TOBACCO AFFORDABILITY FUELS CANCER CRISIS

TOBACCO AFFORDABILITY FUELS CANCER CRISIS

Syllabus:

GS-3: ● Issues related to health and family. ● Measures taken to combat health crisis

Why in the News?

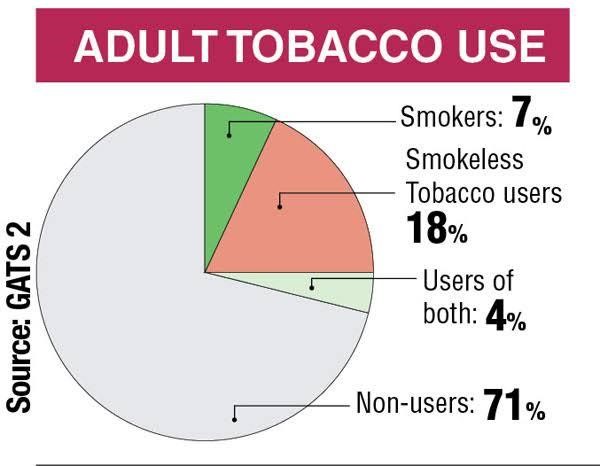

India observes World No Tobacco Day on May 31, amid rising concerns over the increasing affordability of tobacco products, particularly among rural and low-income groups. Despite global trends showing reduced consumption due to higher taxation, India’s low tobacco prices continue to fuel a growing epidemic of cigarette smoking and its harmful effects, posing a serious public health and economic challenge. Understanding what is tobacco and its various uses is crucial to addressing this issue. Recent tobacco news highlights the urgency of addressing this crisis, while tobacco facts underscore the severity of the situation.

SOCIETAL NORMALISATION OF TOBACCO USE

- Cultural Embedment: Practices like the “chai-sutta” culture among youth and office-goers normalise cigarette smoking, making it socially acceptable across age groups. This contributes to an increasing smoking index among the population and reinforces nicotine addiction.

- Rural Penetration: In rural areas, bidis and smokeless tobacco (SLT) are preferred due to low prices and deep cultural roots, reinforcing nicotine addiction and increasing tobacco use.

- Peer Pressure: Cigarette smoking is often seen as a social bonding activity, especially among men, weakening individual efforts to quit and contributing to nicotine addiction. Many smokers wonder how many cigarettes are safe, but the truth is that any amount of smoking carries health risks.

- Gendered Impact: While more men use tobacco, secondhand smoke significantly affects women and children, escalating public health risks and the consequences of cigarette smoking. This exposure can lead to respiratory symptoms and cardiovascular disease in non-smokers, highlighting the broader impact of tobacco use.

- Awareness Gap: Many users, especially in semi-urban and rural areas, lack awareness about the long-term effects of tobacco and health consequences, delaying smoking cessation efforts. This gap in knowledge extends to the toxic effects of tobacco on both users and those exposed to secondhand smoke, emphasizing the need for smoking articles for students to educate the younger generation about the cigarette harmful effects.

HEALTH CONSEQUENCES AND CANCER RISK

- Cancer Correlation: Tobacco use—both smoked and smokeless—is linked to lung cancer, oral, pancreatic, and stomach cancers, contributing heavily to India’s cancer burden and overall public health concerns. The cigarette harmful effects are numerous and severe, and cigarette smoking kills thousands each year.

- Oral Dominance: India leads globally in lip and oral cancers, surpassing lung cancer due to the high use of gutkha, pan masala, and SLT. These tobacco uses significantly increase the risk of oral health problems and contribute to oxidative stress in the body.

- Youth Onset: The early initiation of tobacco use in adolescence increases lifetime risk and fosters nicotine addiction. Teen smoking is a particular concern, as it often leads to lifelong tobacco use, with adolescent smokers being especially vulnerable to long-term addiction.

- Secondhand Smoke: Non-smokers frequently exposed to tobacco smoke, particularly in public spaces, face elevated risks of respiratory symptoms and cardiovascular disease. This exposure can also lead to changes in lipid profiles, increasing the risk of heart disease and contributing to oxidative stress.

- Limited Screening: In a tuberculosis-endemic country, the diagnosis and treatment of tobacco-induced lung cancer are further complicated by overlapping symptoms. Additionally, chronic obstructive pulmonary disease (COPD) is a common consequence of long-term cigarette smoking, further straining healthcare resources.

ECONOMIC IMPACT AND HOUSEHOLD BURDEN

- Massive Expenditure: Cigarette smoking and tobacco use cost India ₹1.77 lakh crore in 2017-2018, which is 1.04% of GDP, reflecting the staggering economic burden. This figure contributes to the global tobacco burden, which disproportionately affects low- and middle-income countries.

- Treatment Costs: Hospitalisation and cancer care drain family savings, leading to financial ruin and pushing households into poverty. The long-term effects of tobacco use often result in prolonged and expensive medical treatments, particularly for lung cancer and cardiovascular disease.

- Income Diversion: For daily wage workers, spending on tobacco cuts into basic necessities, worsening malnutrition and health outcomes. This economic strain is particularly severe in low- and middle-income countries, where tobacco users die younger due to lack of access to proper healthcare.

- Addiction Economics: The low upfront cost of bidis and SLT keeps them within reach for even the poorest, perpetuating daily dependence and nicotine addiction. This accessibility makes it challenging for users to break the cycle of addiction and increases the likelihood of adolescent smokers developing long-term habits.

- Indirect Losses: Productivity losses due to illness and premature death reduce workforce participation and burden the public health system. Smoking deaths per year worldwide are estimated in the millions, with a significant portion occurring in developing nations, underscoring the need for effective tobacco control measures.

WEAK POLICY IMPLEMENTATION

- Pricing Strategy: Manufacturers use “undershifting” tactics, absorbing tax hikes to maintain low prices and expand their market base. This strategy undermines efforts to reduce smoking prevalence through pricing measures and perpetuates cigarette smoking.

- Inadequate Taxation: India’s tax rate on tobacco remains far below the WHO-recommended 75% of MRP, failing to discourage consumption and support effective tobacco control measures. Increasing tobacco taxes is a proven method to reduce tobacco use and support smoking cessation programs.

- Political Apathy: The lack of political will and influence of the tobacco industry hinder decisive policy reform and enforcement. This apathy extends to implementing comprehensive smoking cessation programs and addressing the health consequences of secondhand smoke.

- Loose Regulations: Single-stick sales, though banned in 88 countries, remain legal in India, enabling impulse buying and warning label avoidance. This practice makes it difficult for smokers to gauge their actual cigarette smoking habits and contributes to nicotine addiction.

- Public Access: Dense tobacco vendor networks, especially near tea stalls and schools, reinforce accessibility and temptation for cigarette smoking and tobacco use. This easy access is particularly problematic for adolescent smokers and undermines efforts to reduce tobacco use.

PRICING AND PURCHASING POWER

- Unit Pricing: Bidis sell for as low as ₹5, and SLT products for ₹1–₹5, making them more affordable than a cup of tea. This low pricing contributes to the high smoking index in India and facilitates nicotine addiction.

- Income Growth: Rising middle-class incomes, now over 450 million strong, have outpaced tobacco tax increases, increasing effective affordability. This trend makes it crucial to implement stronger tobacco control measures and address the growing prevalence of cigarette smoking.

- Single Sticks: Cigarettes sold as single units (around ₹15) are widely available, avoiding graphic warnings and promoting experimentation. This practice makes it difficult for users to realize how many cigarettes they actually consume and contributes to nicotine addiction.

- Adolescent Access: Low prices and small packaging make it easy for teens and students to buy tobacco without attracting attention, contributing to youth smoking. This easy access is a major factor in teen smoking rates and the development of adolescent smokers.

- Consumption Volume: Affordable pricing allows frequent daily use, accelerating nicotine addiction and making quitting harder for low-income users. This high consumption leads to increased oxidative stress in the body, contributing to various health issues including respiratory symptoms and cardiovascular disease.

POLICY RECOMMENDATIONS AND REFORMS

- Tax Reforms: Implement annual tax hikes that outpace inflation and income growth, aiming for WHO-compliant tax rates to reduce cigarette smoking and tobacco use. These tobacco taxes can significantly impact consumption patterns and support smoking cessation efforts.

- Ban Single-Sticks: Prohibit sale of loose cigarettes and bidis to ensure consumers see and are influenced by health warnings. This ban can help reduce impulse purchases and increase awareness of tobacco disadvantages, particularly among adolescent smokers.

- Packaging Reform: Enforce plain packaging laws with prominent graphic health warnings to reduce tobacco’s visual appeal. These warnings should clearly illustrate the hazards of tobacco use, potentially including harms of tobacco drawing to make the message more impactful and discourage cigarette smoking.

- Revenue Allocation: Channel tobacco tax revenue into public health programs, especially for cancer screening in underserved regions. This allocation can help address the long-term effects of tobacco use on public health, including the treatment of lung cancer and cardiovascular disease.

- Stronger Enforcement: Mandate regular inspections, penalties for illegal sales, and limit vendor density around educational and public places to support tobacco control efforts. These measures can help reduce teen smoking and overall tobacco use, particularly among adolescent smokers.

- Smoking Cessation Programs: Implement comprehensive smoking cessation initiatives to help current users quit. These programs should address withdrawal symptoms and provide support for managing nicotine addiction and the consequences of smoking.

- Public Awareness Campaigns: Launch extensive campaigns to educate the public about the effects of tobacco on health, including the risks of cardiovascular disease, lung cancer, and other smoking-related diseases. These campaigns should also highlight how tobacco users die younger and the importance of antioxidant micronutrients in combating oxidative stress caused by smoking. Additionally, create smoking articles for students to educate the younger generation about the dangers of tobacco use and cigarette harmful effects.

CONCLUSION

India’s rising cancer burden, driven by affordable tobacco and widespread cigarette smoking, demands urgent and bold interventions. Strong taxation, regulation of single-stick sales, and stricter enforcement can significantly curb use. Without comprehensive and proactive policy reform, including effective smoking cessation programs and measures to reduce secondhand smoke exposure, the nation risks further escalating its public health and economic crisis related to tobacco use and nicotine addiction. Addressing the oxidative stress caused by tobacco use and improving overall self-rated health of the population should be key priorities in the fight against the tobacco epidemic. It’s crucial to remember that smoking kills, and effective tobacco control measures are essential for safeguarding public health and reducing respiratory symptoms associated with tobacco use. Understanding the full spectrum of the consequences of smoking and the side effects of tobacco is vital for developing targeted interventions and policies to combat this pervasive health issue.