UNION GOVERNMENT’S REINS ON FINANCIAL TRANSFERS TO STATES

Syllabus:

- GS 3 : Indian Economy and issues relating to Planning, Mobilization of Resources.

Why in the News?

- The Union government has been decreasing financial transfers to States since the Fourteenth Finance Commission award period (2015-16).

Background:

- Despite the Fourteenth Finance Commission’s recommendation to devolve 42% of Union tax revenues to States, the Union government reduced financial transfers.

- The Fifteenth Finance Commission maintained this recommendation, yet the Union government diminished transfers, boosting its own discretionary spending.

What is Tax Devolution?

- Tax devolution involves distributing tax revenues between the central and state governments.

- It’s constitutionally mandated under Article 280(3)(a) for the Finance Commission to recommend how tax proceeds are divided.

- The process ensures a fair and equitable allocation of tax revenues among the Union and states.

Source: Scroll

Basic Math on Tax Revenue:

- Finance Commissions suggest States’ shares in the Union government’s net tax revenue, with the gross revenue decreasing over the years.

- While the Union government’s gross tax revenue doubled between 2015-16 and 2023-24, the States’ share only doubled.

- Grants-in-aid to States declined, leading to a drop in the combined share of statutory financial transfers in the Union government’s gross tax revenue.

| About 15th Finance Commission

· The 15th Finance Commission is a constitutional body tasked with devising the methodology and formula for distributing tax revenues among the Centre, states, and among states themselves, in line with constitutional provisions and current needs. · As per Article 280 of the Indian Constitution, the President of India is obligated to establish a Finance Commission every five years or earlier. · Chaired by NK Singh, the 15th Finance Commission was established by the President of India in November 2017. · Its recommendations are slated to cover a five-year span from 2021-22 to 2025-26. |

15th Finance Commission:

(Key Recommendation )

Vertical Devolution:

- The 15th Finance Commission recommends maintaining states’ share in central taxes at 41% for 2021-2026.

- This is a reduction from the 42% recommended by the 14th Finance Commission for 2015-2020.

- The adjustment accounts for the inclusion of Jammu and Kashmir and Ladakh as union territories.

Horizontal Devolution:

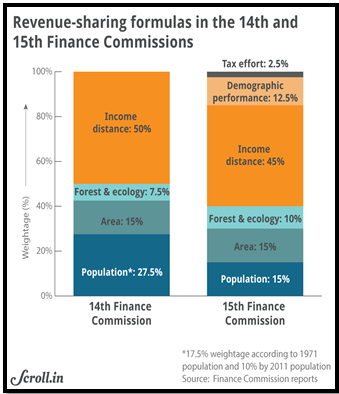

- Proposed criteria include 12.5% weightage to demographic performance, 45% to income, and 15% each to population and area.

- Additionally, 10% weightage is for forest and ecology, and 2.5% for tax and fiscal efforts.

Revenue Deficit Grants:

- Recommendations include providing post-devolution revenue deficit grants totaling about Rs. 3 trillion over five years ending FY26.

Performance-Based Incentives and Grants:

- Focus areas encompass social sectors like health and education, rural economy including agriculture, rural roads, and governance reforms.

- Performance-based incentives are introduced in the power sector, offering additional borrowing options for states.

Grants to Local Governments:

- Includes grants for municipal services, local government bodies, and incubation of new cities.

- For urban areas, a portion of grants is performance-linked through the Million-Plus Cities Challenge Fund, tied to improving air quality and meeting service benchmarks.

Comparative Analysis

(14th Finance Commission and 15th Finance Commission)

| Aspect | 14th Finance Commission | 15th Finance Commission |

| Tax Revenue Devolution | Recommended 42% to States | Retained recommendation for 41% devolution |

| Duration | Recommendations for 2015-16 to 2019-20 | Recommendations for 2020-21 to 2024-25 |

| Devolution Criteria | Horizontal devolution based on population, area, fiscal capacity | Continued horizontal devolution, added criteria like demographic performance, forest cover, and tax efforts |

| Focus | Greater fiscal autonomy for States | Addressed impact of GST, fiscal consolidation |

| Grants-in-aid | Emphasized grants-in-aid to enhance State autonomy | Considered fiscal stability and debt sustainability |

Note:

- Both Commissions aimed to enhance fiscal federalism and State autonomy but differed slightly in the percentage of tax revenues recommended for devolution.

- Both commissions emphasized the importance of ensuring fiscal stability and sustainability while addressing States’ developmental needs.

Editorial Highlights : Key Challenges

- Centralization of Public Expenditure:

- Reduced financial transfers to States give the Union government more discretionary funds, potentially impacting resource distribution.

- Centrally Sponsored Schemes (CSS) and Central Sector Schemes (CSec

- Schemes) allow the Union government to influence State priorities.

- CSS funding increased substantially from ₹2.04 lakh crore to ₹4.76 lakh crore between 2015-16 and 2023-24, impacting State finances differently based on their ability to match funding.

- Scope for Anti-Federal Fiscal Policies:

- Centrally Sponsored Schemes (CSS) and Central Sector Schemes (CSec Schemes), non-statutory transfers, tie States’ hands by allocating funds for specific purposes.

- These schemes form a significant proportion of the Union government’s financial transfers, limiting States’ expenditure freedom.

- The Union government’s argument for revising States’ share in Union tax revenue raises concerns about cooperative federalism’s integrity, as noted by the Fifteenth Finance Commission.

| Key Terms

Centrally Sponsored Schemes (CSS): CSS are programs where both the Union and State governments contribute funds. The Union government sets the scheme’s objectives and provides a portion of the funding, while the States implement the scheme and contribute a share of the funding. Central Sector Schemes (CSec Schemes): CSec Schemes are initiatives exclusively funded by the Union government. They cover sectors where the Union government has sole legislative or administrative authority. The Union government designs, finances, and implements these schemes without requiring contributions from the States. |

Way Forward:

- Enhance vertical devolution: Increase the share of states in central taxes to ensure adequate fiscal autonomy.

- Improve horizontal devolution: Refine criteria weighting for demographic performance, income, population, area, forest, ecology, and tax efforts.

- Ensure equitable revenue deficit grants: Provide sufficient post-devolution revenue deficit grants to address states’ fiscal imbalances.

- Strengthen performance-based incentives: Foster efficiency and accountability by linking grants to states’ performance in key sectors like health, education, and rural development.

the 15th Finance Commission’s recommendations aim to address challenges in fiscal federalism by refining tax devolution, enhancing grants, and strengthening incentives for equitable resource distribution and cooperative federalism.

Source:

Mains Practice Question:

Critically analyze the impact of the Union government’s reduction in financial transfers to states, as observed since the Fourteenth Finance Commission, on the principles of fiscal federalism and cooperative governance in India.

Source: Scroll

Source: Scroll