THE CURSE OF SMALLNESS DEFINITION OF MSMES

SYLLABUS:

GS 3: Indian Economy and issues relating to planning, mobilization, of resources, growth, development and employment.

Focus:

The recent changes to the definition of Micro, Small, and Medium Enterprises (MSMEs) in India have sparked a critical debate on the fairness and effectiveness of this classification.

The recent changes to the definition of Micro, Small, and Medium Enterprises (MSMEs) in India have sparked a critical debate on the fairness and effectiveness of this classification. The broadened definition, intended to streamline support for micro-enterprises, has inadvertently marginalized the smallest businesses. This editorial analysis delves into the implications of these changes and the urgent need for a more nuanced understanding of MSMEs.

Definition of MSMEs and Its Implications

Broadened Definition:

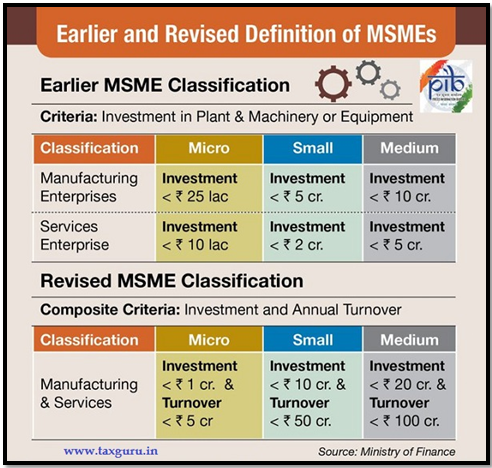

- In 2020, the definition of micro-enterprises was updated to include all with an annual turnover of up to Rs 5 crore, significantly higher than the previous limit of Rs 50 lakh.

- The intention behind this change was to prevent firms from underreporting revenues to qualify for micro-enterprise benefits and incentives.

- However, this broad definition has resulted in a significant skew in the distribution of enterprises, with larger micro-enterprises now overshadowing smaller ones.

- The updated definition does not adequately represent the vast differences in revenue among micro-enterprises.

- This broad categorization fails to address the specific needs of enterprises with the lowest revenues.

Impact on Smallest Enterprises:

- The new definition marginalizes enterprises with the lowest revenues by grouping them with much larger ones.

- As a result, smaller enterprises often get overlooked, leading to the invisibility of their workers.

- The broad definition does not adequately address the specific challenges faced by enterprises with revenues under Rs 12 lakh.

- These smaller enterprises struggle to compete for the same resources and benefits as their larger counterparts within the micro category.

- The definition obscures the true economic conditions of the smallest enterprises, hindering effective policy-making.

The Need for Systematic Understanding

- A recent government order demanding timely payments to MSMEs highlighted significant gaps in the understanding of the structure and functioning of these enterprises.

- Effective interventions are difficult to design without a comprehensive understanding of the largest category of enterprises.

- The absence of systematic data on enterprises not registered under the Factories Act since 2016 complicates policy-making.

- The categorization of enterprises without revealing their annual revenue adds to the opacity.

- There is an urgent need for a systematic understanding of enterprises within the MSME ambit to design effective policies.

Parliamentary Panel’s Recommendations:

- A parliamentary panel has suggested regular revision of the MSME definition every five years to keep up with changing economic conditions.

- The panel also considered separating micro-enterprises from the larger MSME umbrella to address their specific needs.

- Revising the definition regularly can help address the evolving needs of enterprises and ensure that policies remain relevant.

- A more nuanced classification within the micro category is necessary to provide targeted support.

- These recommendations aim to reduce the lack of clarity created by broad definitions and improve policy effectiveness.

Distribution and Characteristics of Micro-Enterprises

Revenue Distribution:

- According to the NSSO Unorganised Enterprise Survey 2016, 95% of surveyed enterprises reported revenues under Rs 50 lakh, with 89% under Rs 12 lakh.

- In the Annual Survey of Industries (ASI), over 66% of enterprises reported revenues below Rs 50 lakh, with 45% under Rs 12 lakh.

- Only 2% of firms in the enterprise survey reported revenues above Rs 50 lakh.

- GST data from 2022 shows that 63% of firms have revenues under Rs 50 lakh, with 30% under Rs 10 lakh.

- This data highlights the skewed distribution within the micro-enterprise category, with a significant concentration of low-revenue enterprises.

Formality and Borrowing Patterns:

- The formality of workers employed in enterprises shares a direct relationship with the size of the enterprise.

- For enterprises with revenues below Rs 12 lakh, there is one formal worker for every nine informal workers.

- This ratio improves to one formal worker for every two informal workers for enterprises with revenues between Rs 50 lakh and Rs 1 crore.

- Borrowing patterns also differ significantly between smaller and larger micro-enterprises.

- Median borrowings for Category 1 (under Rs 50 lakh) are about Rs 0.57 crore, whereas Category 2 (Rs 50 lakh to Rs 5 crore) have median borrowings of Rs 8 crore.

Challenges and Recommendations

Challenges:

- The broad definition of micro-enterprises leads to a lack of targeted support for the smallest enterprises.

- Smaller enterprises struggle with visibility and access to resources due to their marginalization within the broad category.

- The skewed distribution of enterprises within the micro category complicates policy implementation.

- The lack of systematic data since 2016 makes it difficult to understand the operations and needs of enterprises.

- Overlooking low-revenue enterprises exacerbates the issue of informal employment and invisibility of their workers.

Recommendations:

- Further classify enterprises within the micro category to better address their specific needs and challenges.

- Regularly revise the MSME definition to ensure it reflects changing economic conditions and remains relevant.

- Improve data collection and transparency regarding enterprise revenues and operations to inform better policy-making.

- Design targeted interventions for the smallest enterprises to ensure equitable support and resources.

- Enhance the understanding of the economic impact of different-sized enterprises within the MSME sector to develop effective policies.

Addressing the disparities within the MSME classification is crucial for ensuring equitable support and fostering economic growth. A systematic understanding and regular revision of the definitions, along with targeted interventions, can help uplift the smallest enterprises. By recognizing and addressing the unique challenges faced by low-revenue enterprises, policymakers can create a more inclusive and effective support system for all MSMEs.

What are the Recent Government Initiatives Related to MSMEs?

|

Source: Indian Express

Mains Practice Question:

The recent expansion of the definition of Micro, Small, and Medium Enterprises (MSMEs) in India has led to significant disparities within the micro-enterprise category, particularly affecting the smallest businesses. Discuss the implications of this broadened definition on low-revenue enterprises and their workers. Suggest measures that can be taken to address these disparities and ensure equitable support for all enterprises within the MSME sector.

Associated Articles: