SOVEREIGN FUNDS IN ZOMATO

Why in the News?

- Despite exits by global investors like Tiger Global and SoftBank, sovereign funds from Kuwait and Singapore are increasing their stakes in Zomato.

- Zomato’s stock has surged over 160% in the past year, attracting confidence from sovereign wealth funds.

Key Terms

Sovereign Wealth Funds (SWFs):

Sovereign Wealth Funds are state-owned investment pools, managing a country’s reserves. These funds invest globally in various assets, including stocks, bonds, and real estate, to generate wealth for the nation.

Shares:

Shares, or stocks, represent ownership in a company. Investors buy shares to become shareholders, participating in the company’s profits and losses. Shares are traded on stock exchanges.

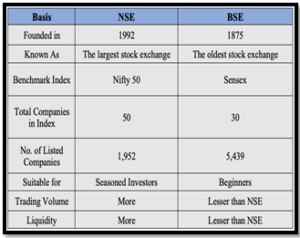

National Stock Exchange (NSE):

The NSE is India’s leading stock exchange, facilitating electronic trading. It lists a wide range of financial instruments, including stocks, derivatives, and ETFs, providing a platform for efficient capital market operations.

Source: Fundamental Stock

Bombay Stock Exchange (BSE):

The BSE is one of Asia’s oldest stock exchanges, based in Mumbai, India. It offers a platform for trading various financial instruments, contributing significantly to India’s capital market development.

Angel Investors:

Angel investors are affluent individuals who provide capital to startups in exchange for ownership equity or convertible debt. They support early-stage businesses, often offering expertise and mentorship along with funding.

Source: Fundamental Stock

Source: Fundamental Stock