Trump Pushes for Weaker Dollar to Cut Trade Deficit

Why in the News ?

Donald Trump argues that the strong U.S. dollar worsens trade deficits and shifts manufacturing abroad. There is speculation about a “Mar-a-Lago Accord”, similar to the 1985 Plaza Accord, to devalue the dollar and boost U.S. exports.

Trump’s Concerns Over the Strong Dollar:

- Donald Trump has long argued that the overvalued U.S. dollar contributes to trade deficits and the outsourcing of manufacturing.

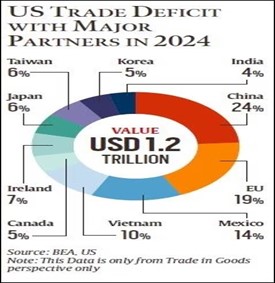

- The U.S. recorded a trade deficit exceeding $1 trillion in 2023, marking the fourth consecutive year of trillion-dollar deficits.

- Despite a low unemployment rate, Trump aims to boost U.S. manufacturing and reduce reliance on imports.

Exchange Rates and Global Trade

- A strong U.S. dollar increases purchasing power, making imported goods cheaper than domestic products.

- Global trust in the U.S. dollar ensures high demand, keeping its exchange rate strong.

- The Federal Reserve’s commitment to price stability and S. economic strength further prevent dollar devaluation.

- Countries can counter U.S. tariffs by weakening their own currencies, impacting global trade balances.

About the “Mar-a-Lago Accord” and Historical Parallels:● Inspired by the 1985 Plaza Accord, there is speculation about a “Mar-a-Lago Accord” to intentionally weaken the dollar. ● The Plaza Accord helped lower the dollar’s value, but led to economic stagnation in Japan. ● Unlike 1985, today’s scenario involves China as a major trade and military rival, complicating negotiations. ● Trump’s tariff threats may be a strategy to force currency realignment and favor U.S. exports. |