SPREAD DEMO IN YOUR COS

Syllabus:

- GS 2: Transparency and Accountability & E-governance

Why in the news?

Improving corporate governance, addressing whistleblowing concerns, and fostering worker involvement are crucial steps in current news discussions.

About Improving Corporate Governance:

- Companies rarely provide directors with training on subjects crucial for corporate performance.

- Lack of knowledge about critical aspects like CBAM proposed by the EO raises concerns.

- Boarding school tactics in corporate governance need to change for effective functioning.

| What is Corporate governance?

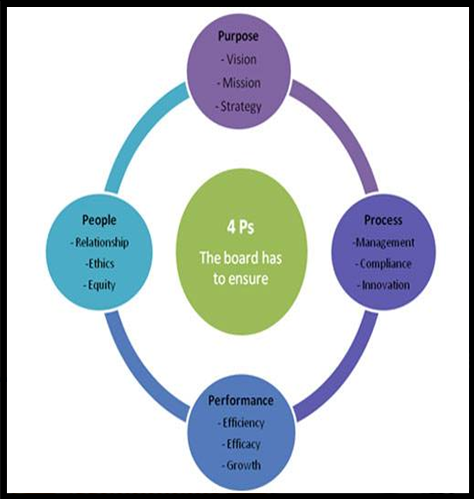

● Corporate governance: rules and processes guiding company management. ● Ensures ethical operations and acts in the best interests of stakeholders. ● Aims to prevent corporate greed and promote transparency. ● Establishes high ethical standards and holds individuals accountable. ● Safeguards against misconduct, protecting shareholder and community interests. About Four Ps of Corporate governance: People: ● Emphasises the importance of individuals in governance, including the board, executives, and employees. ● Consider board composition, skills, independence, and diversity. Purpose: ● Focuses on the company’s mission and goals, ensuring alignment with ethical standards. ● Aims to create long-term value for shareholders and stakeholders. Processes: ● Involves systems and procedures for overseeing and managing the company. ● Includes decision-making, risk assessment and management, and accountability. Practices: ● Reflects overall success in achieving goals while maintaining ethical standards. ● Monitors and evaluates performance against established benchmarks. Key Components Corporate Governance: Board of Directors: ● Composition and Independence: Minimum and maximum director requirements, mandatory women director, and independent directors for listed companies. ● Board Committees: Audit, compensation, and nominating committees. Shareholders and Stakeholders: ● Rights and Responsibilities: Voting, receiving dividends, and inspecting company records. ● Minority Shareholder Protection: Rights to vote and hold accountable despite not having full control. Disclosure and Transparency: ● Financial Reporting: Preparation of financial statements adhering to accounting standards. ● Non-Financial Disclosure: Reporting on Environmental, Social, and Governance (ESG) practices. |

About the Environmental, Social, and Governance (ESG) Goals:

- Definition: Standards for company operations emphasising better governance, ethical practices, environmental sustainability, and social responsibility.

- Environmental Criteria: Assess company’s role as a steward of nature.

- Social Criteria: Evaluate relationships with employees, suppliers, customers, and communities.

- Governance: Focus on leadership, executive pay, audits, internal controls, and shareholder rights.

- Investment Decision Metric: Non-financial factors guiding investment decisions, beyond just financial returns.

- UNPRI Introduction: United Nations Principles for Responsible Investing (UNPRI) introduced in 2006, acknowledging ESG’s importance in modern businesses.

- ESG vs. CSR: ESG framework focuses on intangible aspects of corporate governance, unlike Corporate Social Responsibility (CSR), which addresses tangible aspects through project implementation.

- CSR in Developing Economies: Seen as corporate philanthropy supporting government initiatives for social development, aligning with good governance and corporate governance concepts.

Understanding the Regulatory Framework for Corporate Governance in India:

- Regulatory Authorities:

- The Ministry of Corporate Affairs (MCA) and Securities and Exchange Board of India (SEBI) oversee corporate governance initiatives, ensuring ethical business practices and stakeholder protection.

- Corporate Governance Regulation (1990s):

- SEBI regulated corporate governance through key laws like Security Contracts (Regulation) Act, 1956; Securities and Exchange Board of India Act, 1992; and Depositories Act of 1996, signifying regulatory development.

- Introduction of Formal Framework (2000):

- SEBI established the first formal regulatory framework in 2000, responding to Kumar Mangalam Birla Committee, 1999

- This aimed at enhancing corporate governance standards, promoting transparency, and accountability.

- Subsequent Initiatives (2002):

- The Naresh Chandra Committee on Corporate Audit and Governance extended recommendations in 2002, addressing governance issues.

- Initiatives like Confederation of Indian Industry (CII), National Foundation for Corporate Governance (NFCG), and Institute of Chartered Accountants of India (ICAI) bolstered responsible and transparent corporate practices.

About Companies Act, 2013: Provisions and Amendments

Provisions Related to Corporate Governance:

- Appointment of Key Managerial Personnel (KMPs): Companies are held accountable through the appointment of KMPs, ensuring effective management.

- Role of Audit Committees: Enhanced oversight through audit committees promotes transparency and accountability.

- Independent Audits: Stricter regulation of audits ensures impartial assessment of financial statements.

- Restrictions on Layers of Companies: Limiting layers of companies reduces complexity and enhances transparency in corporate structures.

- Enhanced Disclosures: Mandated disclosures in board reports, financial statements, and filings ensure accessibility of relevant information to investors and regulatory bodies.

Amendments and Updates:

- Introduction of NCLT and NCLAT: National Company Law Tribunal (NCLT) and National Company Law Appellate Tribunal (NCLAT) replaced the Company Law Board, streamlining legal processes.

- Insolvency and Bankruptcy Code, 2016: Introduction of the code facilitates efficient resolution of insolvency cases, promoting financial stability.

- Amendment of Definition of “Related Party”: Expanded definition includes entities holding equity shares of 10% or more, broadening the scope of related party transactions.

- Appointment of Independent Directors: Mandatory appointment of independent directors strengthens corporate governance in larger companies.

- Requirement of Special Resolution for Auditor Appointment: Ensures thorough scrutiny and accountability in the appointment of auditors.

About National Financial Reporting Authority (NFRA):

- Establishment:

Established in 2018 under section 132 of the Companies Act, 2013, NFRA recommends accounting and auditing standards for approval by the Central Government.

- Duties:

NFRA’s responsibilities include promoting transparency and accuracy in financial reporting through the adoption of standardised policies and procedures.

Challenges/Way Forward:

Strengthening Board Independence:

- Ensure a balanced board composition with a significant number of independent directors.

- Conduct periodic assessments of board and director performance.

Enhancing Transparency and Disclosure:

- Implement rigorous financial reporting practices.

- Disclose non-financial information, such as ESG factors.

Empowering Shareholders:

- Encourage the use of proxy advisory services.

- Promote shareholder activism.

Corporate Social Responsibility (CSR):

- Integrate CSR practices into business operations.

Addressing Whistleblowing and Harassment:

- There’s a need for better mechanisms to address issues like sexual harassment in companies.

Japanese Model and Worker Involvement:

- Encouraging worker agency and involvement can lead to improved productivity and quality of work.

Conclusion:

Corporate governance needs to evolve to address current challenges effectively.Emphasising shareholder democracy, addressing whistleblowing concerns, and fostering worker involvement are crucial steps.Ensuring proper training for directors and revisiting remuneration policies can enhance corporate governance practices.

Source:

The Economic Times

Mains Practice Question:

Discuss the significance of improving corporate governance and addressing whistleblowing concerns in the context of fostering transparency, accountability, and worker involvement.