UNIFIED PENSION SCHEME: A BALANCED APPROACH TO GOVERNMENT RETIREMENT BENEFITS

Syllabus:

GS 2:

- Government Policies and interventions.

- Welfare schemes for the vulnerable section of the population.

Focus:

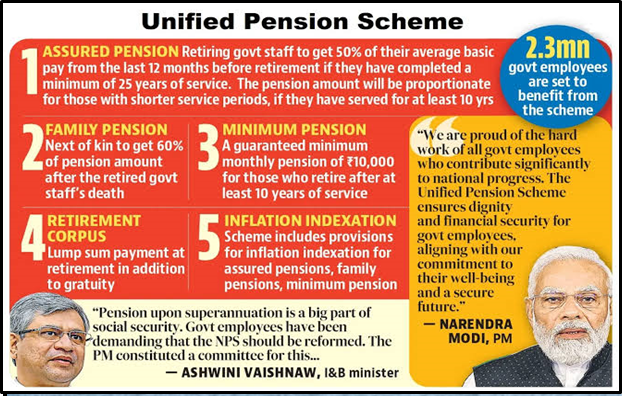

Government has cleared the new Unified Pension Scheme to substitute the National Pension System for the central employees on 1st April of 2025. This new scheme intends to give a clearer pension planning for civil servants and will be providing a guaranteed pension like that of the OPS but it will have features of the NPS as well. The UPS also offers states an opportunity to adopt the scheme .

Source: HT

Provisions of the Unified Pension scheme

- Assured Pension:

- Employees will get 50 percent of the average base pay of their salary during the preceding twelve months upon retirement provided that they have served for at least twenty-five years.

- In case the service duration is less than twenty years, pension will be paid at a proportional ratio depending on the number of years served but not less than ten years of service.

- Assured Minimum Pension: All the employees have a pension right that gives them a minimum pension of ₹ 10000/- per month in case they have put in 10 years of service minimum.

- Assured Family Pension: In the case of the employee’s death, the family will receive 60% of the pension last drawn by the retiree.

- Inflation Indexation: The pension amount will be enhanced by such factors and linked with- Inflation Indexed with All India Consumer Price Index for Industrial Workers to make certain that the pension increases with the hike in price level.

- Lumpsum Payment at Retirement: Employees will also be entitled to a gratuity payment of six months’ emoluments in addition to a lump sum payment of one-tenth of their monthly pay and DA for every six months served. By this lumpsum payment the assured pension shall not be affected.

- Choice for Employees: Currently, those who are under NPS can migrate to UPS, a plan, which once chosen cannot be changed.

Old Pension Scheme (OPS) and Its Issues

- No Employee Contribution: As for pension schemes, at the time, OPS did not call on employees to make any contributions to the pension fund; only the government financed it.

- Fiscal Burden: This placed a large financial burden on the government as one receiving a pension for life and with current population trends there was a growing number of pensioners.

- Lack of Flexibility: OPS lacked investment options or personal savings growth hence it was rigid in its funding and solely dependent on government means.

- Limited to Government Employees: OPS was only meant for the employees of the government sector while leaving out a huge chunk of the population.

- Inflation Adjustment: Benefits such as pensions were upward indexed to maintain the purchasing power of pensioners.

NPS – The Structure and Some of Its Functions

- Defined Contribution Scheme: NPS works on the principle of defined contribution where the retirement benefits will depend on the contributions made by the individual and employer and the returns of investment.

- Two-Tier Structure: NPS include the

- Tier I (basic retirement saving account with tax incentives and only limited withdraw power) and

- Tier II (savings account with flexible power of withdrawal but without tax benefits).

- Investment Choices: The plan offers different investment assets which include equity, corporate bonds, government securities where members can do active or auto selection.

- Annuity Purchase: For subscribers, after attaining 60 years of age 40% of the corpus has to be utilized for buying an annuity ,with upto 60% can be taken in lump sum. India still in terms of purchase of annuity rates remains low, having a significant effect on post retirement income.

- Tax Benefits: It allows deduction of contributions to NPS from one’s income and also tax free lump sum withdrawal on retirement.

Comparative Analysis between UPS , OPS and NPS:

| Features | Unified Pension Scheme (UPS) | New Pension Scheme (NPS) | Old Pension Scheme (OPS) |

| Method For Pension Calculation | 50 % of Average Basic Pay + DA ( In last year of retirement)

Reduced Proportionally for service of less than 25 years. |

Based on contributions and investment return and no fixed pension amount | 50 % of last basic pay + DA |

| Minimum Pension | Rs. 10000 / Month for minimum 10 years of service | No guaranteed minimum pension | No guaranteed minimum pension |

| Assured Family Pension | 60% of pension last drawn | Depends on annuity purchased : no provision of automatic family pension | Often Included to provide stability to family |

| Inflation Indexation | Indexed to All India Consumer Price Index for Industrial Workers (AICPI-IW) | Return depends on Investment performance . there is no specific Inflationn indexation | Pension Adjusted Periodically for inflation |

| LumpSum Payment | 1/10th of last drawn monthly emoluments | 60 % of corpus can be withdrawn | Upto 40 % of total pension |

| Employee Contribution | 10% of basic pay + DA | 10 % of Basic Salary | none required |

| Government Contribution | 18.5 % of Basic Pay + DA | 14 % of basic pay for the government employees | Entirely funded by Government |

Fiscal Implications of UPS

- Large Debt-to-GDP Ratio: This will only serve to increase the fiscial pressure on a government that is already burdened by a high debt-to-GDP ratio .

- High Fiscal Burden: A study shows that in case all the states implement UPS, the fiscal cost could reach up to 9 % of GDP annually by 2060. This is developing fears on the sustainability of the scheme .

Conclusion

The move to implement the UPS is an attempt at providing both, adequate benefits for the employees and reasonable fiscal measures, based on the principles of both the OPS and the NPS. It provides fixed returns along with the inflation index and minimizes the danger connected with the market. It is believed that thanks to the UPS some pension benefits are to be improved and some fiscal risks which are linked with the OPS and NPS are to be reduced.

Mains Practice question:

Discuss the key differences between the UPS and the OPS. Evaluate how the transition from usage of OPS to UPS might affect government revenues and employees’ welfare.

Associated Article:

https://universalinstitutions.com/india-approves-unified-pension-scheme-balancing-ops-and-nps/