Trump’s Tax Plan May Hurt the Poor

Trump’s Tax Plan May Hurt the Poor

Why in the News?

The U.S. Congress is debating President Trump’s new tax and spending bill, which includes tax breaks on tips. However, analysts warn that low-income Americans may face a net income loss due to social program cuts. The Trump tax plan, proposed by the GOP (Republican Party), has sparked intense debate over its potential impacts on different income groups and the overall economy, especially in comparison to recent UK tax cuts. As many wonder how old is Donald Trump in relation to his economic policies, the discussion extends to international implications, including potential effects on the Indian diaspora and non-resident Indian populations.

Key Features of the Tax Bill:

- Tip income tax deduction for workers earning up to $160,000/year until 2029. ● Tips remain taxable under Social Security and Medicare. ● Additional deductions on overtime pay and auto loan interest. ● Bill also seeks to permanently extend Trump’s 2017 tax cuts. ● Claimed to offer a $1,300 tax cut to typical families. ● Introduction of clean energy tax credits to promote sustainable development.

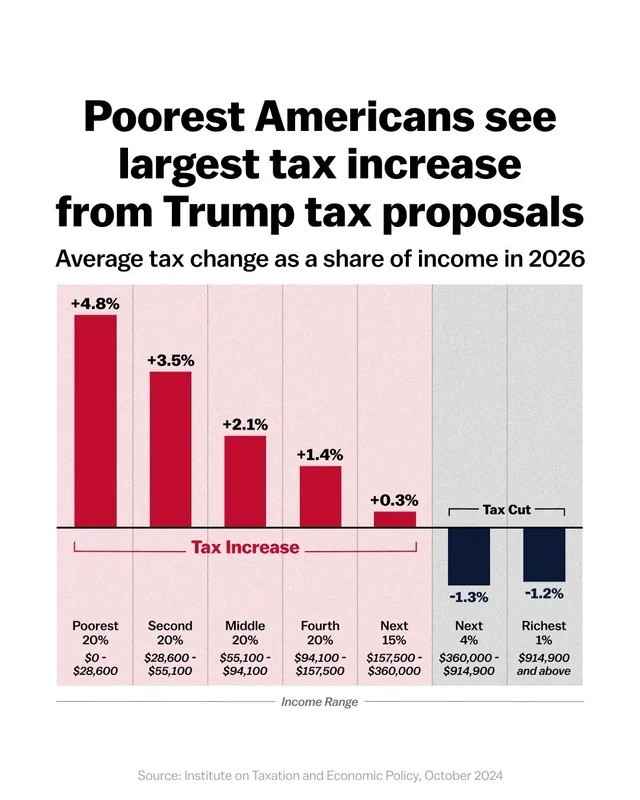

Impact on Low-Income Americans

- 37% of tipped workers already don’t pay income tax—excluded from benefits. ● Only 2.5% of U.S. workforce is tipped employees. ● Analysts say net income will decline for poor, increase for the rich. ○ Families earning <$22,000 may lose $1,500 in income. ○ Those earning >$5.2 million may gain $104,000 (equivalent to $1.5 million in rupees). ● Cuts to Medicaid and Affordable Care Act could remove health insurance from 8.7 million people. ● Restrictions on Child Tax Credit and Earned Income Tax Credit may exclude 4.5 million children. ● Potential reductions in disability benefits and concerns over SSA overpayments recovery methods, including overpayment clawbacks and benefit garnishment.

Economic and Fiscal Concerns

- Estimated $40 billion loss in government revenue by 2028.

- National debt projected to rise by $3.8 trillion, reaching $36.2 trillion (to put it in perspective, that’s over a trillion in million dollars).

- Experts suggest the bill benefits higher earners more than the working class, potentially affecting Social Security benefits in the long term.

- Critics argue it could widen inequality while weakening the social safety net.

- The Congressional Budget Office and Joint Committee on Taxation have raised concerns about the potential deficit increase resulting from the proposed tax cuts.

- The House Budget Committee is scrutinizing the plan’s impact on income tax rates, corporate tax rates, and overall fiscal health.

- The Treasury Secretary has defended the plan, arguing it will stimulate economic growth and boost manufacturing investment.

- However, critics point out that the plan may negatively affect Social Security and other retirement benefits in the long term, including social security insurance programs and epfo ssa agreements for international workers.

- The debate also touches on other economic issues such as the carried interest loophole, pass-through deduction, and SALT deduction, with some drawing comparisons to historical salt tax policies.

- Concerns raised about the impact on student loan debt and potential changes to federal student loans repayment terms.

- Discussions on how the plan might interact with existing immigration policies and their economic implications, including potential impacts on asylum seekers and their notice period for work authorization.

- Proposed changes to the standard deduction and its effects on taxpayers across different income brackets.

- Potential introduction of a remittance tax and its impact on international money transfers, with some drawing comparisons to remittance tax India policies.

- The plan’s effects on MAGA accounts and other politically-aligned financial instruments have also been a point of discussion.