Stand-up India

Relevance

- GS Paper 2 Important aspects of governance, transparency and accountability, e-governance, applications, models, successes, limitations, and potential;

- Government policies and interventions for development in various sectors and issues arising out of their design and implementation.

- Tags: #standupIndia #scheme #currentaffairs #upsc

What is the Stand-up India Scheme?

- The Stand Up India Scheme, introduced by the Ministry of Finance on April 5, 2016, aims to stimulate entrepreneurship at the grassroots, emphasizing economic empowerment and employment generation.

- This Scheme has been extended until 2025.

- It is a government initiative in India aimed at promoting entrepreneurship and financial inclusion, particularly among women and individuals belonging to Scheduled Castes (SC) and Scheduled Tribes (ST).

- Scheme Anchor: Managed by the Department of Financial Services (DFS), Ministry of Finance, Government of India.

Objective of scheme

The primary goal of the Stand-Up India Scheme is to encourage entrepreneurship and self-employment by providing access to credit and support to individuals from marginalized communities, including SC, ST, and women.

- Each bank branch is encouraged to extend loans to at least one SC or ST borrower and at least one woman borrower

- The scheme’s objective is to incentivize all bank branches to provide loans. Interested applicants can apply through one of the following methods:

- Directly at their nearest bank branch.

- Via the Stand-Up India Portal (standupmitra.in).

- Through the Lead District Manager (LDM).

- Loan Amount: The scheme facilitates bank loans ranging from Rs 10 lakh to Rs 1 Crore to eligible entrepreneurs.

- Provides a RuPay debit card for credit withdrawal, promoting financial access.

- Banks maintain the credit history of borrowers to ensure funds are used for business purposes and not personal use.

- Loan Facility: Under this scheme, bank loans are made available to eligible beneficiaries for starting a new greenfield enterprise. Greenfield enterprises are those ventures that are being established for the first time.

- Ownership Requirement: In the case of non-individual enterprises, such as partnerships or companies, a minimum of 51% of shareholding and controlling stake should be held by either an SC/ST or woman entrepreneur. This ensures that the targeted beneficiaries have a significant ownership stake in the business.

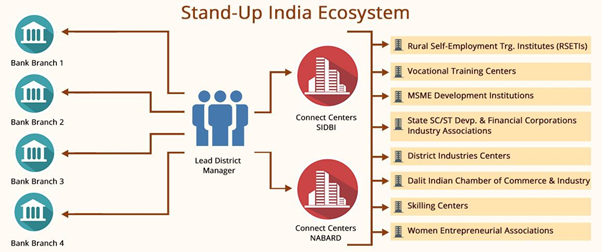

- Implementation Partners: Led by Small Industries Development Bank of India (SIDBI) with involvement from the Dalit Indian Chamber of Commerce and Industry (DICCI) and other sector-specific institutions.

- Refinance window: Establishes a refinance window through the SIDBI with an initial fund of Rs 10,000 crore.

- Creates a corpus of Rs 5,000 crore for credit guarantee through NCGTC (National Credit Guarantee Trustee Company).

- Stand Up Connect Centres (SUCC): Designates SUCC to SIDBI and the National Bank of Agriculture and Rural Development (NABARD)

- These centers play a crucial role in facilitating and supporting entrepreneurs by providing guidance, resources, and assistance in accessing the Stand Up India Scheme’s benefits, thus contributing to the program’s successful implementation and outreach.

- Online Portal: Develops a web portal (standupmitra.in) for online registration and support services to assist applicants.

- Online Resource Familiarization: Provides training on online platforms, e-marketing, web-entrepreneurship, factoring services, and registration resources to scheme applicants.

Eligibility Criteria for the scheme

- Age Requirement: The individual applying for the loan must be 18 years of age or older.

- Business Structure: The eligible entities for the loan include private limited companies, Limited Liability Partnerships (LLP), or partnership firms.

- Turnover Limit: The firm’s annual turnover should not exceed 25 crores.

- Beneficiary Categories: The entrepreneur seeking the loan should either be a woman or a person belonging to the Scheduled Caste (SC) or Scheduled Tribe (ST) category.

- Project Type: The loan is specifically for funding greenfield projects, which means the project must be the entrepreneur’s first undertaking in the manufacturing or service sector.

- Financial History: The applicant must not be a defaulter with any bank or other organizations.

- Business Nature: The business should deal with commercial or innovative consumer goods, and approval from the Department of Industrial Policy and Promotion (DIPP) may be required.

- Eligible Sectors: Aims to enhance the institutional credit structure by providing bank loans to minority sections in the non-farm sector. The loan can be utilized to start a greenfield enterprise in various sectors, including manufacturing, services, or the trading sector. It allows for flexibility in the choice of business.

Benefits of Standup India

- Employment Generation: Encourages and motivates new entrepreneurs to reduce unemployment by fostering new businesses.

- Investor Support: Offers a platform for investors to access professional advice, time, and legal knowledge. Provides assistance during the initial two years of the startup phase.

- Post-Setup Assistance: Provides post-setup aid and support to consultants and entrepreneurs.

- Loan Repayment Flexibility: Eases loan repayment stress by allowing borrowers to repay the loan over a span of seven years. Offers flexibility in annual repayment amounts based on the borrower’s choice.

- Overcoming Obstacles: Aims to eliminate legal, operational, and institutional barriers for entrepreneurs.

- Socio-Economic Empowerment: Promotes job creation, contributing to the socio-economic empowerment of marginalized communities such as Dalits, tribals, and women.

- Support for Government Schemes: Acts as a catalyst for other government initiatives like ‘Skill India’ and ‘Make in India,’ fostering economic growth.

- Demographic Dividend: Helps harness and protect the demographic dividend in India by empowering a diverse range of entrepreneurs.

- Financial and Social Inclusion: Enhances financial and social inclusion by providing access to bank accounts and technological education for underprivileged segments of society.

Tax benefits and incentives

- Patent Application Rebate: Applicants, particularly startups, are eligible for an 80% rebate after filing a patent application. Startups receive more substantial benefits compared to other types of companies.

- Credit Guarantee Fund: Entrepreneurs benefit from the inclusion of a Credit Guarantee Fund, which enhances their access to credit, making it easier to secure loans.

- Income Tax Relaxation: Entrepreneurs, especially during the initial phase of their businesses, enjoy relaxation in income tax for at least the first three years. This relieves them from the burden of high tax costs.

- Capital Gain Tax Exemption: Entrepreneurs receive complete relaxation from Capital Gains Tax, reducing the tax burden when they sell assets or investments for a profit.

- Tax Profit Redemption: Entities that qualify for the program can further benefit from the redemption of tax on the profits earned, which can significantly reduce their tax liability.

Challenges

- Lack of Socio-Economic Education: Insufficient focus on educating people about the socio-economic dimensions of Dalit and women entrepreneurship, potentially limiting the scheme’s effectiveness.

- Innovation Criteria and Discretion: The scheme’s requirement for companies to be innovative leaves the judgment of innovation to the discretion of the Department of Industrial Policy and Promotion (DIPP), possibly leading to delays and missing out on promising entrepreneurial ventures.

- Turnover Requirement: The stipulated turnover of 25 crores poses a challenge as very few women-led and SC/ST-led firms meet this criterion.

- Challenges in Self-Help Groups: Self-help groups, which have supported women entrepreneurs in rural areas, face issues such as elite capture and dominance by local interests. The scheme lacks institutional measures to address these challenges.

- Banking Sector Reach: Limited penetration of the banking sector in rural areas can hinder institutional bank linkages, awareness among the people, and digital access, despite the success of initiatives like Pradhan Mantri Jan Dhan Yojana (PMJDY).

- Inadequate Funding for Manufacturing: The funding support of 10 lakhs to 1 crore may be insufficient for the manufacturing sector, potentially limiting the growth of businesses in this category.

- Empowerment Gaps: SC/ST communities and women may not have access to adequate technical knowledge, skilled labor, or sector-specific expertise, limiting their ability to succeed as entrepreneurs.

Mains Question

Critically analyze the impact and challenges of the Stand Up India Scheme, with a focus on its effectiveness for marginalized communities.