SEBI Board Meet : Likely Changes in SME IPO Norms

Why in the news?

- SEBI Board: The Securities and Exchange Board of India (SEBI) is set to revamp SME IPO norms in a meeting on December 18.

- Concerns Raised: The changes follow irregularities in SME IPOs, including issues like manipulation in pricing and fund diversion to shell companies.

SME IPOs Boom

- Surge in IPOs: There has been a significant rise in SME IPOs, particularly from 2022-23 onwards. In FY24, 196 SME IPOs raised over Rs 6,000 crore.

- Investor Participation: The applicant-to-allotted investor ratio has surged, increasing from 4x in FY22 to 245x in FY24.

- Promoter Influence: Many SME companies are promoter-driven, with high shareholding concentration and limited involvement from private equity investors.

The Concerns

- Misuse of Funds: SEBI has identified cases of diversion of IPO funds to related parties and shell companies.

- Inflated Revenues: Concerns also include revenue inflation through circular transactions among promoters and related parties.

Norms Overhaul

- Proposed Changes: SEBI is expected to implement key changes such as:

- Higher minimum application size for SME IPOs (Rs 2-4 lakh).

- Minimum allottees requirement raised to 200.

- Lock-in period for promoter contribution increased to 5 years.

- Eligibility criteria: IPO only if issue size is over Rs 10 crore and operating profit is Rs 3 crore for at least 2 out of 3 years.

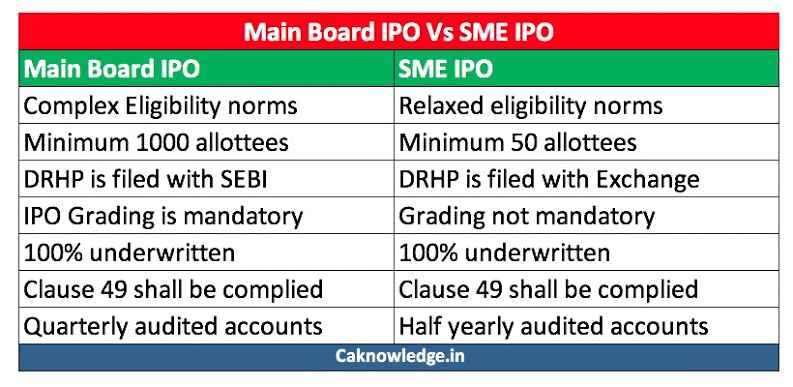

Difference Between Normal IPO and SME IPO

- Target Companies:

- Normal IPO: Issued by large, well-established companies with a significant track record.

- SME IPO: Issued by small and medium-sized enterprises (SMEs) with a relatively shorter business history or smaller scale of operations.

- Market Size:

- Normal IPO: Typically involves large amounts of capital, often raising hundreds or thousands of crores.

- SME IPO: Generally smaller in size, with a focus on raising funds in the range of a few crores to tens of crores.

- Eligibility Criteria:

- Normal IPO: Requires stringent financial criteria, including profitability, operational history, and size.

- SME IPO: More lenient in terms of profitability, with the focus on business potential rather than a long track record.

- Investor Base:

- Normal IPO: Attracts institutional investors, mutual funds, and a broader retail investor base.

- SME IPO: Primarily aimed at retail investors and HNI (High Net-Worth Individual) investors, with fewer institutional participants.

- Regulatory Requirements:

- Normal IPO: Subject to more rigorous regulatory requirements and disclosures due to larger market impact.

- SME IPO: While regulated, SME IPOs have relatively simpler regulatory requirements and a faster approval process.

Sources Referred:

PIB, The Hindu, Indian Express, Hindustan Times