“STATES’ REVENUE GROWTH TO RISE 8%-10% IN FY 2024-25: CRISIL”

Why in the news?

- CRISIL projects a revenue growth of 8%-10% for India’s top 18 States in 2024-25.

- Growth driven by higher GST collections and central tax devolutions, accounting for 50% of State revenues.

source:quora

About Goods and Services Tax (GST):

- GST was introduced through the 101st Constitution Amendment Act, 2016.

- The GST has subsumed indirect taxes like excise duty, Value Added Tax (VAT), service tax, luxury tax etc.

- Destination-based Taxation: It follows a consumption-based taxation principle rather than origin-based.

- Import Treatment: Imports are treated as interstate supplies, subject to Integrated Goods & Services Tax (IGST) and applicable customs duties.

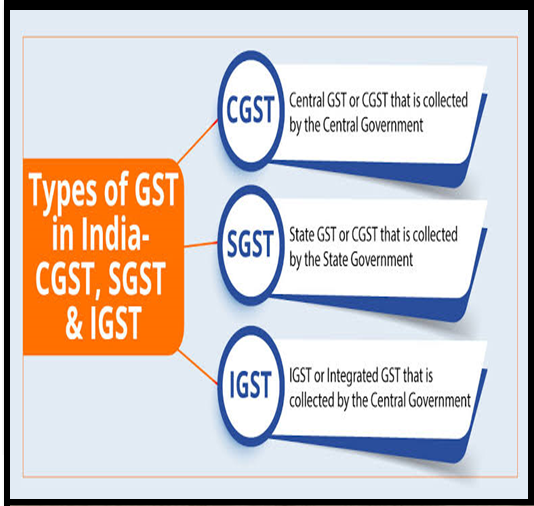

- Mutually Decided Rates: GST rates (CGST, SGST, IGST) are decided jointly by the Centre and States through the GST Council.

- Multiple Rates: Initially, GST had four rates: 5%, 12%, 16%, and 28%, determined based on item classifications by the GST Council.

About CRISIL:

Associated Article: |