The rise of services

Domestic services, exports are fast-evolving, moving up the value chain, crossing over into manufacturing

Relevance

- GS Paper 3 Indian Economy and issues relating to planning, mobilization, of resources, growth, development and employment.

- Inclusive growth and issues arising from it.

- Tags: #export #services #internationaltrade #india #currentaffairs #upsc

Why in the News?

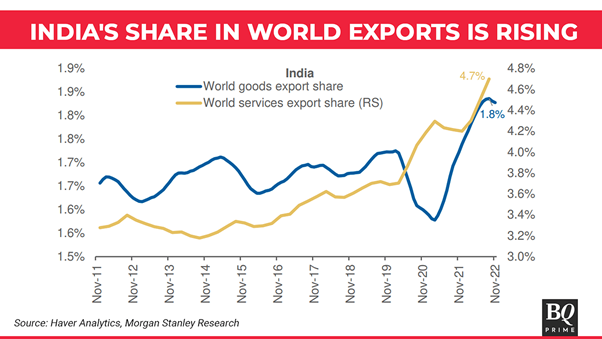

- Services exports recorded impressive growth, expanding by 13.84%. India’s services sector is currently undergoing two major transformations that have the potential to shape the country’s economic growth trajectory.

- These developments encompass the evolution of services exports and the rapid modernization of domestic services. Moreover, there are indications that these services are beginning to transcend traditional boundaries and merge with manufacturing, presenting exciting prospects for the future.

Services Exports: A Growing Powerhouse

In recent years, India’s services exports have experienced remarkable growth, surpassing previous records by a substantial margin. This surge has been significantly driven by the demand for IT services during the pandemic-induced era of remote work, and it shows no signs of abating.

- The Pandemic Boost: The pandemic facilitated an increased demand for IT services as remote work became the norm, leading to significant growth in this sector.

- Diversification of Services: India has progressed beyond being the call center hub of the 1990s and the software solutions provider of the early 2000s. It now offers a wide range of professional services encompassing accounting, legal, HR, business development, design, and R&D.

- The Players: Multiple service providers, including large IT firms, mid-sized IT companies, and consulting firms, have contributed to this growth. Additionally, India boasts the world’s largest share in Global Capability Centres (GCCs).

Global Capability Centres: Bridging the Gap

GCCs, which were traditionally focused on providing tech and IT support to multinational companies, have gradually expanded their offerings to encompass higher-value-added services such as legal, audit, design, and R&D. These centers have become a vital component of India’s services export landscape, accounting for a significant portion of the market.

- GCC Expansion: In 2022-23, approximately 1,600 GCCs contributed to a market worth $46 billion, employing 1.7 million individuals.

- Fast-Growing Professional Services: Professional and consulting services exports have grown at a remarkable 31% CAGR over the last four years, outpacing other sectors like computer services and R&D.

Domestic Services: Paving the Way for Manufacturing Growth

The transformation in domestic services is not limited to exports. India is witnessing the emergence of a “new” domestic services sector that is venturing into manufacturing, particularly in areas such as transport services, procurement support, and e-commerce. This shift is of paramount importance because it addresses India’s challenge of having a stagnant low- and medium-tech manufacturing sector.

- The Problem: Many manufacturing firms in India remain small for extended periods, preventing them from enjoying economies of scale or creating substantial job opportunities.

- The Solution: Enabling small manufacturers to emulate the advantages of larger counterparts can incentivize their expansion and generate job growth.

- Synergy Between Services and Manufacturing: There is significant complementarity between manufacturing and services, offering the potential for mutual growth.

Sustaining Growth in Services Exports

While the growth in India’s IT services exports may moderate in the short term due to global economic conditions, there are structural factors that can sustain long-term growth.

- Remote Work as a New Norm: The trend toward remote work is likely to persist, creating ongoing demand for India’s IT services.

- Diverse Skill Portfolio: India’s diverse skills portfolio, ranging from engineering to design, positions it as a competitive service provider.

- Cost-Competitiveness: India offers cost-competitive solutions, accounting for a significant share of global trade in both value and volume terms.

- Growth Tipping Point: India is poised at a tipping point in services exports, with potential for accelerated growth similar to other leading economies.

The Future: A Confluence of Services and Manufacturing

- Multinational corporations are expanding their presence in India, transitioning from services to manufacturing sectors such as medical equipment, electronics, and precision manufacturing.

- This convergence of services and manufacturing has the potential to drive significant economic growth and job creation.

Services Start-ups: Bridging the Gap in Manufacturing

- India’s digital infrastructure has enabled numerous tech start-ups to offer services solutions. As these start-ups mature, they could expand their scope to address challenges faced by small manufacturers, including access to credit, affordable raw materials, market expansion, logistics, and quality control.

- This collaboration between services start-ups and manufacturing could be a catalyst for growth.

The transformations in India’s services sector, both in exports and domestic services, hold the promise of shaping the country’s economic future. These trends are not only indicative of a maturing services landscape but also offer solutions to India’s persistent challenges in the manufacturing sector. With the right policies and continued innovation, India may witness a convergence of services and manufacturing that fuels robust economic growth and job creation in the years to come.

|

Export Trends

Import Dynamics

Export and Import Destinations

New Foreign Trade Policy Initiatives

|

Sources: Indian Express

Mains Question

” How do the evolving trends in India’s services sector, particularly the growth in services exports and the convergence of services with manufacturing, hold the potential to address longstanding challenges in the Indian economy and contribute to sustainable growth and job creation? Discuss with reference to specific examples and policy implications.