SBI AND BOB RAISE MCLR, BORROWERS’ EMIS LIKELY TO INCREASE

Why in the news?

- State Bank of India (SBI) and Bank of Baroda (BoB) increased their marginal cost of funds-based lending rates (MCLR).

- SBI raised MCLRs by 5-10 basis points across various tenors, with the one-month MCLR up to 8.35% and the one-year MCLR to 8.85%.

source:toppersnotes

About Marginal Cost of Funds based Lending Rate(MCLR):

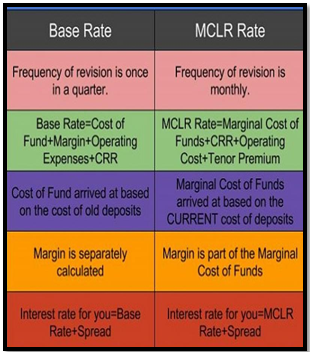

- Definition: MCLR is the minimum rate below which banks can’t lend, introduced by RBI on April 1, 2016.

- Calculation: Based on marginal cost of funds, cash reserve ratio, operating costs, and tenor premium.

- Review: Banks review and publish MCLRs monthly.

What is Cash Reserve Ratio?

Key Facts about Bank of Baroda (BoB):

Key Facts about State Bank of India(SBI):

Associated Aritcle: |