The IMF’s Need for Governance Reform

Syllabus:

GS-3:

Important International Institutions

Focus:

Calls for IMF governance reform have intensified as emerging economies demand fairer representation, highlighting the imbalance of voting power favouring G7 nations. With rising global debt, climate risks, and protectionism, reform is seen as essential to maintain the IMF’s credibility and effectiveness in addressing global challenges.

Why Is IMF Reform Essential?

- Global Financial Crises: Post-pandemic debt levels, climate risks, and emerging threats call for a robust International Monetary Fund (IMF) that can address these challenges effectively.

- Increased Protectionism: Rising protectionism and shifting economic policies hinder developing countries, emphasising the need for a fair mediator in international finance.

- A Changing Global Economy: As economic powers shift, the IMF must evolve to represent emerging economies fairly, ensuring global stability and equitable governance.

Key points:International Monetary Fund (IMF)

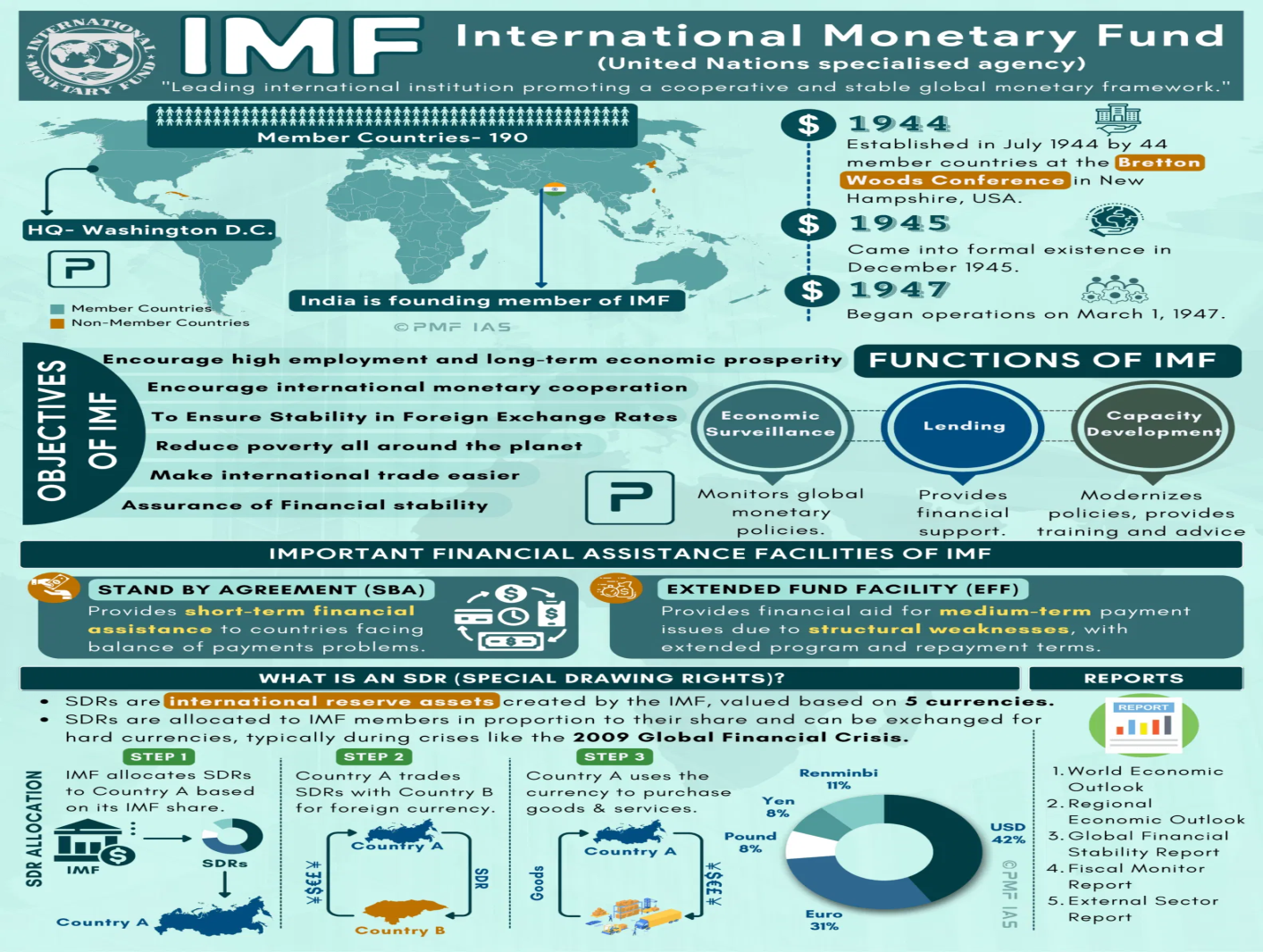

- Overview: Established as a UN agency to maintain global monetary stability, the IMF aims to promote cooperation, reduce poverty, and act as a “lender of last resort.”

- History: Formed in July 1944 at the Bretton Woods Conference; formally established in December 1945. India is a founding member.

- Operations Begin: Began in March 1947, with France being the first borrower.

- Membership: 190 member countries, headquartered in Washington, D.C.

Objectives of the IMF:

- Promote global monetary cooperation and financial stability.

- Facilitate international trade and support economic growth.

- Encourage high employment and alleviate poverty worldwide.

Governance Structure:

- Managing Director: Leads IMF for a five-year term.

- Board of Governors: Highest decision-making body, includes one Governor per member (India’s Governor is the Finance Minister).

- Executive Board: 24-member board overseeing daily operations.

- Voting Power: Quota-based; India holds 8th rank with 76% of quota and 2.64% of total votes.

Core Functions:

- Economic Surveillance: Monitors member policies, providing economic and financial oversight.

- Lending: Offers temporary financial aid to countries facing payment crises.

- Capacity Development: Supports modernised economic policies through technical assistance and training.

Key IMF Reports:

- World Economic Outlook, Global Financial Stability Report, Fiscal Monitor Report, External Sector Report, and Regional Economic Reports.

India’s Relationship with IMF:

- Borrowing History: Took loans in 1981-84 and 1991-93; completed repayments by

- Creditor Role: Became an IMF creditor in 2012, aiding Eurozone stability.

- Financial Transaction Plan (FTP): Participates in FTP, allowing IMF to encash rupee holdings for hard currency, supporting global financial needs.

Historical Context and Evolution of G7:

- Origins: Formed in 1975 as the Group of Six (G6) to tackle economic issues after the 1973-74 OPEC oil embargo.

- Expansion: Canada joined in 1976, forming the G7. Russia joined in 1997, creating the G8, but was excluded in 2014 due to Crimea annexation.

- EU Participation: The EU has attended since 1981 but has no rotating presidency.

Functioning of G7:

- Structure: No formal institution or secretariat; presidency rotates yearly.

- Role of Sherpas: Envoys manage policy negotiations and draft the summit communiqué, coordinating with Political Directors and other deputies.

The Issue with IMF’s Current Structure:

- Outdated Voting Power: Dominated by G7 countries, the IMF’s decision-making does not reflect today’s economic landscape, where emerging economies like China and India hold substantial influence.

- US Dominance: The U.S. retains veto power, and countries like Japan have voting shares higher than rapidly growing economies such as China, skewing policy-making.

- Emerging Economies Underrepresented: Fast-growing nations like India have smaller voting shares than older, less dynamic economies, creating an imbalance that impedes effective global decision-making.

Challenges in Lending and Governance:

- Biassed Lending Decisions: Political connections influence IMF lending terms, risking the quality of the IMF’s financial assistance to troubled economies.

- Limited Resources from G7: With G7 countries facing their own financial constraints, IMF funds are increasingly at risk of being directed politically, with limited genuine support for struggling economies.

- Need for Depoliticized Decision-Making: Political influence over lending often compromises the effectiveness of IMF aid, which could benefit from more objective, rules-based policies.

Proposed Structural Changes for Improved Governance:

- Operational Autonomy: Suggests shifting operational decision-making from the Executive Board to top IMF management to ensure efficient and unbiased operations.

- Transition to a Governance Role: Recommends that the Executive Board functions more as a governance entity, setting strategic guidelines while refraining from micromanaging operational choices.

- Corporate Governance Approach: By setting objectives and evaluating overall performance, the IMF could operate with greater efficiency, similar to a corporation’s board structure.

Obstacles to Reform:

- Resistance from Powerful Nations: G7 countries may be reluctant to relinquish control unless they see mutual benefits, as they currently maintain strong influence over IMF operations.

- Emerging Powers’ Hesitancy: Countries like China, nearing substantial influence within the IMF, might resist reforms that dilute their expected gains in power.

- Concerns Over Unelected Management: Countries worry about fiscal resources managed by unelected IMF officials, though a governance board could ensure decisions align with member interests.

The Way Forward: A Grand Bargain

- Balancing Interests: Reform requires a strategic compromise between established powers and emerging economies to balance influence and safeguard the IMF’s future.

- Uniform Application of Rules: An impartial IMF management would apply consistent lending rules across nations, ensuring fair treatment and avoiding favouritism.

- Securing IMF’s Relevance: Without a reformative “grand bargain,” the IMF risks fading into irrelevance as it struggles to meet the needs of a rapidly changing global economic landscape.

Conclusion:

The IMF requires a modernised governance model to address global challenges effectively. Reforming voting structures and depoliticizing decision-making could restore its relevance, ensuring the IMF remains a pivotal force for stability in international finance.

Source: Mint

Mains Practice Question:

Discuss the necessity of IMF governance reform in the context of a shifting global economic landscape. How can the IMF balance the interests of established and emerging economies to remain relevant?

Associated Article:

https://universalinstitutions.com/understanding-imf-bailouts/