UNNECESSARILY COMPLEX’ GST NEEDS URGENT REFORM: KELKAR

Why in the news?

Vijay Kelkar calls for urgent GST reform, advocating a single 12% rate and equitable revenue sharing with local governments.

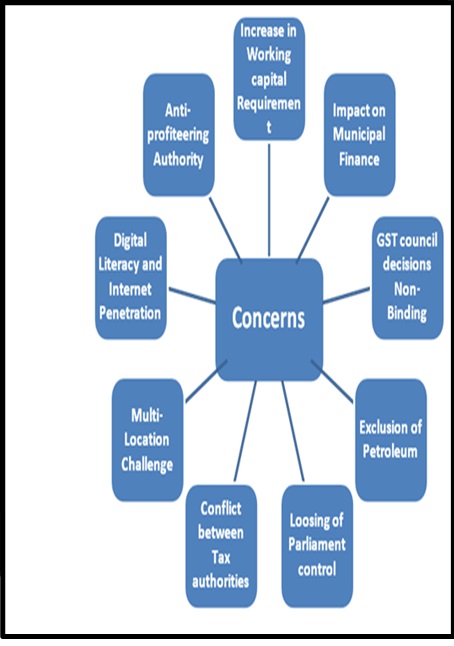

source:slideserve

About the Proposal for Single GST Rate:

- Advocates adoption of a single GST rate of 12%, shared equally among all tiers of government, to streamline tax structure.

- Highlights success of countries with single-rate GST or VAT systems in optimising tax revenue and reducing disputes.

- Vijay Kelkar, Chairman of 13th Finance Commission, urges urgent reforms in India’s GST regime, terming it “unnecessarily complex”.

- Cites high GST rates as contributing to frauds in the indirect tax system, suggesting simplification as critical fiscal reform.

What is GST?

Main Features of GST: Multiple Rates: Initially, GST was implemented at four rates: 5%, 12%, 16%, and 28%, with specific items categorised under each slab by the GST council. About The legislative basis of GST in India: The legislative basis of GST in India is The Constitution (101st Amendment) Act, 2016. Central GST covers excise duty, service tax, etc., while State GST covers VAT, luxury tax, etc. Integrated GST applies to inter-state trade and facilitates coordination between state and union taxes. Article 246A: grants states the power to tax goods and services. What is Value Added Tax (VAT)? Value Added Tax (VAT) is a consumption tax levied on the value added to goods and services at each stage of production or distribution. |

Source: