 2 Polity, International Relations

- GS Paper- 3 Economy

- Tags: #upsc #china’sgdp #chineseeconomy.

Why in the news?

- China, the world’s second-largest economy, is slowly but surely moving towards an economic slowdown.

- Persisting geopolitical challenges amid the ongoing Russia-Ukraine war, high global inflation and frequent lockdowns due to its strict Covid Zero policy have all combined to put the Chinese economy under pressure.

- The recent power shortage and the unprecedented hot weather across the country are set to further complicate the task of Chinese policymakers.

Covid Zero policy battered economy

- China’s zero tolerance for Covid and the disruptive measures being taken to contain any flare-up have proved to be a bane for the economy. The impact is both direct and indirect, hampering both supply and sentiments.

- As of August 15, 22 cities accounting for 8.8% of China’s gross domestic product, were under full or partial lockdowns, according to Nomura.

- The containment measures have surely crushed the morale of the people. Consumer sentiments have weakened, the property sector is witnessing its own challenges, thereby reducing the scope of investments further.

Where does economy stand

- China’s economic growth slowed sharply in the second quarter, expanding 0.4% year-on-year and missing expectations, as widespread lockdowns to curb record Covid cases during the quarter hit industrial activity and consumer spending.

- Industrial output grew 3.8% in July from a year earlier, according to the National Bureau of Statistics (NBS), below the 3.9% expansion in June and a 4.6% increase expected by analysts in a Reuters poll.

- Retail sales in July, which had just returned to growth in June, rose 2.7% from a year ago, missing forecasts for 5.0% growth and the 3.1% growth seen in June.

- China’s economy narrowly escaped a contraction in the June quarter, hobbled by the lockdown of the commercial hub of Shanghai, a deepening downturn in the property market and persistently soft consumer spending.

- Risks still abound as many Chinese cities, including manufacturing hubs and popular tourist spots, imposed lockdown measures in July after fresh outbreaks of the more transmissible Omicron variant of the coronavirus.

- Fixed asset investment, which Beijing hopes will compensate for slower exports in the second half, grew 5.7% in the first seven months of 2022 from the same period a year earlier, versus a forecast 6.2% rise and down from a 6.1% jump in January-June.

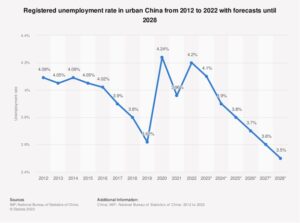

- The employment situation remained fragile. The nationwide survey-based jobless rate eased slightly to 5.4% in July from 5.5% in June, although youth unemployment stayed stubbornly high, reaching a record 19.9% in July.

Why is China’s economy collapsing?

- After a rapid spurt of activity earlier this year following the lifting of Covid lockdowns, growth is stalling. Consumer prices are falling, China’s a real estate crisis is deepening and exports are in a slump, not to mention the record low unemployment looming over the country.

- Remaining highly dependent on exports, China is often described as “the workshop of the world”, however, recession gears in the US and Europe, combined with spiking inflation, has weakened global demand for Chinese products.

- Country’s exports slumped 14.5 percent year-on-year — the biggest drop in more than three years.

- Another major problem is the debt incurred by local government, which has risen largely due to a sharp drop in land sale revenues because of the property downfall, as well as the lingering impact of the cost of imposing Covid-19 lockdowns.

- In a country like China, property has long been seen as a safe bet for middle class seeking to grow their wealth.

- Yet financial woes at a large number of developers, many of whom are now struggling to stay afloat, are fueling a crisis of confidence among potential buyers and depressing prices.

- With population and demographic related challenges, the decline in labor supply and increased healthcare and social spending could also further lead to a wider fiscal deficit and higher debt burden.

- A smaller workforce could also erode domestic savings, resulting in higher interest rates and declining investment. Investors are also losing patience now with what they see as incoherent, slow and stingy measures by the government to revive its collapsing economy and disable a deepening property crisis. Global investors are fleeing China.

- The country’s CSI300 index of blue-chip stocks has tumbled more than 9% in the past two weeks as foreigners pulled out 78 billion yuan ($10.73 billion), in their longest selling streak since 2015.

Wobbly property market

- The debt crisis in China’s property sector has worsened in recent weeks after a growing number of homebuyers threatened to stop making mortgage payments on stalled property projects, aggravating a crisis that could lead to social instability.

- The property sector’s credit troubles risk seeping into secondary industries such as asset management companies, privately-owned construction firms and small steelmakers, said Fitch Ratings in an August note.

- In fact, China’s real estate sector has been lurching from one crisis to another over the past year, as it grapples with mounting liabilities, a slowing economy and flagging demand, while its sources of fresh fundraising have been drying up.

- Some big private developers like Evergrande have already defaulted on offshore debt obligations and struggled to raise funds from other sources, including banks.

- A recent report by UBS estimated the property crisis in China to get worse, wiping off $1 trillion from the global market.

- In other words, what started as trouble with China Evergrande Group is now snowballing into a crisis that risks engulfing the majority of the country’s developers, its biggest lenders and a middle class that has significant wealth tied to the property market.

- As a result, home sales tumbled 41.7% in May from a year earlier, with investment drop of 7.8%.

Fall in bank loans

- China Banking and Insurance Regulatory Commission (CBIRC) is looking at banks’ loan book exposure to property developers to find out if those credit decisions were made according to the rules, Reuters reported quoting sources.

- The aim is to measure risks to the financial system from the ongoing property sector turmoil in the world’s second-largest economy, two of the sources said. It was not immediately clear what action the regulator might take after the investigation.

- The latest probe comes as policymakers have been trying to stabilise the property sector, which accounts for a quarter of the economy, after a string of defaults among developers on their bond repayments and a slump in home sales.

- Property loans accounted for 25.7% of total banking sector credit in China as of end-June, central bank data showed. The banking sector’s total outstanding loans was 206 trillion yuan ($30.3 trillion) at the end of the first half.

- Commercial banks’ non-performing loan ratio stood at 1.67% at the end of June, down from 1.73% at the beginning of this year, according to CBIRC data, though many analysts believe the real number is much higher.

- New bank lending in China tumbled more than expected in July while broad credit growth slowed, as fresh Covid-19 flare-ups, worries about jobs and the property crisis made companies and consumers wary of taking on more debt.

- Yuan near 2-year low. China’s yuan slumped to a near two-year low against the dollar on Monday, as Beijing stepped up easing measures.

- Currency traders and analysts said a firmer dollar and weaker domestic economic fundamentals both contributed to the yuan’s declines.

- The selling pressure on the yuan has grown since the PBOC surprised markets by cutting two key interest rates earlier this week, traders say.

- Widening policy divergence, along with worries over weaker economic fundamentals, raised the risks of capital outflows and yuan depreciation.

- Yuan’s fall dragged down most emerging market currencies.

What is central bank doing

- At a time when central banks of most major economies are raising benchmark lending rates as a measure to curb soaring prices of commodities in their respective countries, the central bank in China has slashed the rates.

- The People’s Bank of China (PBOC) cut its benchmark lending rate and lowered the mortgage reference by a bigger margin on Monday, adding to last week’s easing measures.

- The one-year loan prime rate (LPR) was lowered by 5 basis points (bps) to 3.65% at the central bank’s monthly fixing on Monday, while the five-year LPR was slashed by 15 bps to 4.30%.

- To prop up growth, the central bank on Monday unexpectedly lowered interest rates on key lending facilities for the second time this year.

How is China’s economic slowdown affecting the world?

- The second largest economy, which was meant to drive a third of global economic growth this year, has fallen into a dramatic slowdown over the months sending ripples across the globe.

- Policymakers are bracing for a hit to their economies as China’s imports of everything from construction materials to electronics have declined.

- Taking the biggest hit to their trade so far are Asian economies besides countries in Africa.

- Last month, for the first time in two years, Japan’s exports dropped after China cut back on purchases of cars and chips. Central bankers from South Korea and Thailand last week cited China’s slouched recovery for downgrades to their growth forecasts.

- However, the silver lining here is that China’s slowdown will drag down global oil prices, and deflation in the country means the prices of goods being shipped around the world will fall.

- Beneficial for countries like the US and UK still battling high inflation, emerging markets like India also see opportunities, hoping to attract the foreign investments leaving China’s shores.

- A seperate study by bloomberg showed that, the depreciation in the offshore yuan is having a greater impact on its peers in Asia, Latin America and the Central and Eastern Europe bloc, with the correlation of the Chinese currency to some others rising.

- The weak sentiment spillover may weigh on currencies like the Singapore dollar, Thai baht, and Mexican peso as well, Barclays Bank Plc added. Currencies of commodity-led economies, such as the Chilean peso and South African rand, may suffer due to weakness in the construction sector.

- While, the Australian dollar, which often traded as a proxy for China, has also lost more than 3% this quarter.

How it may impact India

- It will also ease the pressure on rupee and will give a boost to India’s foreign reserves. The West is more sincerely looking at reducing their dependence on China and expanding their sourcing base. Now, India has an opportunity to gain market share.

- If it can strengthen the manufacturing sector further, India will be able to attract more global investments and can hope to emerge as an alternative global manufacturing hub vis a vis China.

- However, there is a downside to a Chinese slowdown for India. In terms of bilateral trade, China has been one of India’s top trading partners since long. It is on course to cross $100 billion for the 2nd consecutive year.

- In the first half of this year, India’s trade with China has gone up to $67.08 billion.

- China’s exports to India have gone up to $57.51 billion, up by 34.5% since last year. While, Indian exports to China fell to $9.57 billion, a decline of 35.3% compared to last year, according to the trade data released by China’s General Administration of Customs (GAC).

- Interestingly, of the total imports from China in FY21, majority of the commodities and goods were where India introduced the production-linked incentive (PLI) scheme like textile, agri, electronics goods, pharmaceuticals & chemicals.

- In FY22 April-December period, there were 6,367 products with a total value of $68 billion (or 15.3 per cent of the total imports) imported by India from China.

- Therefore, a slowdown in India’s top trading partner will hit bilateral trade as well.

- With overall demand slowing down, it may impact both inbound and outbound supply of goods and services between the two nations.

Is China’s economy expected to get better soon?

- Unlike the global financial crisis in 2008-09 and during a capital outflow scare in 2015, from which China came out with a shock boost to infrastructure investment and by encouraging property market speculation, among other measures, now the infrastructure upgrades have created too much debt, and the property bubble has been burst.

- Posing risks to financial stability, whether China bounces back largely depends on whether it can convince households to spend more and save less, and whether they will do so to such an extent that consumer demand compensates for weaknesses elsewhere in the economy, reports said.

Source: The Hindu