THE SOCIAL BENEFITS OF STOCK MARKET SPECULATION

Relevance: GS 3 – Indian Economy and issues relating to Planning; Government Budgeting.

Why in the news?

- The Government of India, in its Budget, increased taxes on both short-term and long-term capital gains made in the stock market.

- The securities transaction tax on derivatives transactions was also raised.

- A better understanding of the benefits of stock market speculation, often mistakenly compared to gambling, can lead to improved public policy.

Views on Taxing Stock Market Profits

- The Economic Survey, released a day prior to the Budget, argued that unlike developed countries, a developing country like India cannot afford to waste its limited savings on stock market speculation.

- Finance Secretary T.V. Somanathan noted that capital gains could be taxed at higher rates as they are currently the fastest-growing income class.

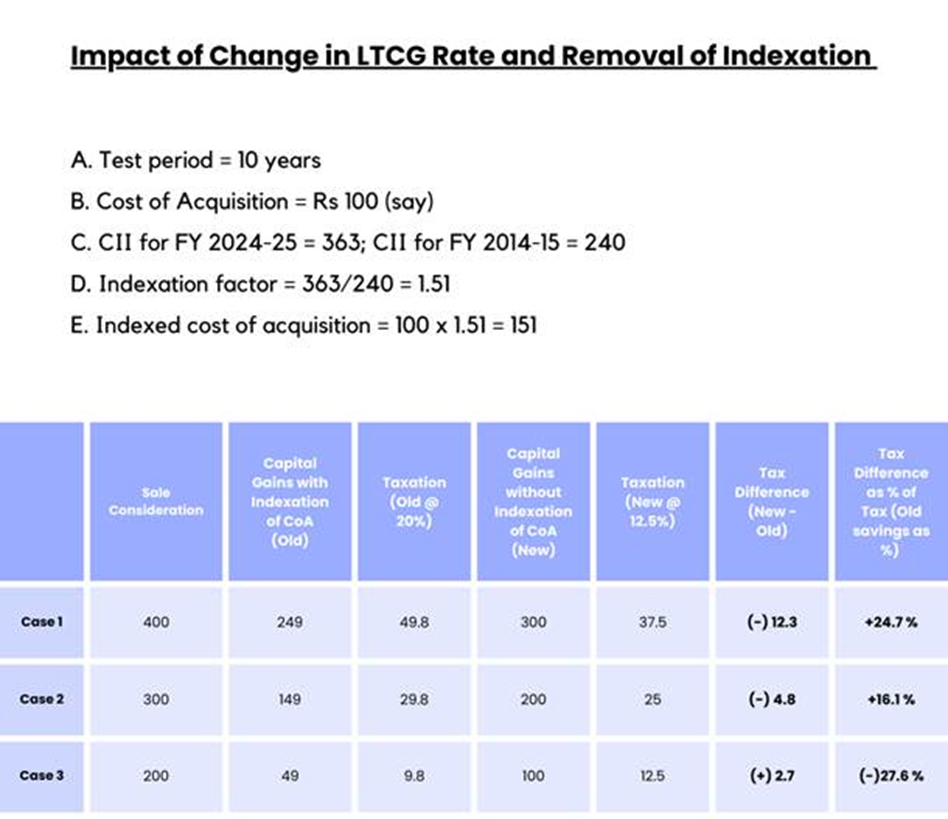

- Similar disdain is shown towards real estate profits, as seen in the removal of indexation benefits for real estate investors in the recent Budget.

- The fundamental belief behind imposing higher taxes on stock market profits is that gains from stock market speculation are similar to gains from gambling.

- Capital gains in the stock market are often seen as easy profits earned by investors without providing any useful service to society.

- Many believe that when an investor buys an asset and sells it at a higher price in the future, they do not add value to society in the process.

- Capital gains are often viewed as a major reason behind growing inequality, and taxing these gains is considered beneficial for society.

How Capital Gains Occur

Perfect Forecast Scenario:

- In an ideal world where investors could perfectly forecast future cash flows from different assets, there would be no capital gains.

- Example: If investors knew a business would yield a one-time cash flow of ₹110 a year from now and wanted a minimum annual return of 10%, competition among investors would ensure that any buyer would have to pay ₹100 for it.

- In this perfect scenario, it would be impossible for an investor to buy an asset for ₹50 and sell it later for ₹100 to earn a profit of 100%.

Real World Uncertainty:

- The real world is far from perfect due to the uncertainty of future cash flows.

- Forecasts about future cash flows of businesses can vary greatly, leading to overvaluation or undervaluation of certain businesses.

- Investors who invest in undervalued businesses have the opportunity to earn capital gains when the fair value of these businesses is recognized and their prices rise.

- Conversely, investors who misallocate capital into overvalued businesses suffer capital losses.

Efficient Capital Allocation:

- An investor who makes capital gains efficiently deploys capital into businesses whose future cash flows justify the investment.

- An investor who suffers capital losses misallocates capital into businesses whose future cash flows do not justify the investment.

Social Implications:

- Efficient capital allocation leads to a richer economy, as it ensures that scarce resources are allocated towards satisfying different societal needs.

- During a pandemic like COVID-19, if investors misallocated capital into building cruise ships and passenger aircraft instead of hospitals and testing facilities, the country would be worse off.

- A uniform tax on capital gains across all businesses may help prevent such misallocation of resources, but higher tax collections could still affect private incentives and the overall economic pie.

Criticism of Speculation:

- Some argue that the benefits of speculation do not apply to most stock market transactions.

- When a retail investor buys a share, their cash often goes to the previous owner, not the business itself.

- Importance of Active Markets: Critics overlook that early investors may not invest in a business without an active market like the stock exchange for future sales. The government aims to encourage long-term investing by raising taxes on short-term capital gains.

- Role of Short-Term Traders: Traders with “gambling instincts” who buy and sell stocks in the short term provide necessary market liquidity. Sufficient liquidity allows long-term investors to sell their stocks more easily.

- Efficient Pricing and Resource Allocation:

- A highly liquid market ensures that shares are priced accurately.

- Efficient pricing helps companies with promising prospects to raise funds more easily than those with shaky prospects.

- This efficient allocation of resources supports overall economic health.

Worse Reputation of Derivatives:

- Gains from derivatives like futures and options suffer a worse reputation than capital gains from trading shares.

- Disdain towards derivatives speculation stems from a lack of understanding of their social benefits.

- Function of Derivatives:

- Derivatives are contracts allowing investors to buy or sell an underlying asset at a predetermined future price. These instruments transfer risk from one group of investors to another willing to assume the risk.

- Without derivatives, many investors might avoid certain investments due to risk.

- Example of Risk Management: A farmer may produce agricultural output but lacks the skill or risk appetite to predict future prices. Futures contracts assure the farmer a certain price, encouraging production despite potential price fluctuations.

- Appearance of Gambling: Derivatives trading can appear as pure gambling, especially when neither party intends to buy or sell the underlying asset. Such speculative bets seem similar to betting on a sports game.

- Speculative Trading Benefits:

- Pure speculative bets in derivatives are similar to much of the trading in the cash market, where traders may not have long-term interests in the underlying asset.

- Active trading in stocks provides crucial liquidity to long-term investors trading based on fundamentals.

- Similarly, speculative traders in derivatives improve the availability of these instruments for fundamental investors managing risk.

Way forward for Indian Government

- Rationalize Capital Gains Tax: Streamline the capital gains tax regime by standardizing holding periods and tax rates for long-term and short-term investments across different asset classes to enhance clarity and compliance.

- Introduce Uniform Holding Period: Establish a uniform holding period for all asset classes, including equities and debt mutual funds, to simplify tax treatment and encourage longer-term investments.

- Consider Tax Relief for Investors: Explore potential tax relief measures for capital gains to boost investor sentiment and participation in the stock market, especially in light of recent tax increases.

- Enhance Tax Compliance: Implement measures to improve tax compliance among investors, possibly through simplified tax structures and better communication of tax obligations.

- Promote Financial Literacy: Increase efforts to educate investors about capital gains taxation and effective tax-saving strategies, such as tax-loss harvesting and extending investment horizons.

- Support Market Liquidity: Recognize the importance of speculative trading in providing liquidity to the market, which benefits long-term investors and overall market efficiency.

- Evaluate Impact on Investment Behavior: Monitor how changes in capital gains tax affect investor behavior and market dynamics, adjusting policies as necessary to maintain a healthy investment climate.

- Encourage Diverse Investment Options: Create access to new asset classes, particularly in mutual funds related to real estate and infrastructure, to broaden investment opportunities for individuals.

- Maintain Fiscal Prudence: Balance the need for tax reforms with fiscal consolidation to ensure sustainable economic growth and investor confidence in the long term.

- Engage with Stakeholders: Regularly consult with financial experts, investors, and industry stakeholders to assess the effectiveness of tax policies and make informed adjustments.

Alternative articles

https://universalinstitutions.com/capital-gains-tax-changes-and-tax-to-gdp-ratio/

https://universalinstitutions.com/ltcg-taxation-withdrawal-of-indexation-benefit-and-controversy/

Mains question

Discuss the social and economic benefits of stock market speculation and derivatives trading, and analyze how a better understanding of these aspects can inform more effective public policy in India. (250 words)