US Auto Tariffs Threaten Indian Component Export Growth

Why in News ?

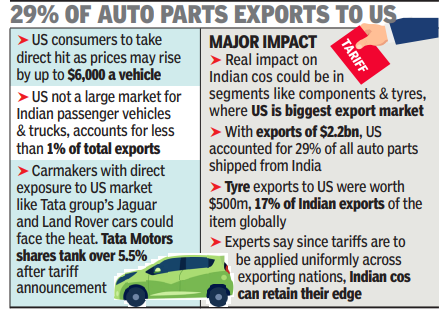

US President Donald Trump announced 25% tariffs on imported automobiles and auto parts from April 5, 2025, raising concerns for India’s $7 billion auto component exports and impacting future growth potential in the North American market.

Trump’s Tariff Decision and Its Implications

- US President Donald Trump announced 25% tariffs on imported automobiles and auto parts starting April 5, citing national security concerns.

- Auto components will face tariffs by May 3, 2025, unless modified or terminated.

- This decision raises uncertainty for India’s $7 billion auto component exports to the US, impacting growth potential in the North American market.

Concerns of Indian Exporters and Industry Impact

- Indian exporters fear selective concessions to specific countries may disadvantage

- The tariffs apply to fully assembled cars and critical auto components, including engines, transmissions, and electrical parts—India’s primary exports.

- The Automotive Component Manufacturers Association of India (ACMA) reported Indian auto component exports at $21.2 billion in FY24, with 32% going to North America.

- If US demand falls due to higher prices or if China offers competitive rates through subsidies, Indian exporters could face significant challenges.

Repercussions on Auto Stocks and Strategic Considerations

- The announcement led to a drop in Indian auto stocks: Tata Motors fell by 56%, Ashok Leyland by 2.77%, and Mahindra & Mahindra by 0.35%.

- A Global Trade and Research Institute (GTRI) report warned against reducing tariffs on passenger cars to avoid US tariffs, citing Australia’s failed auto manufacturing industry post-tariff cuts in the 1980s.

Indian companies like Sona Comstar, Bharat Forge, and Motherson Group have a presence in the US, which may help mitigate some tariff impacts