SEBI’S LATEST REGULATORY MOVES

Why in the news?

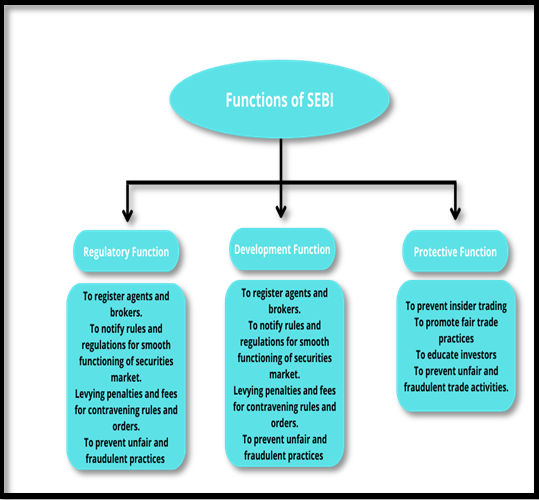

SEBI , in its recent board meeting, has approved significant changes aimed at enhancing market integrity and investor protection.

Key Changes Approved:

- Revised eligibility criteria for stocks in the derivatives segment to improve market quality.

- Introduction of a fixed price delisting process to streamline voluntary delisting of frequently traded shares.

- Minimum limits set for market-wide positions and quarter sigma order size to enhance market participation.

- Sebi directs brokers and mutual funds to stop involving unregistered financial influencers.

Source: Medium

| Key Terms:

Derivatives: Financial contracts whose value derives from the performance of underlying assets, indices, or benchmarks. They include futures, options, forwards, and swaps, used for hedging or speculation. Futures and Options:

|