THE WAY UP THE GLOBAL CREDIT RATING LADDER

Relevance: GS 3 – Indian Economy and issues relating to planning, mobilization, of resources, growth, development and employment.

Why in the News?

- Fitch, a renowned credit rating agency, issued India a sovereign credit rating of ‘BBB-‘ with a stable outlook.

- This development marked the beginning of 2024 on a sober tone for India.

- The assigned rating reflects Fitch’s evaluation of India’s fiscal policies, economic performance, and overall financial health.

Significance of Rating

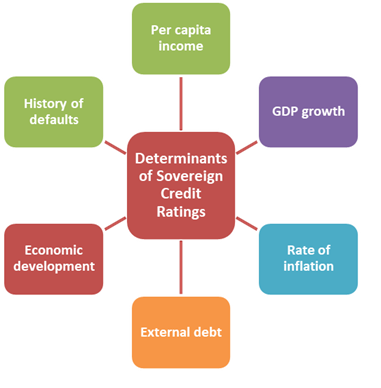

- The rating, known as the long-term foreign-currency issuer default rating, carries substantial importance.

- It serves as an assessment of a country’s creditworthiness by independent agencies like Fitch, Moody’s, and S&P.

- Despite being labeled as ‘investment grade,’ the BBB- rating is just above the junk bond status of BB+.

- The rating contrasts with India’s robust growth trajectory and its recognition as one of the fastest-growing nations.

- The rating prompted questions about the effectiveness of India’s economic policies and management in the eyes of international credit agencies.

- It prompted discussions and scrutiny regarding the discrepancy between the rating and India’s economic performance.

CREDIT RATINGS IMPACT

- Investor Confidence and Decision-Making:

- High sovereign credit ratings function as indicators of investor confidence. They provide valuable insights into the risks associated with investing in a country’s debt.

- These ratings guide investors in deciding whether to increase investment or withdraw from the market.

- Economic Impact and Foreign Direct Investment (FDI):

- The ratings influence international perceptions of a country’s economic stability and financial health.

- Positive ratings can enhance a country’s appeal for foreign investors, fostering economic growth.

- Credit Risk and Government Borrowing:

- The credit risk associated with sovereign credit ratings reflects the likelihood of government default on debt.

- Poor credit ratings indicate macroeconomic, structural, and political challenges. This elevates the cost of external borrowings for the government.

- Private corporations also face challenges in securing debt at favorable rates when a country has low credit ratings.

INDIAN ECONOMY PERFORMANCE

- Dependency on Government Capital Expenditure

- India’s GDP growth, estimated at 7.3 percent in 2023-24, relies heavily on government capital expenditure.

- This reliance poses the risk of escalating the fiscal deficit, which reached 9.2 percent (general government deficit) in 2022-23.

- Addressing this issue necessitates either cutting spending, particularly on capital expenditures, or exploring alternative revenue sources.

- India’s GDP growth, estimated at 7.3 percent in 2023-24, relies heavily on government capital expenditure.

- Challenges in Private Investments:

- Revitalizing private investments is crucial, as evidenced by declining gross domestic investment rates and sluggish growth in the Index of Industrial Production (IIP).

- Despite the IIP’s average growth increasing from 4 percent (2014-15 to 2018-19) to 11.4 percent (2021-22) due to pandemic-induced base effects, it dropped to 5 percent in 2022-23.

- The gross domestic investment rate also decreased from 33.1 percent (2014-15) to 31.4 percent (2021-22).

- Revitalizing private investments is crucial, as evidenced by declining gross domestic investment rates and sluggish growth in the Index of Industrial Production (IIP).

- Persistent Inflationary Pressure:

- Inflation remained elevated throughout 2022-23, with core inflation declining from 6 percent in late 2022 to 3.7 percent in December 2023.

- However, headline inflation consistently exceeded the safe upper threshold of 6 percent during this period.

- Elevated inflation eroded purchasing power, leading to a reduction in the share of consumption expenditure from 61.1 percent (2021-22) to 60.9 percent (2023-24).

- This situation further jeopardizes gross domestic savings and private investments.

- Inflation remained elevated throughout 2022-23, with core inflation declining from 6 percent in late 2022 to 3.7 percent in December 2023.

- Electoral Spending:

- Despite robust revenue collections, impending elections present a significant challenge as state governments compete to distribute benefits to constituents.

- This surge in deficits and debt ratios compared to peer nations poses obstacles to improving credit ratings, which are often based on such comparisons.

- High interest payments relative to overall government expenditure, resulting from these deficits, limit fiscal space for economic stabilization measures during downturns.

- Trade Dynamics and External Vulnerabilities:

- Efforts to enhance export competitiveness and diversify trade relationships have not fully addressed concerns about the persistent trade deficit.

- Vulnerabilities such as currency depreciation risks and reliance on volatile capital flows further complicate efforts to maintain a favorable credit rating trajectory.

- Structural Issues in the Labor Market:

- Despite GDP growth, issues like stagnant organized formal labor, low and declining female labor participation rates, and deteriorating employment quality persist.

- Structural issues in general

- India must tackle institutional bottlenecks and regulatory impediments hindering business expansion and innovation.

- Inadequate infrastructure, red tape, and regulatory inconsistencies deter foreign investors and impede the ease of doing business.

ADDRESSING STRUCTURAL ISSUES

Streamlining regulatory frameworks, increasing infrastructure investment, and fostering a conducive business environment are crucial for private sector-led growth and bolstering India’s creditworthiness.

- Improving Environment, Sustainability, and Governance Indicators:

- Attention is required in areas such as political stability, rights, and human rights to improve percentile ranks, which are currently below 50 according to Fitch Ratings and the World Bank governance Indicators.

- Improvement in these areas is essential to positively impact India’s credit profile.

- Mitigating Environmental Risks and Promoting Sustainable Development:

- Enhancing renewable energy infrastructure, implementing stringent environmental regulations, and fostering green innovation are imperative steps.

- Interpreting the Credit Rating:

- Rather than viewing the BBB- credit rating as a Western conspiracy, India can see it as an opportunity to address deep-rooted structural and macroeconomic issues.

- By addressing these challenges, India can become more resilient and inspire confidence not only in rating agencies and investors but also in its own economic future.

Source: https://www.newindianexpress.com/opinions/2024/Feb/07/the-way-up-the-global-credit-rating-ladder

Mains question

How can India enhance creditworthiness for sustained economic growth? Discuss measures to address structural impediments emphasising the role of regulatory reforms. (250 words)