Urban Consumers Face Income Stagnation and Rising Prices

Why in the News ?

Urban consumers are concerned about stagnant incomes amid rising commodity prices, leading to increased spending. Despite improved job prospects, pessimism persists about the overall economic situation, with many struggling to meet their financial needs.

Income Stagnation Amid Rising Job Optimism:

- A significant share of urban consumers remains optimistic about job opportunities, with 35.5% reporting an improvement in employment prospects compared to a year ago (as of March 2025).

- However, only 23.8% of respondents said their income levels have increased, highlighting the stagnation in wages despite employment opportunities. This marks a notable gap in income growth compared to job availability.

Rising Commodity Prices Fuel Higher Spending

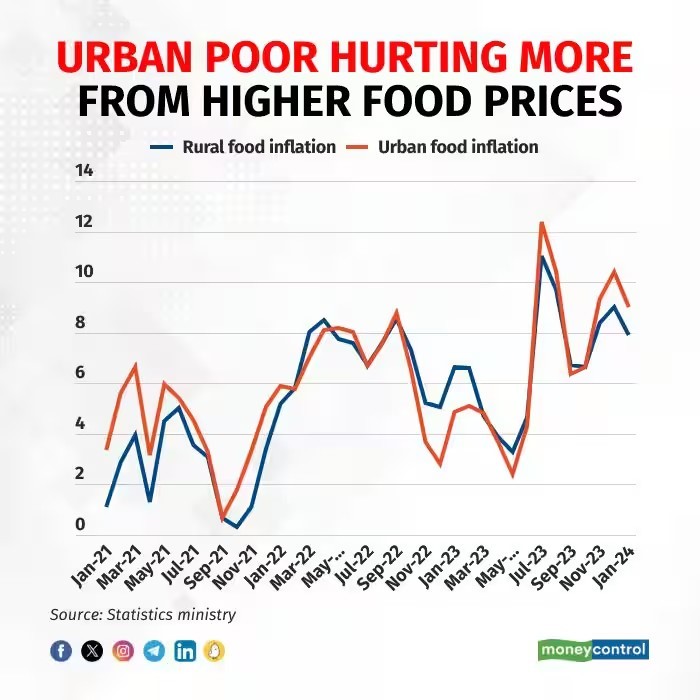

- Over 90% of urban respondents reported that commodity prices have risen compared to a year ago, causing an increase in spending for many.

- More than 80% of urban consumers acknowledged that their spending has increased, directly tied to the higher costs of goods and services. This suggests that many urban residents are facing financial strain, as incomes remain stagnant while prices continue to climb.

Pessimism About Overall Economic Outlook

- Despite improvements in employment prospects, urban residents’ perceptions of the overall economic situation have worsened. Only 34.7% expressed optimism about the economy, marking the lowest share in over a year.

- Consumers’ growing concerns about their economic situation are compounded by income stagnation and rising living costs, leaving many feeling financially insecure. Rural areas, in particular, show even greater pessimism regarding income, with 29.9% of rural respondents reporting a decline in their income.

| About Monetary Policy Framework Agreement (MPFA):

Monetary Policy Framework Agreement (MPFA): Between the Government of India and RBI, aims for price stability and growth. ● RBI Action: If inflation stays outside 2%-6% for three consecutive quarters, RBI must report to the government, explain reasons, propose corrective actions, and estimate when inflation will return to target range. About Consumer Price Index (CPI): ○ Measures changes in retail prices of goods and services consumed daily. ● Consumer Food Price Index (CFPI): ○ Measures inflation specific to food items. |