SPECIAL CATEGORY STATUS: A POLITICAL BARGAINING CHIP

Syllabus:

GS 3:

- Issues and Challenges Pertaining to the Federal Structure, Devolution of Powers and Finances .

- Government Policies and Interventions

Why in the News?

The demand for special category status (SCS) has resurfaced as various states, particularly those led by regional parties, seek additional financial benefits and support from the central government. The issue remains politically sensitive and contentious, impacting federal dynamics and resource allocation.

Source: Disc

Introduction to Special Category Status (SCS)

- Historical Context: Introduced in 1969 by the Planning Commission to allocate higher plan assistance to states facing socio-economic challenges.

- Initial States: Initially granted to Jammu and Kashmir, Assam, and Nagaland; later extended to all northeastern states, Uttarakhand, and Himachal Pradesh.

- Gadgil Formula: Plan assistance was distributed using the Gadgil formula, prioritizing population and economic deprivation.

- Finance Commission Role: The Finance Commission (FC) incorporated the essence of the Gadgil formula for budgetary deficits and tax devolution.

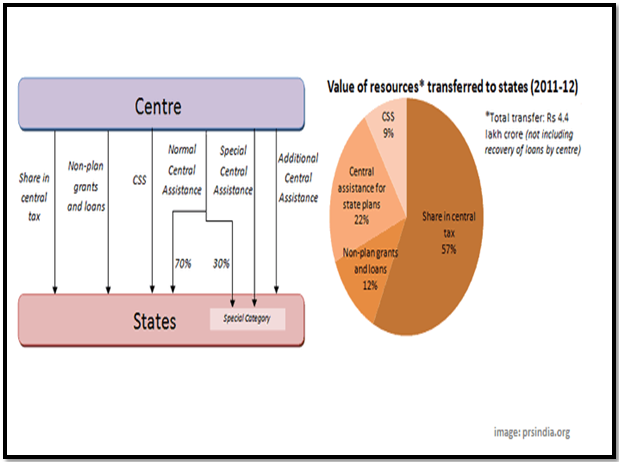

- Central Grants: SCS states receive 90% grants and 10% loans for centrally sponsored schemes, compared to 60-75% grants for other states.

- Economic Concessions: Significant concessions were provided in excise, customs duties, income tax, and corporate tax.

Changes and Political Dynamics

- Structural Changes: With the Planning Commission replaced by NITI Aayog, all transfers are now managed by the FC, except for central sector and centrally sponsored schemes.

- Increased Demand: Regional parties’ influence in central government has heightened demands for SCS status.

- Political Bargaining: SCS status has become a tool for political negotiation, requiring amicable resolution.

- Andhra Pradesh Case: In 2014, PM Manmohan Singh announced special assistance for Andhra Pradesh, sparking debates on its status and implications.

- Constitutional Questions: There are questions about the constitutional and fiscal appropriateness of adding new states to the SCS list.

- Future Government Obligations: Uncertainty exists on whether declarations by one government bind future governments.

Finance Commission Recommendations

- 14th FC: Did not consider SCS but increased fund allocations for underprivileged states like NE, Uttarakhand, and Himachal Pradesh.

- Special Grants: Continued higher grants and lower cost-sharing for central projects; sanctioned special grants for specific challenges.

- 15th FC: No mention of SCS; assigned 10.5% of devolved taxes to northeastern and hilly states, resulting in lower shares for southern and western states.

- Weightage Factors: Focused on ecology, area, and 2011 Census population, benefiting SCS states due to higher population growth.

- Divisible Taxes: Higher allocation of divisible taxes to SCS states due to weightage assigned to ecology or forest cover.

- Impact of Population Data: Using the 2011 Census data instead of 1971 benefited SCS states with higher population growth rates.

| About Special Category Status (SCS)

Criteria:

Evolution of the Idea

Current States with SCS

|

Challenges and Controversies:

Politically Charged Nature

- Political Sensitivity: The process of assigning or changing SCS status is highly sensitive and often leads to political disputes. Changes can create tensions between states and the central government.

- Regional Party Influence: The increasing presence of regional parties in central government has amplified demands for SCS, often turning it into a political bargaining chip rather than a developmental tool.

- Public Perception: Politicians often use SCS status as a promise during elections, raising public expectations and making it difficult to backtrack or refuse such demands without facing political backlash.

Framework Update Challenges

- Outdated Criteria: The original criteria for SCS designation, based on the Gadgil formula and conditions from the 1960s and 1970s, may no longer be fully applicable in today’s economic and social context.

- Complex Socio-Economic Factors: Updating the framework requires a comprehensive understanding of various socio-economic factors that differ widely among states, making it difficult to develop a universally acceptable criterion.

- Implementation Hurdles: Even if a new framework is developed, its implementation can be contentious, with states lobbying for favorable inclusion criteria that benefit their specific needs.

Politically Motivated Claims

- Lack of Proper Assessment: State leaders often stake claims for SCS based on political motives rather than a detailed analysis of the actual economic benefits or needs of the state.

- Overstated Benefits: Politicians may exaggerate the benefits of SCS to gain public support, without considering if similar benefits could be achieved through better utilization of existing funds and opportunities.

- Neglect of Alternative Solutions: Focus on SCS status can overshadow other viable means of achieving economic growth and development, such as optimizing central project funds and leveraging local resources.

Economic and Fiscal Implications

- Budgetary Strain: Granting SCS status to additional states places a significant strain on the central budget, diverting funds that could be used for other national priorities.

- Inequitable Resource Distribution: Higher central assistance to SCS states may lead to perceptions of inequitable resource distribution among states, causing dissatisfaction among non-SCS states.

- Dependency Culture: Prolonged reliance on special assistance can foster a culture of dependency, where states may not prioritize developing self-sustaining economic policies.

Transparency and Accountability

- Opaque Processes: The criteria and process for granting SCS status lack transparency, leading to allegations of favoritism and political manipulation.

- Accountability Issues: Without proper oversight, funds allocated to SCS states may not be used effectively, leading to wastage and corruption.

- Need for Clear Guidelines: Establishing clear, transparent guidelines for SCS status and monitoring the use of allocated funds is crucial for ensuring accountability and effective utilization of resources.

Inclusive Development Goals

- Strategic Intervention Need: Effective development requires strategic interventions tailored to the specific needs of each state, rather than a one-size-fits-all approach like SCS.

- Special Budgetary Allocations: Targeted budgetary allocations that are well-planned and transparent can achieve more sustainable development outcomes than blanket SCS status.

- Equitable Growth: Ensuring equitable growth across all states, regardless of SCS status, is essential for balanced national development. This includes focusing on underprivileged areas within non-SCS states as well.

Way Forward

- Transparent Criteria: Establish clear and transparent criteria for granting special category status (SCS) to avoid allegations of favoritism and ensure fairness in the process.

- Periodic Review: Regularly update the framework for SCS based on current socio-economic conditions, ensuring that the criteria remain relevant and effective.

- Focus on Development: Shift the emphasis from SCS to comprehensive development plans tailored to each state’s unique needs, promoting sustainable economic growth.

- Optimize Existing Funds: Encourage states to fully utilize existing central funds and opportunities, ensuring efficient use of resources before seeking additional assistance.

- Strategic Interventions: Implement targeted strategic interventions and special budgetary allocations to address specific challenges faced by underprivileged states, fostering balanced regional development.

- Encourage Self-Sufficiency: Promote policies that encourage states to develop self-sustaining economic strategies, reducing long-term dependency on central assistance.

- Enhanced Monitoring: Strengthen monitoring and accountability mechanisms to ensure that funds allocated to states are used effectively and transparently.

- Equitable Resource Distribution: Ensure equitable distribution of resources among all states, focusing on underprivileged areas within non-SCS states to achieve balanced national development and address regional disparities.

Conclusion

Addressing the demand for SCS requires a transparent, equitable approach focused on sustainable development. States should optimize existing funds, and strategic interventions should be prioritized to ensure balanced regional growth, reducing dependency and fostering self-sufficiency.

Source:Indian Express

Mains Practice Question:

Discuss the relevance of special category status (SCS) in contemporary India. How can the government address the developmental needs of states while ensuring equitable resource distribution?

Associated Article:

https://universalinstitutions.com/bihars-call-for-special-category-status/