SWIFT’s Role in Global Financial Communication Network

Why in the news?

SWIFT remains vital for secure global financial transactions, and its exclusion has been increasingly used as an economic sanction, impacting nations’ access to international banking systems.

SWIFT Overview:

- SWIFT, established in 1973, is a global, member-owned cooperative for secure financial communications.

- Initially founded by 239 banks from 15 countries, it now serves institutions worldwide, facilitating standardised financial transactions.

- Each member bank is assigned a unique Bank Identifier Code (BIC), allowing smooth cross-border payments and information exchange.

Role and Operations:

- SWIFT doesn’t hold or transfer funds but transmits crucial information like account details, transfer amounts, and payment instructions.

- It acts as a secure communication network for international banking transactions, ensuring efficiency and accuracy.

- Headquartered in La Hulpe, Belgium, SWIFT operates under the governance of a 25-member board and is overseen by global central banks.

Strategic Importance

- Exclusion from SWIFT is a powerful financial sanction, disrupting a nation’s ability to conduct international trade and monetary transactions.

- It plays a critical role in maintaining the global financial infrastructure, making it a key tool for monitoring and regulating cross-border payments.

- As an essential part of international finance, SWIFT helps maintain transparency and security in the global banking ecosystem.

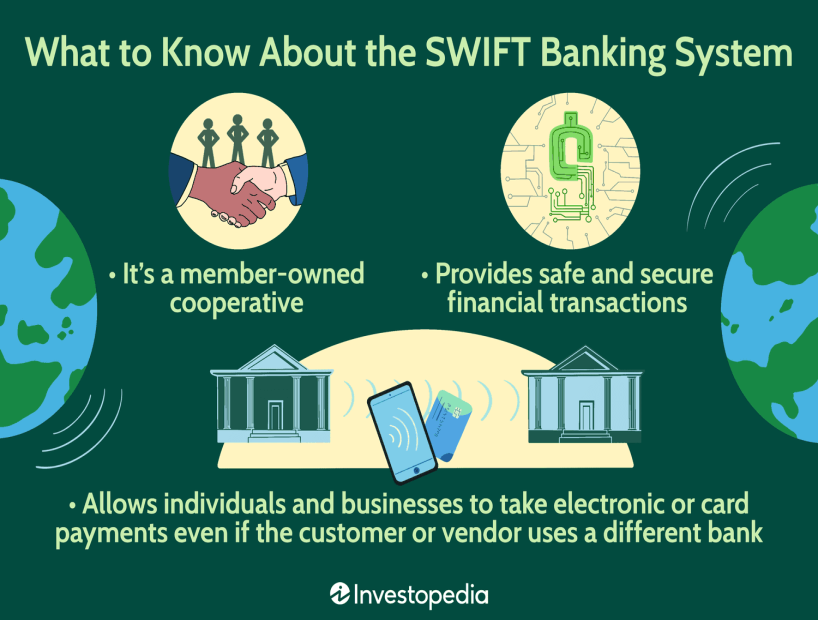

What Is the SWIFT Banking System?

- Definition: Society for Worldwide Interbank Financial Telecommunications (SWIFT) is a cooperative network facilitating secure international financial transactions.

- Functionality: It enables financial institutions to send and receive payment instructions quickly, accurately, and securely.

- Payment Network: Allows electronic or card payments between customers and vendors using different banks.

- Unique Identification: Assigns each member institution a unique Bank Identifier Code (BIC) to identify the bank and its location.

- Economic Sanctions: SWIFT has been utilised to impose sanctions on countries like Iran, Russia, and Belarus.

Sources Referred:

PIB, The Hindu, Indian Express Hindustan Times

Watch on Youtube : SWIFT Explained: The Backbone of Global Banking