THE GROWTH STORY

Syllabus:

GS 2:

- Indian Economy and issues relating to Planning, Mobilization of Resources, Growth, Development and Employment.

- Economic Growth and Development.

Why in the News?

India’s economy has surpassed growth expectations, achieving an 8.2% increase in GDP for 2023-24. This performance exceeds previous estimates and highlights the resilience of India’s economic framework despite challenges in the agricultural sector, private consumption, and service industries.

Source: Money Control

Impressive Economic Performance

- Exceeding Expectations: India’s economy grew at an impressive 8.2% in the financial year 2023-24, surpassing the RBI’s projection of 7% and the NSO’s estimate of 7.6%.

- Quarterly Boost: The higher full-year growth estimate is largely due to strong fourth-quarter performance, where growth was revised to 7.8%, up from the previously estimated 5.9%.

- Economic Indicators: This robust growth has been confirmed by the National Statistical Office’s provisional estimates, highlighting the economy’s resilience.

- Comparison with Forecasts: Most private forecasters had predicted lower growth, making this outcome particularly noteworthy.

- Annual Growth Trend: The overall growth trend shows a significant improvement from the previous year’s figures, indicating a positive economic trajectory.

Sectoral Performance

- Agriculture Struggles: The agricultural sector grew by only 0.6% in the fourth quarter, reflecting the lingering effects of last year’s unfavorable monsoon.

- Manufacturing Stability: Manufacturing showed better performance, though it dipped from the highs observed in the second and third quarters.

- Construction Growth: Construction activity remained robust, supported by strong growth in cement production and steel consumption, which increased by 9.1% and 13.6%, respectively.

- Service Sector Slowdown: Trade, hotels, transport, and communication sectors, which employ a significant portion of the informal workforce, experienced a slowdown.

- Detailed Data Analysis: The data reveals mixed performances across sectors, necessitating a nuanced understanding of the economic landscape.

Discrepancies and Divergences

- GDP vs. GVA: There is a notable divergence between GDP and GVA estimates, particularly in the second half of the year, influenced by net taxes on products.

- Net Taxes Impact: Net taxes grew significantly, by 31.2% in the third quarter and 22.2% in the fourth quarter, impacting the overall economic measurements.

- Real vs. Nominal Growth: While real GDP growth increased to 8.2%, nominal growth fell from 14.2% to 9.6%, indicating the role of the deflator in these figures.

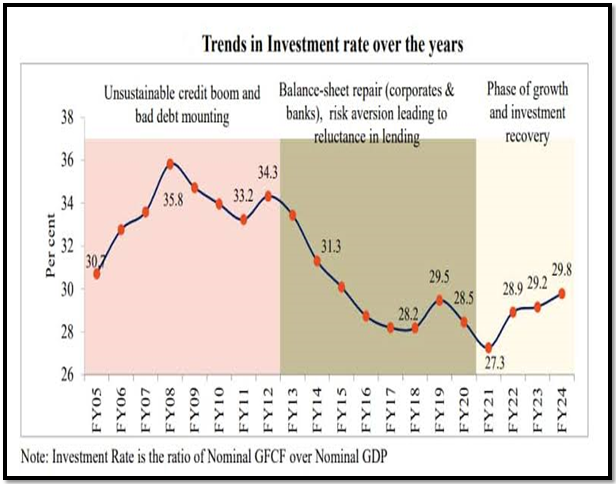

- Consumption vs. Investment: Private consumption remained weak, growing at only 4%, whereas investment activity was healthy, growing at almost 9%.

- Economic Indicators Analysis: These divergences highlight the complex dynamics of the economy, with varying contributions from different components.

Future Economic Prospects

- Continued Growth Momentum: Leading economic indicators suggest that growth momentum has continued into the current financial year, with a recent RBI study estimating first-quarter growth at 7.5%.

- Rural Demand: The future trajectory of the economy will depend significantly on whether rural demand improves.

- Private Consumption: A pickup in private consumption is crucial for sustained economic growth.

- Investment Activity: Continued robust investment activity will be essential to maintain the growth trajectory.

- Policy Influence: The upcoming Union budget proposals and the stance of fiscal and monetary policy will play a critical role in shaping economic outcomes.

Shaping Factors

- Monsoon Impact: The performance of the monsoon will be a key determinant of agricultural output and rural demand.

- Fiscal Policy: The next government’s fiscal policy, as reflected in the Union budget, will influence public spending and investment.

- Monetary Policy: The Reserve Bank of India’s monetary policy stance will affect inflation, interest rates, and overall economic activity.

- Rural vs. Urban Demand: Balancing rural and urban demand will be crucial for comprehensive economic growth.

- Global Economic Conditions: External factors, such as global economic conditions and trade policies, will also impact India’s economic performance.

| KEY TERMS

Gross Domestic Product (GDP)

Types:

Importance: GDP is a key indicator of economic health, guiding policymakers, investors, and analysts in making informed decisions. Gross Value Added (GVA) Definition: GVA measures the value of goods and services produced in an economy, subtracting the cost of inputs and raw materials used in production. It provides a more detailed view of economic activity by focusing on the value generated by different sectors. Calculation: GVA = GDP – Taxes on products + Subsidies on products. Importance: GVA helps in understanding the contribution of different sectors (agriculture, industry, services) to the economy. It provides insight into sectoral performance and productivity. Key Differences

|

Challenges Faced by the Indian Economy

- Agricultural Sector Weakness: Despite overall economic growth, agriculture continues to struggle, growing at a mere 0.6% in the fourth quarter due to the previous year’s unfavorable monsoon.

- Service Sector Slowdown: Sectors like trade, hotels, transport, and communication, which employ a significant portion of the informal workforce, have shown slower growth, affecting job creation and income levels.

- Private Consumption Lag: Private consumption growth remains weak at 4%, indicating subdued consumer demand, which is critical for sustained economic expansion.

- Discrepancies Between GDP and GVA: The divergence between GDP and GVA estimates, especially due to high net tax growth, complicates the accurate assessment of economic health and policy effectiveness.

- Inflationary Pressures: The reduction in nominal GDP growth from 14.2% to 9.6% suggests underlying inflationary pressures that need careful management to avoid eroding purchasing power.

- Investment Variability: While investment activity has been healthy, maintaining this momentum is essential, and any slowdown could impact long-term economic growth.

- Global Economic Uncertainties: External factors such as global economic conditions, trade policies, and geopolitical tensions can adversely affect India’s economic stability and growth prospects.

- Policy and Implementation Gaps: Effective implementation of fiscal and monetary policies is crucial, and any lapses can undermine efforts to stabilize and grow the economy.

Way Forward for the Indian Economy

- Enhance Agricultural Productivity: Investing in agricultural infrastructure, improving irrigation, and adopting modern farming techniques can help boost agricultural output and resilience to climatic variations.

- Stimulate Service Sector: Policies aimed at revitalizing the service sector, especially those employing the informal workforce, can enhance job creation and income levels, stimulating broader economic growth.

- Boost Private Consumption: Encouraging consumer spending through targeted fiscal incentives, tax relief, and measures to increase disposable income can help revive private consumption.

- Address Inflation: Maintaining a balanced approach to monetary policy to control inflation without stifling growth is crucial to preserving purchasing power and economic stability.

- Sustain Investment Momentum: Continuing to foster a conducive environment for investment through policy stability, ease of doing business, and incentives for both domestic and foreign investors is essential.

- Improve Policy Coordination: Ensuring better coordination between fiscal and monetary policies can enhance their effectiveness in addressing economic challenges and fostering growth.

- Leverage Global Opportunities: Strengthening trade relations and diversifying export markets can help mitigate the impact of global economic uncertainties and capitalize on emerging opportunities.

- Focus on Implementation: Prioritizing the effective implementation of government policies and programs can maximize their impact, ensuring that intended benefits reach the targeted sectors and populations.

Conclusion

India’s robust economic growth, driven by manufacturing and construction, faces challenges in agriculture and private consumption. Strategic policy interventions and effective implementation are essential to sustain and enhance growth. Continued focus on balancing fiscal and monetary policies will be crucial for long-term stability and prosperity.

Source:Indian Express

Mains Practice Question:

Discuss the recent performance of India’s economy with reference to the growth figures for 2023-24. How can fiscal and monetary policies be balanced to address these challenges effectively?

Associated Article:

https://universalinstitutions.com/economic-growth-and-development/