UNIFIED PAYMENTS INTERFACE (UPI)

Why in the News?

- The RBI has increased the UPI payment limits for healthcare and education from ₹1 lakh to ₹5 lakh.

- Additionally, the recurring e-payment mandates for credit card, insurance, and mutual fund payments have been raised to ₹1 lakh from the existing ₹15,000 limit.

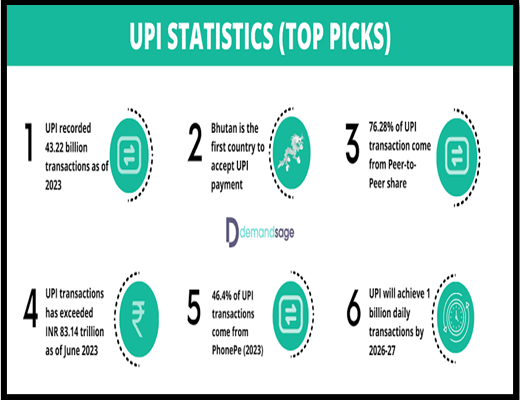

Source: Demand Sage

Regulatory Focus on Digital Lending:

- Issue: Despite introducing a regulatory framework for digital lending in late 2022, the RBI has noted concerns regarding web-aggregation of loan products that may be detrimental to consumers’ interests.

- Step Taken: The central bank is laying down a regulatory framework to ensure enhanced customer centricity and transparency in digital lending.

Fintech Repository Proposal:

- To gain better oversight, RBI proposes the creation of a Fintech Repository by April 2024.

- Framework : Fintechs, including banks and non-banking finance companies partnering with them, would voluntarily provide relevant information to the repository, aiming to ensure regulatory clarity and policy approaches in the evolving landscape.

About Unified Payments Interface (UPI) :

- UPI is a system that integrates multiple bank accounts into a single mobile app, offered by participating banks .

- It serves as a payment system enabling money transfers between any two bank accounts through smartphones both online and offline, eliminating the need for credit card details, IFSC codes, or net banking/wallet passwords.

- Developed by the National Payments Corporation of India (NPCI) and launched in April 2016

- UPI caters to “Peer to Peer” collect requests,

- In 2018, the National Payments Corporation of India (NPCI) launched an upgraded version, UPI 2.0, enhancing the platform’s features and capabilities.

Source: Demand Sage

Source: Demand Sage